Chrysler 1999 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 1999 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

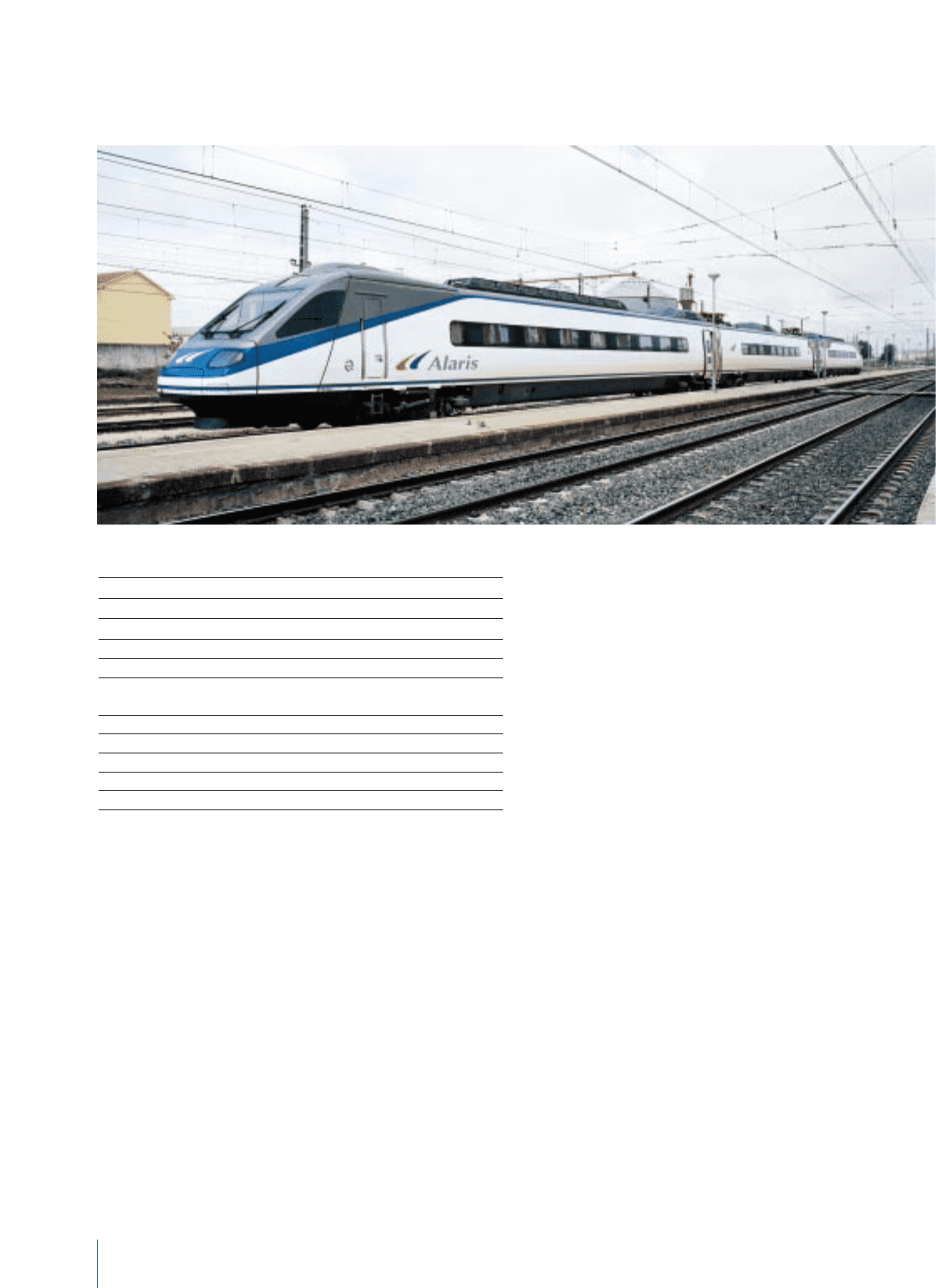

GROWTH STRATEGIES

During 1999, the Italian rolling stock market was characterized

by diverging trends. While investments by the Italian State

Railways were stagnant, sales of urban transport systems

remained relatively healthy.

Outside Italy, demand was flat in the Sector’s target markets.

Against this background, the Fiat Ferroviaria received orders

for 14 additional low-rise trams from ATAC, in Rome. It was

also asked to supply the electrical equipment for 11 trains

used on the MM2 and MM3 lines of the Milan subway system.

Toward the end of the year, it was awarded a contract for

the supply of 15 trams to the municipality of Messina, and

is currently participating in a call for tenders issued by the

municipal transit agency (ATM) of Turin for the supply of

100 trams.

The Sector’s order portfolio amounted to 1,288 million euros

as of December 31, 1999 (1,599 million euros at the end of

1998).

RESULTS FOR THE YEAR

Revenues totaled 375 million euros in 1999, slightly less than

in the previous fiscal year.

Operating income was 13 million euros (3.5 % of revenues),

down from 18 million euros (4.6% of revenues) in 1998. This

decline was due primarily to the impact of orders booked

under extremely competitive conditions.

The Sector reported net income of 3 million euros, compared

with a loss of 1 million euros in 1998, reflecting lower

extraordinary expenses attributable to the implementation of

the new accounting principle on deferred taxes. The Sector’s

interest in net income amounted to 1 million euros (loss of 2

million euros in 1998). Cash flow was 18 million euros (15

million euros a year earlier).

The return on average net invested capital was significantly

higher than the target level needed to create value.

ROLLING STOCK AND RAILWAY

SYSTEMS — FIAT FERROVIARIA

Highlights

(in millions of euros) 1999 1998 1997

Net revenues 375 389 384

Operating income 13 18 26

As a % of revenues 3.5 4.6 6.7

Income (loss) before

minority interest 3(1) 14

Cash flow 18 15 30

Capital expenditures 11 12 14

Research and development 99 9

Net invested capital 29 94 90

Number of employees 2,109 2,294 2,401