Chrysler 1999 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 1999 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

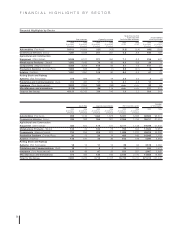

Report on Operations – Analysis of the Financial Position and Operating Results of the Fiat Group and Fiat S.p.A.

Statement of operations

The statement of operations for the fiscal year shows net

income of 396 million euros, compared with 408 million euros

in 1998.

The following table contains a breakdown of net income:

(in millions of euros) 1999 1998

Investment income 608 530

Writedowns (210) –

Net financial income 15 47

Cost of personnel and services, less revenues (15) 25

Extraordinary income (expense) 81 (51)

Income taxes (83) (143)

Net income 396 408

Investment income amounted to 608 million euros. It

consists of dividends, including the respective tax credits,

paid by subsidiaries and affiliated companies (530 million

euros in 1998).

A breakdown of the dividends earned in 1999 and 1998 is

provided in the Notes of Fiat S.p.A. Financial Statements.

The main component of writedowns was the charge of 209

million euros against the carrying value of Fiat Auto S.p.A.,

which, as mentioned above, was taken to reflect a

corresponding change in the net worth of this company.

Net financial income totaled 15 million euros, compared with

47 million euros in 1998. The decrease of 32 million euros

from 1998 is due to the worsening of the net financial position

as a result of the cash outlays for the new investments

discussed above.

The cost of personnel and services, less revenues, totaled

15 million euros (net revenues of 25 million euros in 1998).

In particular, cost of personnel and services came to 174

million euros, or 20 million euros less than the 194 million

euros reported in 1998. The Company’s headcount averaged

245 employees, (including 26 seconded to the Group’s

principal companies) compared with 256 in 1998 (including 25

seconded employees). Revenues totaled 159 million euros,

down from 219 million euros in the previous fiscal year. They

include royalties for the license to use the Fiat trademark,

computed as a percentage of the sales of the individual Group

companies, and fees for services rendered by management

personnel. They also reflect the already mentioned gain

realized on the sale of buildings (42 million euros).

The main components of extraordinary income were the

gains realized on the disposal of 30% of IN.TE.SA. S.p.A.

(32 million euros) and of a 0.46% interest in Banco Central

Hispano Americano S.A. (41 million euros).

The net extraordinary expense shown for 1998 reflects the

special bonus paid to Chairman Cesare Romiti, in accordance

with a resolution approved by the Board of Directors on

January 30, 1998.

Income taxes totaled 83 million euros, compared with 143

million euros in 1998. They include corporate income taxes

of 69 million euros.

Taking into account tax credits on dividends, which are

reflected in investment income (124 million euros in 1999),

income tax receivables totaled 41 million euros (compared

with net taxes payable of 25 million euros in 1998).