Chrysler 1999 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 1999 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

represents a gain of 2.3% over the previous year, reflecting

the appreciation of the U.S. dollar versus the single

European currency.

Stated in euros, sales were down about 5.5% on a

comparable consolidation basis. The decrease is due

mainly to lower unit sales, particularly in North America

where CNH was penalized by an unfavorable sales mix.

The contraction in sales of agricultural equipment was

offset in part by strong sales of construction equipment.

Had Case’s sales been consolidated for the full year on

aproforma basis, the Sector’s revenues would have

increased to about 10,000 million euros.

❚The other industrial Sectors had combined revenues

of 9,173 million euros, compared with 7,551 million euros

in 1998. Changes in the scope of consolidation account

for most of this 21.5% increase.

The best gains were recorded by Teksid, where revenues

rose to 1,682 million euros (+44.4%, but -5.2% on a

comparable consolidation basis); Magneti Marelli, which

posted revenues of 4,062 million euros (+7.1%, but

practically unchanged on a comparable basis); and

Comau/Pico, which reported revenues of 1,693 million

euros (+100.8%, but -5.5% on a comparable consolidation

basis).

The performance of the Service Sectors is reviewed below:

❚Toro Assicurazioni wrote premiums totaling 3,922 million

euros, or 32.5% more than the 2,959 million euros reported

in 1998. Strong sales of life insurance accounted for most

of the increase.

❚Itedi had revenues of 413 million euros. The sale of Satiz,

a company providing publishing activities, is the main

reason for this 5.5% decline.

Gross operating result

At 7,318 million euros, the gross operating result was about

the same as in the previous fiscal year (7,249 million euros),

but its relative amount to revenues declined from 15.8% in

1998 to 15.2% in 1999. For the Industrial Activities alone,

the gross operating result was equivalent to 16.9% of sales

in 1998 and 16.4% in 1999, mainly as a result of extremely

keen price competition and the continuing crisis in the

Mercosur countries.

Overhead

Overhead came to 5,084 million euros in 1999 (+1.1% over

1998), equivalent to 10.6% of revenues (11% in 1998).

The programs implemented under the Nova Project to

reengineer the Group’s business support activities and

simplify its organization were major factors in reducing the

ratio of overhead to revenues. Cost savings exceeded 500

million euros (an 11.8% reduction), well ahead of the 1999 target.

Research and development outlays

Research and development outlays, which were charged

in full to income, totaled 1,406 million euros, or 11.2% more

than in 1998. This increase demonstrates the Group’s ongoing

commitment to innovation and technological excellence.

Operating Income

Operating income before extraordinary, financial and tax

components totaled 788 million euros in 1999, or 42 million

euros more than in 1998. When measured separately from

the Group’s insurance operations, which are characterized by

a structurally negative operating performance, the return on

sales of the industrial activities was 1.9% (2.2% in 1998).

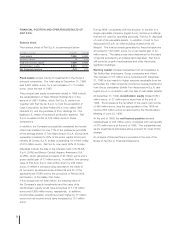

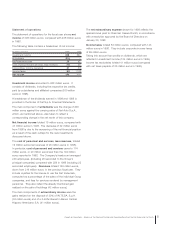

1999 1998

(in millions of euros) Revenues Revenues % change

Automobiles (Fiat Auto) 24,101 24,859 (3.0%)

Commercial Vehicles (Iveco) 7,387 6,649 11.1%

Agricultural and Construction Equipment(CNH Global) 5,2465,127 2.3%

Metallurgical Products (Teksid) 1,682 1,165 44.4%

Components (Magneti Marelli) 4,062 3,793 7.1%

Production Systems (Comau/Pico) 1,693 843 100.8%

Aviation (FiatAvio) 1,361 1,361 –

Rolling Stock and Railway Systems (Fiat Ferroviaria) 375 389 (3.6%)

Publishing and Communications (Itedi) 413 437 (5.5%)

Insurance (Toro Assicurazioni) 3,922 2,959 32.5%

Miscellaneous and eliminations (2,119) (1,813) 16.9%

Total for the Group 48,123 45,769 5.1%