Chrysler 1999 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 1999 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

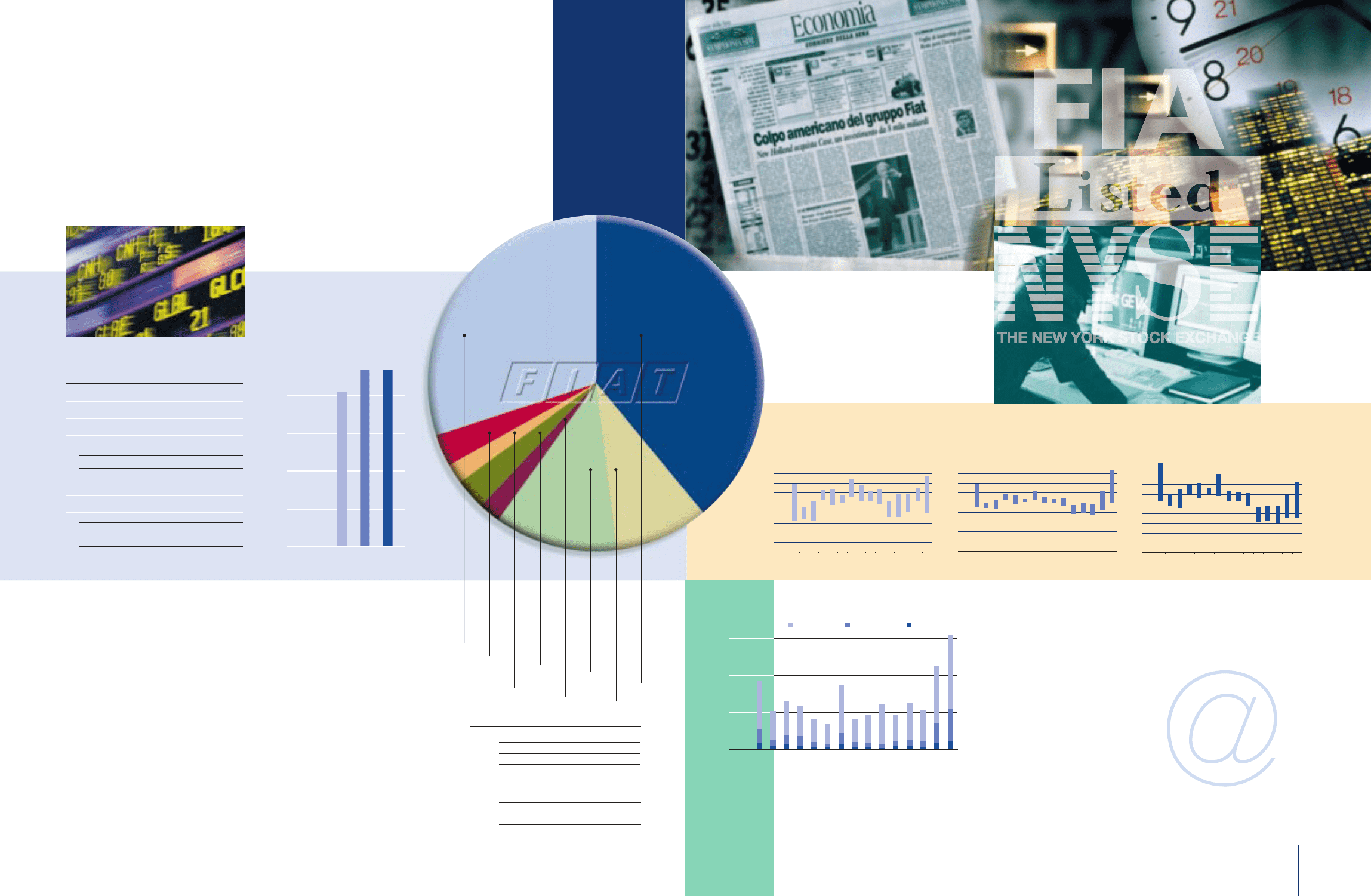

Stockholders

FIAT and its

Ordinary shares

Stockholder base at

December 31, 1999

The shares of Fiat S.p.A. are traded on the

Borsa Italiana S.p.A., Paris Bourse S.A.,

Frankfurter Wertpapier Börse and other

smaller German stock exchanges. The ADRs

issued through JP Morgan are traded on

the New York Stock Exchange.

