Chrysler 1999 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 1999 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

Report on Operations – Automobiles

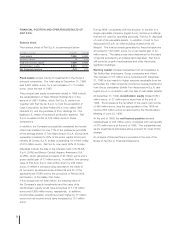

FINANCIAL ACTIVITIES

During 1999, the Sector’s financing activities continue to

grow in the international markets. Financing provided to

end customers totaled 7,734 million euros, for a year-on-year

gain of 3.9%. This volume of business supported the sale

of 1,088,600 units (+8.7% over 1998 on a comparable basis),

equivalent to 37.4% of all vehicles sold by Fiat Auto (33%

in 1998).

In particular, financing was provided for 331,068 units in Italy,

for a share of 36.2% of sales, or 2.8 percentage points more

than in 1998. The vehicles financed in the rest of Europe

increased to 349,603, for a share of 40.8% of sales (3.4

percentage points more than in the previous fiscal year).

In network financing, business volumes reached 16,900 million

euros.

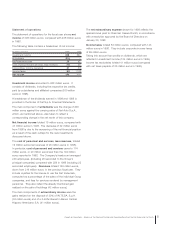

RESULTS FOR THE YEAR

Fiat Auto’s consolidated revenues amounted to 24,101 million

euros, or 758 million euros less (-3%) than in 1998, chiefly

as a result of lower sales in the Mercosur countries and

the devaluation of the Brazilian real.

The aggressive competition that has characterized the

European market showed no signs of abating. In Europe

and in Italy, the introduction of new products, the increase in

the number of components offered as standard equipment

and the growing use of promotions and incentives, while

stimulating demand, had the effect of compressing profit

margins. As a result, the Sector reported an operating loss

of 121 million euros, for a negative return on sales of 0.5%,

about the same as 1998.

In South America, the restructuring of the Brazilian operations

produced improved results despite continued weak demand.

In Argentina, the Sector is reacting to a challenging

environment by implementing similar restructuring programs,

but their beneficial effects have not yet filtered down fully to

the bottom line.

Fiat Auto responded to this difficult situation with aggressive

measures at every level of its organization. As a result, it was

able to reduce manufacturing costs and, thanks to the Nova

Project, cut overhead by 10% in 1999, with a further decrease

of 10% planned for the year 2000.

The higher return on sales earned during the last quarter of

the year reflects primarily the launch of two new models —

the Fiat Punto and Lancia Lybra — in September, as well as

the continuing success of the Alfa Romeo brand and the

beneficial effects of efficiency measures carried out throughout

the Sector. The Sector reported a net loss of 493 million

euros, compared with a loss of 258 million euros in 1998.

Higher net financial expenses and an increased tax burden

caused by lower deferred tax assets than in the previous

fiscal year account for the difference.

Cash flow totaled 855 million euros (1,146 million euros in

1998) after depreciation and amortization of 1,348 million

euros (1,404 million euros in 1998).

The loss reported for the fiscal year prevented Fiat Auto from

creating value in 1999.