CarMax 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

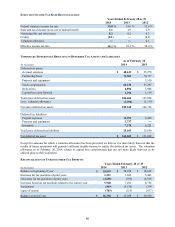

(D) Executive Deferred Compensation Plan

Effective January 1, 2011, we established an unfunded nonqualified deferred compensation plan to permit certain

eligible key associates to defer receipt of a portion of their compensation to a future date. This plan also includes a

restorative company contribution designed to compensate the plan participants for any loss of company

contributions under the Retirement Savings 401(k) Plan and the Retirement Restoration Plan due to a reduction in

their eligible compensation resulting from deferrals into the Executive Deferred Compensation Plan. The total cost

for this plan was $0.6 million in fiscal 2014, $0.4 million in fiscal 2013 and was not material in fiscal 2012.

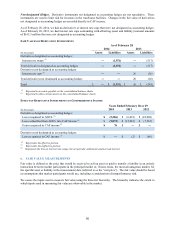

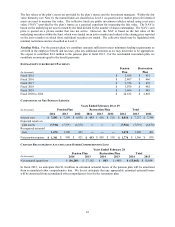

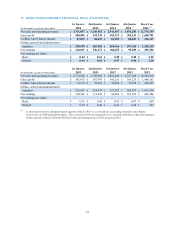

11. DEBT

As of February 28

(In thousands) 2014 2013

Short-term revolving credit facility $582 $ 355

Current portion of finance and capital lease obligations 18,459 16,139

Current portion of non-recourse notes payable 223,938 182,915

Total current debt 242,979 199,409

Finance and capital lease obligations, excluding current portion 315,925 337,452

N

on-recourse notes payable, excluding current portion 7,024,506 5,672,175

Total debt, excluding current portion 7,340,431 6,009,627

Total debt $ 7,583,410 $ 6,209,036

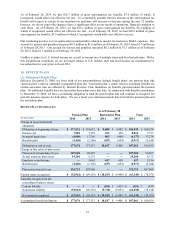

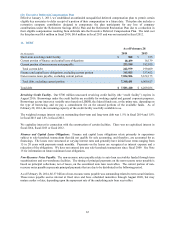

Revolving Credit Facility. Our $700 million unsecured revolving credit facility (the “credit facility”) expires in

August 2016. Borrowings under the credit facility are available for working capital and general corporate purposes.

Borrowings accrue interest at variable rates based on LIBOR, the federal funds rate, or the prime rate, depending on

the type of borrowing, and we pay a commitment fee on the unused portions of the available funds. As of

February 28, 2014, the remaining capacity of the credit facility was fully available to us.

The weighted average interest rate on outstanding short-term and long-term debt was 1.5% in fiscal 2014 and 1.8%

in fiscal 2013 and 1.6% in fiscal 2012.

We capitalize interest in connection with the construction of certain facilities. There was no capitalized interest in

fiscal 2014, fiscal 2013 or fiscal 2012.

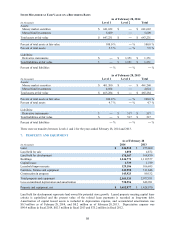

Finance and Capital Lease Obligations. Finance and capital lease obligations relate primarily to superstores

subject to sale-leaseback transactions that did not qualify for sale accounting, and therefore, are accounted for as

financings. The leases were structured at varying interest rates and generally have initial lease terms ranging from

15 to 20 years with payments made monthly. Payments on the leases are recognized as interest expense and a

reduction of the obligations. We have not entered into any sale-leaseback transactions since fiscal 2009. See Note

15 for information on future minimum lease obligations.

Non-Recourse Notes Payable. The non-recourse notes payable relate to auto loan receivables funded through term

securitizations and our warehouse facilities. The timing of principal payments on the non-recourse notes payable is

based on principal collections, net of losses, on the securitized auto loan receivables. The current portion of non-

recourse notes payable represents principal payments that are due to be distributed in the following period.

As of February 28, 2014, $6.37 billion of non-recourse notes payable was outstanding related to term securitizations.

These notes payable accrue interest at fixed rates and have scheduled maturities through August 2020, but may

mature earlier or later, depending upon the repayment rate of the underlying auto loan receivables.