Chrysler 1999 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 1999 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

Report on Operations – Commercial Vehicles

Production of Iveco diesel engines benefited from a

continuation of the positive trend that started in 1998,

reaching an all-time high of 405,000 units, or 11.5% more

than in the previous year.

The main affiliated companies also posted attractive results.

In India, Iveco sold 36,230 vehicles (+24.9%) through the

Ashok Leyland subsidiary. In Turkey, Otoyol, a joint venture

with the Koç Group in which Iveco holds a 27% interest,

manufactured and sold 5,800 units (6,900 in 1998).

FINANCIAL ACTIVITIES

The Sector’s financing activities continued to grow both

internally, with the introduction of new products and the

establishment of new companies (Transolver Service GmbH

in Germany and Transolver Service S.A. in Spain), and through

acquisitions.

In December 1999, consistently with its strategy focused on

lengthening the value chain by offering customers a global

service, Iveco acquired a controlling interest in the Fraikin

Group, the unchallenged leader in the French market for long-

term leases of commercial vehicles, with a strong presence

in the areas of vehicles rental and fleet management.

Established in 1944, the Fraikin Group controls a total of

almost 30,000 vehicles in France, Great Britain, Benelux

and Spain, and operates a proprietary network of 205 repair

shops.

During 1999, the Transolver companies that operate the

Sector’s financing and leasing activities executed contracts

covering more than 22,500 new and used vehicles (+6% over

1998). In Western Europe, they provided financing for 27%

of the new vehicles sold by the Group.

The portfolio of maintenance and repairs contracts rose by

26% in 1999 to 18,300 contracts, reflecting the addition of

6,300 new contracts during the year.

PRODUCT INNOVATION

In June 1999, the Sector started distribution of the new Daily

in all Western European markets. This new vehicle received

the Van of the Year 2000 award. In the heavy-load range,

Iveco launched the Euromover which, with its dropped cab,

is ideally suited for use by municipal agencies.

The Cursor 10, a new 430-bhp 10-liter engine, was also

introduced in 1999 with the goal of repeating the outstanding

success of the Cursor 8, which the Sector brought to market

in 1998. The Cursor 10 targets buyers of long-distance

trucks, who represent a key segment of the European market

for heavy-load vehicles. This new generation of engines

should help Iveco improve its penetration of the European

heavy-load vehicle market.

The capital expenditures carried out during the year were

earmarked primarily for the construction of a factory at Sete

Lagoas, in the Brazilian state of Minas Gerais. This new plant,

built by a joint venture with Fiat Auto, will manufacture vehicles

of the Daily and Ducato lines. Additional resources were

invested to start production of Iveco engines in the same

country.

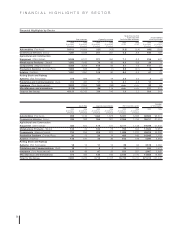

RESULTS FOR THE YEAR

The Sector’s net revenues amounted to 7,387 million euros,

or 11.1% more than in the previous fiscal year.

At 311 million euros (+50 million euros over 1998) operating

income was equivalent to 4.2% of revenues, up from 3.9%

in 1998.

This improved performance reflects the beneficial effects of

higher volumes and lower product costs and overhead, which,

however, were partly offset by increased competitive pressure.

During 1999, the Sector’s profitability was adversely affected

by the phaseout of the old Daily line and the costs incurred

to launch the new range of these vehicles.

Capital expenditures grew to 359 million euros in 1999,

compared with 307 million euros in 1998.

Consolidated net income totaled 180 million euros in 1999,

after depreciation and amortization of 253 million euros

and research and development costs of 215 million euros,

compared with 192 million euros earned in 1998, when

depreciation and amortization amounted to 176 million euros

and R&D outlays were 200 million euros. The 1998 result also

included a net extraordinary gain stemming from a change

in the accounting principle for deferred taxes. The Sector’s

interest in net income came to 163 million euros, compared

with 200 million euros in 1998.

At 433 million euros, cash flow was 65 million euros higher

than in 1998.

The level of profitability achieved in 1999 produced a return on

invested capital in excess of the budgeted rate, enabling Iveco

to create value.