Chrysler 1999 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 1999 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

vehicles (curb weight of 16 tons or more), where demand grew

by 13.8% to 233,000 units, compared with 204,700 in 1998.

Overall, Iveco sold 149,900 vehicles, or 9.6% more than in

1998. If the contribution of the joint ventures and licensees

is added, the total rises to 192,000 units, about the same

as in the previous fiscal year.

In Western Europe, the Sector shipped 119,800 vehicles, for

a gain of 7.7% over 1998. The best results were achieved in

France (+23.3%), Spain (+16.3%) and Italy (11.6%), but sales

were up in all other European countries with the exception of

Great Britain (-12.2%).

Sales to customers outside Western Europe totaled 30,100

units (25,600 in 1998). Starting with 1999, this figure includes

50% (9,000 units) of the light commercial vehicles shipped

by Naveco, a Chinese joint venture in which the Sector holds

a 50% interest.

Irisbus, a recently established joint venture owned in equal

shares with Renault, sold a total of 8,800 units in 1999.

During the year, Irisbus continued to expand its operations

and acquired a controlling interest in Ikarus, a Hungarian bus

manufacturer.

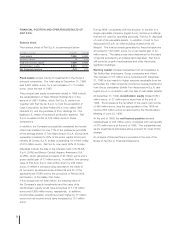

COMMERCIAL VEHICLES — IVECO

Highlights

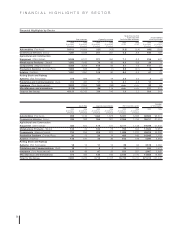

(in millions of euros) 1999 1998 1997

Net revenues 7,387 6,649 5,850

Operating income 311 261 203

As a % of revenues 4.2 3.9 3.5

Income before minority interest 180 192 174

Cash flow 433 368 374

Capital expenditures 359 307 265

Research and development 215 200 187

Net invested capital 2,359 1,764 1,440

Number of employees 36,217 31,912 32,074

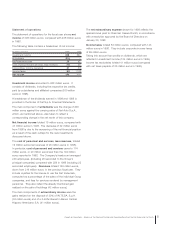

Commercial Vehicles Market (curb weight ≥3.5 tons)

99/98

(in thousands of units) 1999 1998 ∆in %

France 100.4 89.3 12.4

Germany 149.3 131.4 13.6

Great Britain 105.5 108.5 (2.8)

Italy 85.0 68.1 24.8

Spain 64.3 52.6 22.2

Western Europe 629.0 567.5 10.8

Sales Performance – Units Sold

99/98

(in thousands of units) 1999 1998 ∆in %

France 20.1 16.3 23.3

Germany 16.9 16.6 1.8

Great Britain 13.7 15.6 (12.2)

Italy 41.5 37.2 11.6

Spain 15.0 12.9 16.3

Western Europe 119.8 111.2 7.7

Rest of the world 30.1 25.6 17.6

Total units sold 149.9 136.8 9.6

Joint ventures (*) 42.1 56.5 (25.5)

Grand total 192.0 193.3 (0.7)

(*) The figure for 1998 does not include the vehicles sold by Naveco (20,600 units).

SALES PERFORMANCE

In 1999, the European market for commercial vehicles showed

the same sustained growth as in the previous fiscal year,

prolonging the expansion that started in 1994.

In Western Europe, demand for commercial vehicles with

a curb weight of 3.5 tons or more reached 629,000 units

in 1999, or 10.8% more than a year earlier.

The breakdown by country shows gains in all European

markets, with the exception of Great Britain (-2.8%).

Particularly healthy increases were recorded in Italy (+24.8%)

and Spain (+22.2%). The German and French markets also

did remarkably well, rising 13.6% and 12.4%, respectively.

An analysis by segment reveals that while the increase was

across the board, it was more pronounced for heavy-load