Chrysler 1999 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 1999 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

A GROUP IN TRANSITION

From a strategic standpoint, 1999 was marked by a

rapid acceleration in the process of transformation that

characterizes the Group. As we emphasized repeatedly

during the course of the year, we are committed to enabling

all Sectors to achieve positions of competitive excellence,

which entails attaining a leadership position in the markets

we serve, ensuring the satisfaction of our customers and

creating steadily rising value for our shareholders.

During 1999, we sought to shorten the time needed to

attain this objective by implementing numerous programs

involving both a more effective management of our portfolio

of businesses and the strengthening of all our internal system,

which was achieved by streamlining our organization,

innovating our products, expanding our range of services,

and partnering with suppliers and distribution networks.

PORTFOLIO MANAGEMENT AND COMPETITIVE

EXCELLENCE

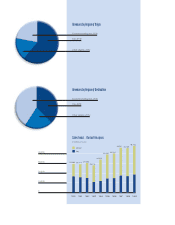

By deploying financial resources in excess of 6 billion euros,

we were able to carry out acquisitions and alliances of

sufficient magnitude to alter radically the size, geographic

footprint and customer mix of many Group Sectors.

The seminal event of the year was New Holland’s purchase of

Case Corporation in the United States. This merger created

CNH, a world leader in the agricultural and construction

equipment markets. Thanks to its diversified geographic

base, the complementarity of its product skills and the

significant synergies that will be generated by merging the

human and technological resources of both companies, CNH

has the potential of redefining the competitive landscape in

the businesses where it operates, and can look forward to

achieving outstanding levels of profitability.

The acquisition of Fraikin, France’s leading provider of

contract-hire services, helped Iveco accelerate the development

of its financial services, which have become an essential tool

in meeting the evolving needs of its customers. 1999 was

also the first year of operation for Irisbus, the joint venture

established by the Sector with Renault Véhicules Industriels

which ranks as a co-leader in the European bus industry and

has become one of the most profitable companies in this field.

In addition, Iveco continued to implement its 1997-2001 capital

spending program. In particular, it launched the new Daily, a light

commercial vehicle that will help the Sector reaffirm its leadership

in this market segment, and introduced the Cursor 10, the

second engine in a family of powerplants that has provided

renewed momentum to the sales of Iveco’s heavy-load vehicles.

The purchase of Pico in the United States and the integration

of Renault Automation’s operations into Comau turned the

Group’s Production Systems Sector into the undisputed leader

in the field of automotive bodywork systems. It also transformed

it into the largest full liner among the world’s top production

systems groups, with excellent geographic diversification

and a customer roster that includes all the most prestigious

automobile manufacturers. With Comau Service, the Sector is

helping develop the fast growing market of plant maintenance

services. After just one year of operation, Comau Service

ranked among the leading players in Europe and is expanding

in the Mercosur and Nafta countries.

During the year, Teksid underwent an important process of

competitive repositioning. Its status as a majority partner in

Renault’s foundry operations and the acquisition of complete

control of Meridian Technologies have turned it into the

largest non-captive producer of metallurgical components for

automotive applications. In particular, the Sector is ranked

first both in cast iron and aluminum components, as well as

in the emerging field of magnesium technology.

Magneti Marelli, which established Automotive Lighting, a joint

venture with Bosch, and toward the end of the year announced

that it agreed to purchase Seima in Italy, has become one

of the top three producers of lighting systems in the world.

As part of its effort to concentrate its portfolio of businesses

in areas of strategic importance, Magneti Marelli acquired

Fiat Auto’s Suspension Systems operations, concluded a

cooperation agreement with Textron Automotive Company,

a U.S. manufacturer, for the development and production

of integrated dashboard modules, sold its Rotary Devices

Division and announced the disposal of its Lubricants