CarMax 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

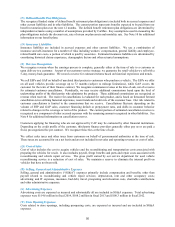

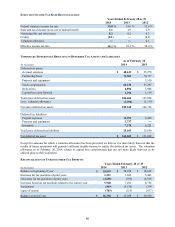

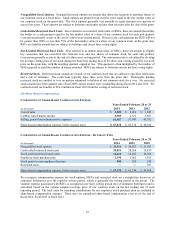

ITEMS MEASURED AT FAIR VALUE ON A RECURRING BASIS

As of February 28, 2014

(In thousands) Level 1 Level 2 Total

Assets:

Money market securities $ 641,622 $ ― $ 641,622

Mutual fund investments 5,609 ― 5,609

Total assets at fair value $ 647,231 $ ― $ 647,231

Percent of total assets at fair value 100.0 % ― % 100.0 %

Percent of total assets 5.5 % ― % 5.5 %

Liabilities:

Derivative instruments $ ― $ 1,351 $ 1,351

Total liabilities at fair value $ ― $ 1,351 $ 1,351

Percent of total liabilities ―% ― % ―%

As of February 28, 2013

(In thousands) Level 1 Level 2 Total

Assets:

Money market securities $ 461,260 $ ― $ 461,260

Mutual fund investments 4,024 ― 4,024

Total assets at fair value $ 465,284 $ ― $ 465,284

Percent of total assets at fair value 100.0 % ― % 100.0 %

Percent of total assets 4.7 % ― % 4.7 %

Liabilities:

Derivative instruments $ ― $ 517 $ 517

Total liabilities at fair value $ ― $ 517 $ 517

Percent of total liabilities ―% ― % ―%

There were no transfers between Levels 1 and 2 for the years ended February 28, 2014 and 2013.

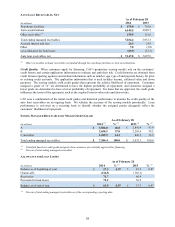

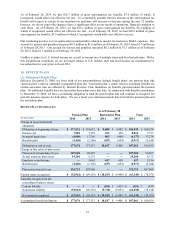

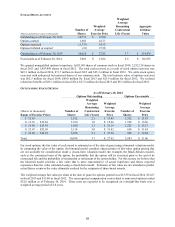

7. PROPERTY AND EQUIPMENT

As of February 28

(In thousands) 2014 2013

Land $ 346,518 $ 275,060

Land held for sale 1,050 4,872

Land held for development 170,387 168,830

Buildings 1,244,772 1,119,577

Capital leases 1,739 1,739

Leasehold improvements 129,186 106,695

Furniture, fixtures and equipment 343,958 311,646

Construction in progress 145,923 89,532

Total property and equipment 2,383,533 2,077,951

Less accumulated depreciation and amortization 730,556 648,981

Property and equipment, net $ 1,652,977 $ 1,428,970

Land held for development represents land owned for potential store growth. Leased property meeting capital lease

criteria is capitalized and the present value of the related lease payments is recorded as long-term debt.

Amortization of capital leased assets is included in depreciation expense, and accumulated amortization was

$0.3 million as of February 28, 2014, and $0.2 million as of February 28, 2013. Depreciation expense was

$90.4 million in fiscal 2014, $82.3 million in fiscal 2013 and $75.2 million in fiscal 2012.