The shares of Fiat S.p.A. are also

actively traded on the London SEAQ.

The Group pursues a policy of open

communications with individual and

institutional investors. In the course

of the year, its investor relations

program includes, in addition to the

presentations organized after the

publishing of the Annual Report and

the Report on Operations in the First

Half of the Year, several seminars,

which furnish a more in-depth

understanding of the activities and

financial performances of the

principal Sectors of the Group, and

numerous meetings and roadshows

which permit more direct contacts

with the Group’s top management.

For holders of Fiat shares:

Toll-free telephone number in Italy:

800-804027

Website:

www.fiatgroup.com

E-mail addresses:

investor[email protected]

For holders of ADRs:

Toll-free telephone number in the United

States or Canada:

1-800-997-8970

Website:

www.adr.com

Financial communications

Changes to the Capital Stock in 1999

On August 23, 1999, Fiat’s shares were redenominated in euros,

rounding down their par value from 1,000 lire to 0.50 euros.

At the same time, the Company declared a reverse stock split

on the basis of one new ordinary, preference or savings share,

par value five euros, for every 10 old shares.

As a result, the Fiat ADRs traded on the NYSE, which represented

five shares, underwent a reverse split on the basis of one new ADR

for every two ADRs outstanding. Consequently, one Fiat ADR is

now equivalent to one Fiat share.

39% Other stockholders

9% Italian institutional investors

12% International

institutional investors

2% Compagnia di San Paolo

3% Generali Group

2% Deutsche Bank Group

30% IFI-IFIL

Maximum and minimum monthly price in euros

Fiat ordinary shares Fiat preference shares Fiat savings shares

Stock Market Capitalization

1997 1998 1999

at December 31

(in millions of euros)

0

3,000

1997 1998 1999

Cash flow per share 7,690 5,928 5,234

Earnings per share 2,313 1,109 0,618

Dividend per share (*)

ordinary and

preference shares 0,620 0,620 0,620

savings shares 0,775 0,775 0,775

Stokholders’ equity

per share at 31.12 24,261 23,883 23,464

Price per share at 31.12

ordinary shares 24,170 29,159 30,090

preference shares 12,752 16,268 14,606

savings shares 13,719 16,847 14,653

(*) Reflects the distribution of earnings attributable to the respective year.

Highlights per Share

in euros

NOTE: The holdings of Italian and international institutional investors have

been estimated on the basis of surveys commissioned by the Company.

14 Fiat and its Stockholders 15

Average monthly trading volume

Ordinary Preference Savings

(in millions of shares)

3% Mediobanca

6,000

9,000

12,000

367,399,890

Preference shares 103,292,310

International institutional investors 26%

Italian institutional investors 8%

Other stockholders 66%

Savings shares 79,912,800

International institutional investors 4%

Italian institutional investors 12%

Other stockholders 84%

NOTE: Price and trading volume data for the period prior to August 23,

1999 have been adjusted to reflect the reverse stock split (1/10)

carried out on that date.

20.000

22.000

24.000

26.000

28.000

30.000

32.000

34.000

36.000

Jan-99 Feb-99 Mar-99 Apr-99 May-99 June-99 July-99 Aug-99 Sep-99 Oct-99 Nov-99 Dec-99 Jan-00 Feb-00 Mar-00

Jan-99 Feb-99 Mar-99 Apr-99 May-99 June-99 July-99 Aug-99 Sep-99 Oct-99 Nov-99 Dec-99 Jan-00 Feb-00 Mar-00

5.000

7.000

9.000

11.000

13.000

15.000

17.000

19.000

21.000

Jan-99 Feb-99 Mar-99 Apr-99 May-99 June-99 July-99 Aug-99 Sep-99 Oct-99 Nov-99 Dec-99 Jan-00 Feb-00 Mar-00

10.000

11.000

12.000

13.000

14.000

15.000

16.000

17.000

18.000

Jan-99 Feb-99 Mar-99 Apr-99 May-99 June-99 July-99 Aug-99 Sep-99 Oct-99 Nov-99 Dec-99 Jan-00 Feb-00 Mar-00

20

40

60

80

100

120

0