CarMax 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

Interest income and expenses related to auto loans are included in CAF income. Interest income on auto loan

receivables is recognized when earned based on contractual loan terms. All loans continue to accrue interest until

repayment or charge-off. Direct costs associated with loan originations are not considered material, and thus, are

expensed as incurred. See Note 3 for additional information on CAF income.

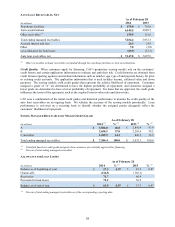

(J) Property and Equipment

Property and equipment is stated at cost less accumulated depreciation and amortization. Depreciation and

amortization are calculated using the straight-line method over the shorter of the asset’s estimated useful life or the

lease term, if applicable. Property held under capital lease is stated at the lesser of the present value of the future

minimum lease payments at the inception of the lease or fair value. Amortization of capital lease assets is computed

on a straight-line basis over the shorter of the initial lease term or the estimated useful life of the asset and is

included in depreciation expense. Costs incurred during new store construction are capitalized as construction-in-

progress and reclassified to the appropriate fixed asset categories when the store is completed.

ESTIMATED USEFUL LIVES

Life

Buildings 25 years

Capital lease 20 years

Leasehold improvements 15 years

Furniture, fixtures and equipment 3 – 15 years

We review long-lived assets for impairment when events or changes in circumstances indicate the carrying amount

of an asset may not be recoverable. We recognize impairment when the sum of undiscounted estimated future cash

flows expected to result from the use of the asset is less than the carrying value of the asset. We recognized an

impairment of $0.1 million in fiscal 2014 and $0.2 million in fiscal 2012 related to assets within land held for sale.

There was no impairment of long-lived assets in fiscal 2013. See Note 7 for additional information on property and

equipment.

(K) Other Assets

Goodwill and Intangible Assets. Goodwill and other intangibles had a carrying value of $10.1 million as of

February 28, 2014 and February 28, 2013. We review goodwill and intangible assets for impairment annually or

when circumstances indicate the carrying amount may not be recoverable. No impairment of goodwill or intangible

assets resulted from our annual impairment tests in fiscal 2014, fiscal 2013 or fiscal 2012.

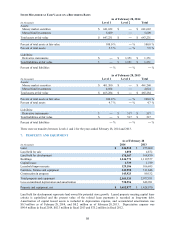

Restricted Cash on Deposit in Reserve Accounts. The restricted cash on deposit in reserve accounts is for the

benefit of holders of non-recourse notes payable, and these funds are not expected to be available to the company or

its creditors. In the event that the cash generated by the securitized receivables in a given period was insufficient to

pay the interest, principal and other required payments, the balances on deposit in the reserve accounts would be

used to pay those amounts. Restricted cash on deposit in reserve accounts was $32.5 million as of February 28,

2014, and $41.3 million as of February 28, 2013.

Restricted Investments. Restricted investments includes money market securities primarily held to satisfy certain

insurance program requirements, as well as mutual funds held in a rabbi trust established to fund informally our

executive deferred compensation plan. Restricted investments totaled $40.2 million as of February 28, 2014, and

$35.0 million as of February 28, 2013.

(L) Finance Lease Obligations

We generally account for sale-leaseback transactions as financings. Accordingly, we record certain of the assets

subject to these transactions on our consolidated balance sheets in property and equipment and the related sales

proceeds as finance lease obligations. Depreciation is recognized on the assets over 25 years. Payments on the

leases are recognized as interest expense and a reduction of the obligations. See Notes 11 and 15 for additional

information on finance lease obligations.

(M) Other Accrued Expenses

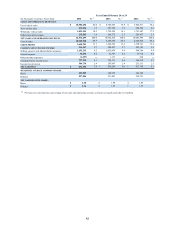

As of February 28, 2014 and February 28, 2013, accrued expenses and other current liabilities included accrued

compensation and benefits of $120.7 million and $103.4 million, respectively; loss reserves for general liability and

workers’ compensation insurance of $29.7 million and $26.6 million, respectively; and the current portion of

cancellation reserves. See Note 8 for additional information on cancellation reserves.