Chrysler 1999 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 1999 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

Net deferred tax assets

At December 31, 1999, net deferred tax assets amounted to

574 million euros, compared with 313 million euros in 1998.

The amount shown under this heading is the net effect of

deferred tax liabilities and prepaid taxes due primarily to from

the following temporary differences: accelerated depreciation,

capital gains reinvested under a deferred tax treatment,

inventories, taxed reserves for risks and charges and allowances

for doubtful accounts in excess of the percentage deductible

for tax purposes.

A more detailed analysis of this item is provided in the Notes

to the Consolidated Financial Statements.

Reserves and allowances

At December 31, 1999, reserves and allowances totaled

16,199 million euros. They included the technical reserves

of the insurance companies (10,293 million euros), the reserve

for severance indemnities of the Italian employees (2,138

million euros), the reserve for pensions and similar obligations

(821 million euros), the warranty and technical support reserve

(959 million euros) and other reserves (1,998 million euros).

The gain of 3,313 million euros over the 12,886 million euros

reported at the end of 1998 is due primarily to the higher

technical reserves of the insurance companies, which rose

by 3,325 million euros, reflecting a significant increase in

premium income and the changes in the consolidation scope

(989 million euros due to the consolidation of the Guardian

Group).

A more detailed analysis of this item is provided in the Notes

to the Consolidated Financial Statements.

Net Invested Capital

At December 31, 1999, net invested capital totaled 18,798

million euros, or 5,098 million euros more than at the end

of 1998. The change in the scope of consolidation and the

acquisitions completed in 1999 (Case, Pico and Fraikin in

particular) account for most of the increase. Had the scope

of consolidation remained the same, net invested capital

would have resulted 800 million euros less than at December

31, 1998.

On a comparable basis, the asset turnover rate was 3.3,

almost unchanged from 1998.

Value Creation

The return on invested capital, which is the ratio of operating

income plus investment income to average net invested

capital, was about 7%, falling short of the 10% needed to

create stockholder value in 1999. As a result, value creation

was a negative 480 million euros, as compared with a

negative 714 million euros in 1998, which was calculated

using a rate of return of 12%.

Net Financial Position of the Group

At December 31, 1999, the consolidated net financial position

of the Group showed net borrowings of 4,031 million euros,

compared with net liquidity of 1,420 million euros at the

beginning of the fiscal year.

The rise in the level of indebtedness reflects the increased

resources required to fund the acquisitions carried out by

the Group, which entailed outlays totaling over 6,000 million

euros.

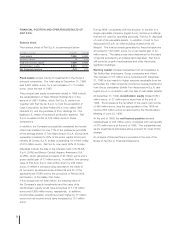

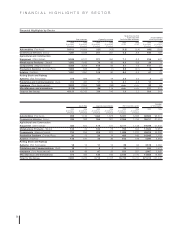

12.31.1999 12.31.1998

Industrial (*) Insurance Industrial (*) Insurance

(in millions of euros) Activities Activities Consolidated Activities Activities Consolidated

Net inventories 7,987 – 7,987 7,084 – 7,084

Trade receivables 6,095 570 6,665 5,999 479 6,478

Trade payables (10,828) (242) (11,070) (8,765) (163) (8,927)

Other receivables (payables), net (2,600) (84) (2,684) (2,706) (58) (2,765)

Working capital 654 244 898 1,612 258 1,870

Net property, plant and equipment 15,014 906 15,920 14,271 784 15,056

Other fixed assets 7,937 9,714 17,605 2,865 6,490 9,347

Net deferred tax assets 631 (57)574334(20)313

Reserves and allowances (5,814) (10,385) (16,199) (5,819) (7,067) (12,886)

Net invested capital 18,422 422 18,798 13,263 445 13,700

Net financial position (5,649)1,618 (4,031) 3 1,417 1,420

Stockholders’ equity before minority interest 12,773 2,040 14,767 13,266 1,862 15,120

Fiat’s interest in stockholders’ equity 11,310 1,610 12,874 12,029 981 12,998

(*) It includes the Toro Assicurazioni Group, Augusta Assicurazioni S.p.A. and Essex & General Insurance Ltd.