Chrysler 1999 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1999 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

Report on Operations – Analysis of the Financial Position and Operating Results of the Fiat Group and Fiat S.p.A.

Consolidated net income before minority interest totaled

506 million euros, compared with 916 million euros in 1998.

Fiat’s interest in net income amounted to 353 million euros,

as against 621 million euros in 1998.

Balance sheet

As required under Legislative Decree No. 127/91, a detailed

analysis of the Group’s balance sheet, which is presented in

accordance with the statutory format for consolidated financial

statements, is provided in the Notes to the Consolidated

Financial Statements.

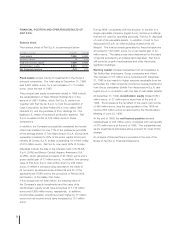

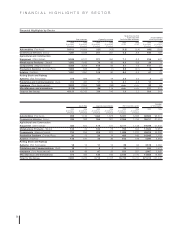

In the table appearing on the following page, the Group’s

consolidated balance sheet has been reclassified and

presented in a condensed format, showing its main

components according to their destination and broken

down between Industrial and Insurance Activities.

Working capital

At December 31, 1999, the Group’s consolidated working

capital totaled 898 million euros, down from 1,870 million

euros in 1998, for a coverage index of 5 days for the Industrial

Activities (14 days in 1998).

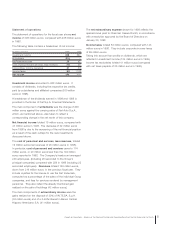

An analysis of the changes affecting the main components

of working capital is provided below:

❚Inventories (raw materials, finished products and work in

progress), net of advances received, amounted to 7,987

million euros compared with 7,084 million euros in 1998.

Inventories were equivalent to 60 days of sales (56 days

in 1998).

❚Trade receivables totaled 6,665 million euros at the end of

1999, for an increase of 2.9% compared with 6,478 million

euros at December 31, 1998. At 50 days, the credit

exposure was about the same as in 1998.

❚Trade payables increased to 11,070 million euros, or 2,143

million euros more than the 8,927 million euros reported at

the end of 1998, while the debt exposure, measured on

sales revenues, increased to 83 days of sales (70 days in

the previous fiscal year). This was mainly due to increased

production activity and capital expenditures in the last

quarter of 1999.

Net property, plant and equipment

Net property, plant and equipment amounted to 15,920

million euros, up from 15,056 million euros at the end of 1998,

mainly as a result of changes in the scope of consolidation.

Net property, plant and equipment include fixed capital

earmarked for the Group’s medium and long-term automobile

and truck leasing operations, a new line of business with

considerable growth potential. Fixed capital in this category

posted a significant increase as compared to 1998.

A breakdown of the changes affecting this item is provided

in the Notes to the Consolidated Financial Statements.

Additions totaled 2,712 million euros (2,418 million euros

in 1998), while depreciation came to 2,074 million euros.

Retirements and other changes totaled 1,013 million euros

while positive changes in the scope of consolidation

amounted 1,239 million euros.

At December 31, 1999, accumulated depreciation and

writedowns totaled 18,920 million euros (18,489 million euros

in 1998). Property, plant and equipment was depreciated

at about 55% in 1999, almost unchanged from 1998.

Other fixed assets

Other fixed assets, which include financial fixed assets

(investments, securities and treasury stock) and intangibles

(start-up and expansion costs, goodwill, and intangible assets

in progress and others) amounted to 17,605 million euros

at December 31, 1999, or 8,258 million euros more than at

the end of 1998. Most of the increase is attributable to the

acquisition of Case Corporation by New Holland, which was

booked at cost, and the higher value of the securities held

by the insurance companies as coverage for their technical

reserves.

Working capital

(in millions of euros)

898

1,870

2,116

199919981997