Chrysler 1999 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 1999 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Report on Operations – Analysis of the Financial Position and Operating Results of the Fiat Group and Fiat S.p.A. 23

Net revenues

The Group’s net revenues, including changes in contract work

in progress, totaled 48,123 million euros in 1999, 44,094

million euros of which are attributable to the Group’s Industrial

Activities (+3,3%), while 4,084 million euros were generated

by the Insurance Activities (+29.4%). Overall, revenues were

up 5.1% over 1998. On a comparable basis, excluding the

impact of changes in the scope of consolidation, the revenue

gain is about 1%.

The results generated by Case, which New Holland acquired

last November, will be consolidated for the first time in the

2000 fiscal year. Had Case’s sales been consolidated for the

full year on a proforma basis, the Group’s revenues would

have increased to about 53,000 million euros.

An analysis of revenues by operating Sector is provided below:

❚Fiat Auto reported consolidated revenues of 24,101 million

euros, or 758 million euros less (-3%) than in 1998, chiefly

as a result of lower sales in the Mercosur countries and the

devaluation of the Brazilian real.

The Sector shipped a total of 2,328,000 vehicles, compared

with 2,397,000 the previous year. Weak sales in South

America account for most of this 2.9% decline. Volumes

were up slightly in Italy (+0.4%), where customers purchased

955,000 Fiat Auto vehicles. Sales held steady in Western

Europe and showed good growth in Poland.

❚At Iveco revenues totaled 7,387 million euros (+11.1%).

The gain of 738 million euros over 1998 reflects an expansion

in unit sales, especially in Europe where the Bus operations

did particularly well, and the consolidation of Naveco (China).

A positive contribution was also provided by the vehicle

financing and leasing operations. On a comparable

consolidation basis, sales were up 4.3%.

❚Stated in U.S. dollars, the Sector‘s reporting currency,

CNH‘s revenues decreased 2.2% to $5,589 million, which

is equivalent to 5,246 million euros. The figure in euros

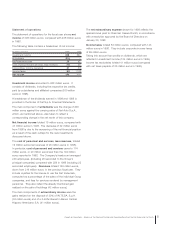

Consolidated Revenues

(in millions of euros)

48,123

45,769

46,257

1997 1998 1999

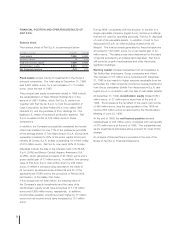

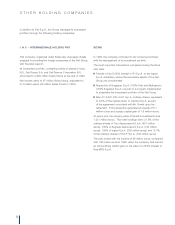

12/31/99 12/31/98

Industrial (*) Insurance Industrial (*) Insurance

(in millions of euros) Activities Activities Consolidated Activities Activities Consolidated

Net revenues 44,094 4,084 48,123 42,667 3,155 45,769

Cost of goods sold 36,848 4,012 40,805 35,454 3,119 38,520

Gross operating result 7,246 72 7,318 7,213 36 7,249

Gross operating result/Net revenues 16.4% 1.8% 15.2% 16.9% 1.1% 15.8%

Overhead 4,835 249 5,084 4,784 247 5,031

Overhead/Net revenues 11.0% 6.1% 10.6% 11.2% 7.8% 11.0%

Research and development 1,406 – 1,406 1,264 – 1,264

Operating income (expenses) (155)115 (40) (219) 11 (208)

Operating income 850 (62)788 946 (200) 746

ROS 1.9% (1.5%)1.6% 2.2% (6.3%) 1.6%

Investment income (**) 194 171 361 168 120 286

Financial income (expenses) (507) 49 (458) (112) 233 121

Extraordinary income (expenses) 229 104 333 293 (4) 289

Income before taxes 766 262 1,024 1,295 149 1,442

Income taxes 460 88 518 480 46 526

Income before minority interest 306 174 506 815 103 916

Fiat interest in net income 201 152 353 561 60 621

(*) It includes the Toro Assicurazioni Group, Augusta Assicurazioni S.p.A. and Essex & General Insurance Ltd.

(**) It includes investment income, as well as writedowns and upward adjustments on investments in subsidiaries and affiliates valued by the equity method.