Chrysler 1999 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 1999 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

Report on Operations – Analysis of the Financial Position and Operating Results of the Fiat Group and Fiat S.p.A.

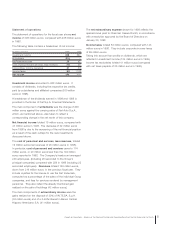

A breakdown of the changes affecting net financial position in

1999 is provided below:

(in millions of euros)

Net financial position at December 31, 1998 1,420

Decrease in working capital 972

Investments in fixed assets (2,712)

Cash flow 2,860

Dividends paid by Fiat S.p.A. (350)

Dividends paid by other companies (67)

Acquisitions and capital contributions (6,149)

Other changes (5)

Total changes (5,451)

Net financial position at December 31, 1999 (4,031)

A breakdown of acquisitions and capitalizations is provided

in the Notes to the Consolidated Financial Statements.

Cash flow, which is equivalent to net income before minority

interest plus depreciation and amortization, declined to 2,860

million euros from 3,226 million euros in 1998, reflecting a

decrease in net income. Depreciation and amortization

totaled 2,354 million euros, about the same as in the previous

fiscal year.

However, the cash flow generated in 1999 was sufficient

to fund capital investments for the period, which amounted

to 2,712 million euros (2,418 million euros in 1998).

Investments in fixed assets include 465 million euros (353

million euros in 1998) for the Group long-term automobile

and truck leasing operations.

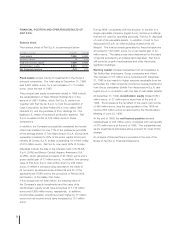

A breakdown of net financial position is provided below:

(in millions of euros) 12/31/99 12/31/98

Cash 1,906 1,673

Marketable securities 1,613 1,903

Financial receivables and investments in leases 19,103 17,128

Accrued financial income 295 212

Deferred financial income (1,892) (1,957)

Total financial assets (A)21,025 18,959

Short-term debt (14,073) (9,588)

Long-term debt (10,756) (7,801)

Accrued financial expenses (309) (200)

Deferred financial expenses 82 50

Total financial liabilities (B) (25,056) (17,539)

Group’s net financial position (A-B) (4,031) 1,420

Stockholders’ equity

Stockholders’ equity totaled 14,767 million euros at

December 31, 1999, compared with 15,120 million euros

at the end of 1998. Group interest in stockholders’ equity

amounted to 12,874 million euros compared with 12,998

million euros in the previous fiscal year.

A breakdown of the changes in stockholders’ equity is

provided in the Notes to the Consolidated Financial

Statements.

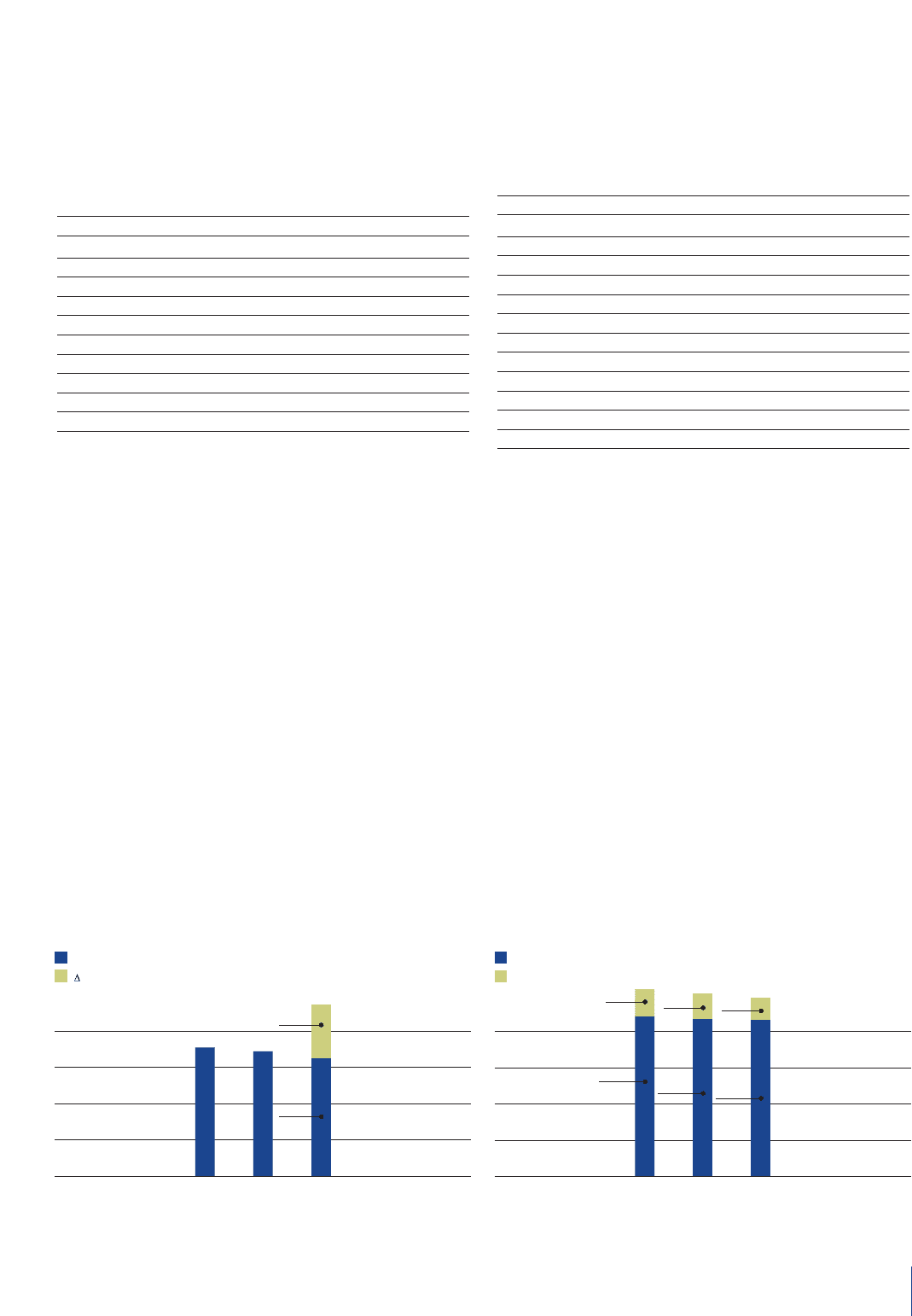

Net Invested Capital

(in millions of euros)

Comparable basis

consolidation scope

1999

18,798

19981997

13,700

14,122

5,898

12,900

Stockholders’ equity

(in millions of euros)

Group

Minority

1999

14,767

19981997

15,120

15,462

13,203

2,259

12,998

2,122 1,893

12,874