Chrysler 1999 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 1999 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

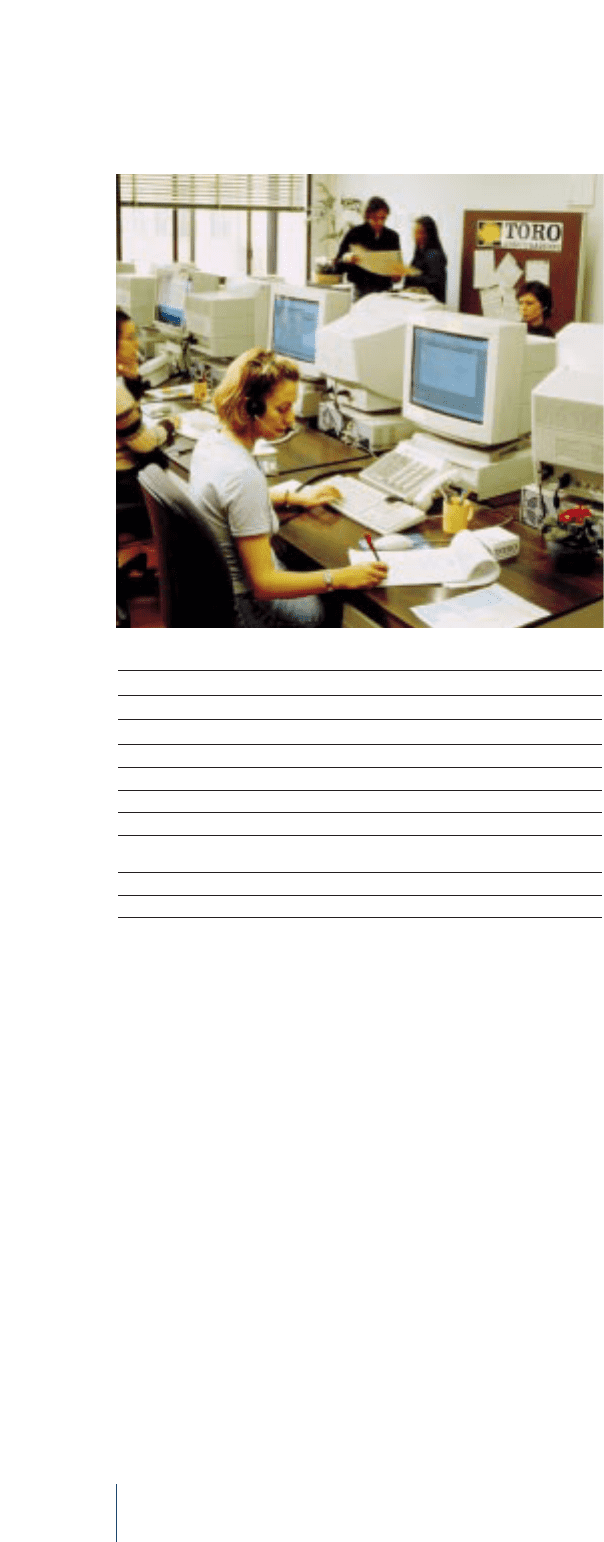

GROWTH STRATEGIES

The Italian insurance market posted strong growth in 1999. Total

premiums written are estimated to have risen by about 20%, with

especially good gains in life insurance. In this environment, the

Insurance Sector continued to pursue a growth strategy that has

already enabled it to triple in size over just four years.

❚In life insurance, Roma Vita, a joint venture with Banca di

Roma, posted particularly gratifying results and has now

become one of the top life insurance companies in Italy.

❚The success of Toro Targa Assicurazioni, a joint venture with

Fiat Auto, enabled the Sector to strengthen its ties with the

Group’s dealer network, which it uses to distribute insurance

products in Italy and abroad.

❚The traditional distribution networks of Toro Assicurazioni

and Nuova Tirrena also performed well.

❚In an important development, the Sector acquired the

French operations of the Guardian Royal Exchange Group,

which specializes in the sale of life insurance and the

provision of asset management services. This transaction

will help Le Continent expand its business in several

attractive market segments with excellent growth potential.

RESULTS FOR THE YEAR

Consolidated premiums totaled 4,088 million euros, or

29% more than in 1998. This amount does not include the

premiums written by the Guardian Group in France (more than

180 million euros), which, if added, would raise the 1999 total

to more than 4,200 million euros. At 2,205 million euros, life

insurance grew by 53% compared with 1998. Over the same

period, casualty insurance premiums increased by 8.7%,

reaching 1,883 million euros.

Premiums earned totaled 3,922 million euros, for a gain of

32.5% over 1998.

The insurance operations were affected by a further increase

in the cost of automobile insurance claims, particularly in the

area of personal injury awards. Another important negative

factor was the impact of the natural disasters that devastated

France at the end of 1999.

The Sector posted improved results in 1999, owing to a sharp

reduction in operating costs and strong gains in investment

income.

In particular, the ratio of distribution costs and overhead to

premiums earned fell by more than one percentage point.

Investment income, which reflects both ordinary and

extraordinary transactions, totaled about 620 million euros

(526 million euros in 1998), as gains generated on trading

securities more than offset the negative impact of the lower

interest rates earned on bonds.

Income before taxes amounted to 178 million euros (116 million

euros in 1998). It reflects a decrease in net financial income

caused by a drop in the market rates available for investments

of liquid funds, offset in part by lower extraordinary expenses. In

1998, the Sector absorbed extraordinary non recurring charges

from the implementation of Legislative Decree No. 173/97.

At December 31, 1999, investments in financial assets and real

estate totaled more than 10,800 million euros, or 3,400 million

euros more than at the end of the previous fiscal year,

exceeding technical reserves by more than 1,100 million euros.

Net income came to 92 million euros (64 million euros in

1998). The Sector’s interest in net income amounted to

94 million euros, up from 59 million euros in 1998.

In 1999, the Sector was again successful in its effort to create

value.

INSURANCE — TORO ASSICURAZIONI

Highlights

(in millions of euros) 1999 1998 1997

Consolidated premiums 4,088 3,169 2,162

Premiums earned 3,922 2,959 2,016

Income before taxes 178 116 133

Net income before minority interests 92 64 88

Technical reserves 9,733 6,386 4,738

Investments in financial

assets and real estate 10,867 7,393 5,520

Stockholders’ equity 1,444 1,334 1,083

Number of employees 2,907 2,869 2,786