Chrysler 1999 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 1999 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

SALES PERFORMANCE

In 1999, the tractor market grew slightly in Western Europe.

In North America, although overall tractor sales evidenced a

small increase, this was entirely attributable to the growth in

sales of low horsepower tractors. The North American market

for more powerful tractors, such as those produces by CNH,

continued to reflect ongoing market weakness.

In Latin America, the market was slightly above 1998 levels.

However, drought-related problems had a negative impact

on the industry as a whole.

The market for combine harvesters was particularly weak in

most regions throughout 1999. North America recorded the

weakest performance, primarily as a result of low commodity

prices throughout the year. In Western Europe, the market

declined by approximately 15% due to a difficult year for

crops. The Brazilian market grew by 15%, continuing the

positive trend of the previous year.

The market for construction equipment experienced different

trends in the various product lines. The worldwide market for

loader/backhoes was disappointing, ending significantly below

1998 levels. North America, which accounts for approximately

60% of the worldwide industry, finished the year well below

1998 performance, influenced by rising interest rates. This

trend, however, was partially offset by encouraging growth in

the European market, primarily driven by an improved housing

sector.

In North America, demand for skid-steer loaders remained

strong (+6%), fueled by a favorable economy and suburban

growth. In Western Europe, the market improved significantly,

up 8% over the prior year.

The heavy construction equipment market experienced an

overall decline in all products, except excavators. In North

America, sales of heavy equipment dropped 16% over 1998.

Strong growth in Western European and Latin American

markets could not offset the sharp decline in North America.

GROWTH STRATEGIES

During 1999, CNH continued to support its growth through

both strategic corporate initiatives that strengthened its

position in international markets and the launch of new

products in markets around the world.

❚In November 1999, following the acquisition of Case in

the United States, New Holland changed its name to CNH

Global N.V. (CNH). This new group is the world’s largest

manufacturer of agricultural equipment and one of the

leading international producers of construction equipment.

The acquisition of Case Corporation, which was reflected

on a cost basis in 1999, will be consolidated into the

Group’s accounts in year 2000.

The product line breadth, geographic sales distribution,

and technological capabilities of New Holland and Case

are highly complementary and will provide significant

opportunities for CNH to grow and increase profitability in the

future. The combined resources of the merged companies

also provide CNH with opportunities to significantly enhance

both services to our customers and expand the Company’s

worldwide equipment product offerings.

❚In 1999 the accounts of O&K Orenstein & Koppel AG

(German producer of construction equipment) were

consolidated for the first time.

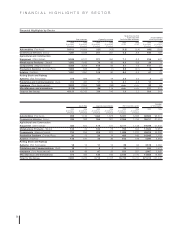

AGRICULTURAL AND CONSTRUCTION

EQUIPMENT — CNH GLOBAL

Highlights

(in millions of euros) 1999 1998 1997

Net revenues 5,246 5,127 5,284

Operating income 371 452 602

As a % of revenues 7.1 8.8 11.4

Income before minority interest 216 507 422

Cash flow 333 624 528

Capital expenditures 178 151 135

Research and development 158 136 113

Net invested capital 5,777 1,123 592

Number of employees 19,049 21,344 19,077