CarMax 2014 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2014 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

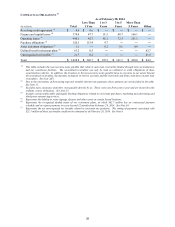

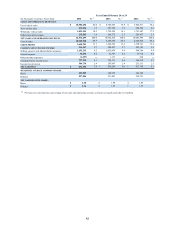

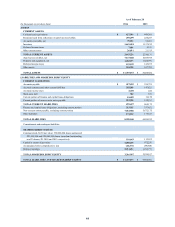

CONTRACTUAL OBLIGATIONS

(1)

As of February 28, 2014

Less Than 1 to 3 3 to 5 More Than

(In millions) Total 1 Year Years Years 5 Years Other

Revolving credit agreement (2) $ 0.6 $ 0.6 $ ― $ ― $ ― $ ―

Finance and capital leases (3) 374.0 47.7 91.5 68.7 166.1 ―

Operating leases (3) 448.1 42.3 82.1 72.5 251.1 ―

Purchase obligations (4) 120.1 115.4 4.7 ― ― ―

Asset retirement obligations (5) 1.1 ― 0.2 0.1 0.8 ―

Defined benefit retirement plans (6) 63.2 0.5 ― ― ― 62.7

Unrecognized tax benefits (7) 21.7 0.2 ― ― ― 21.5

Total $ 1,028.8 $ 206.7 $ 178.5 $ 141.3 $ 418.0 $ 84.2

(1) This table excludes the non-recourse notes payable that relate to auto loan receivables funded through term securitizations

and our warehouse facilities. The securitized receivables can only be used as collateral to settle obligations of these

securitization vehicles. In addition, the investors in the non-recourse notes payable have no recourse to our assets beyond

the securitized receivables, the amounts on deposit in reserve accounts and the restricted cash from collections on auto loan

receivables. See Note 2(F).

(2) Due to the uncertainty of forecasting expected variable interest rate payments, those amounts are not included in the table.

See Note 11.

(3) Excludes taxes, insurance and other costs payable directly by us. These costs vary from year to year and are incurred in the

ordinary course of business. See Note 15.

(4) Includes certain enforceable and legally binding obligations related to real estate purchases, marketing and advertising and

third-party outsourcing services.

(5) Represents the liability to retire signage, fixtures and other assets at certain leased locations.

(6) Represents the recognized funded status of our retirement plans, of which $62.7 million has no contractual payment

schedule and we expect payments to occur beyond 12 months from February 28, 2014. See Note 10.

(7) Represents the net unrecognized tax benefits related to uncertain tax positions. The timing of payments associated with

$21.5 million of these tax benefits could not be estimated as of February 28, 2014. See Note 9.