CarMax 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

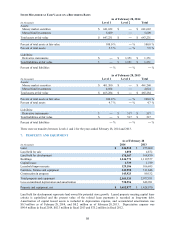

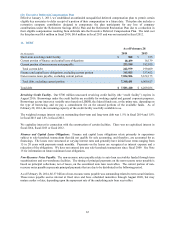

The fair values of the plan’s assets are provided by the plan’s trustee and the investment managers. Within the fair

value hierarchy (see Note 6), the mutual funds are classified as Level 1 as quoted active market prices for identical

assets are used to measure fair value. The collective funds are public investment vehicles valued using a net asset

value (“NAV”) provided by the plan’s trustee as a practical expedient for measuring the fair value. The NAV is

based on the underlying net assets owned by the fund divided by the number of shares outstanding. The NAV’s unit

price is quoted on a private market that was not active. However, the NAV is based on the fair value of the

underlying securities within the fund, which were traded on an active market and valued at the closing price reported

on the active market on which those individual securities are traded. The collective funds may be liquidated with

minimal restrictions and are classified as Level 2.

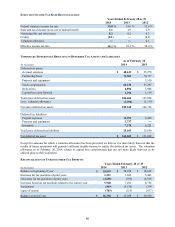

Funding Policy. For the pension plan, we contribute amounts sufficient to meet minimum funding requirements as

set forth in the employee benefit and tax laws, plus any additional amounts as we may determine to be appropriate.

We expect to contribute $4.2 million to the pension plan in fiscal 2015. For the non-funded restoration plan, we

contribute an amount equal to the benefit payments.

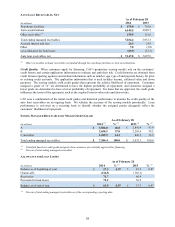

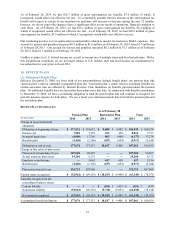

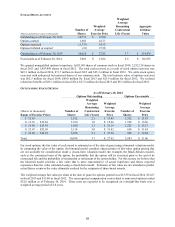

ESTIMATED FUTURE BENEFIT PAYMENTS

Pension Restoration

(In thousands) Plan Plan

Fiscal 2015 $ 2,056 $ 451

Fiscal 2016 $ 2,407 $ 466

Fiscal 2017 $ 2,726 $ 476

Fiscal 2018 $ 3,076 $ 482

Fiscal 2019 $ 3,464 $ 485

Fiscal 2020 to 2024 $ 24,182 $ 2,810

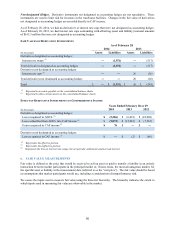

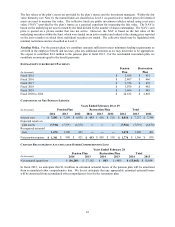

COMPONENTS OF NET PENSION EXPENSE

Years Ended February 28 or 29

(In thousands) Pension Plan Restoration Plan Total

2014 2013 2012 2014 2013 2012 2014 2013 2012

Interest cost $ 7,583 $ 7,299 $ 6,830 $ 433 $ 458 $ 518 $ 8,016 $ 7,757 $ 7,348

Expected return on

plan assets (7,916) (7,591) (6,870) ― ― ― (7,916) (7,591) (6,870)

Recognized actuarial

loss 1,674 1,200 461 ― ― ― 1,674 1,200 461

N

et pension expense $ 1,341 $ 908 $ 421 $ 433 $ 458 $ 518 $ 1,774 $ 1,366 $ 939

CHANGES RECOGNIZED IN ACCUMULATED OTHER COMPREHENSIVE LOSS

Years Ended February 28

Pension Plan Restoration Plan Total

(In thousands) 2014 2013 2014 2013 2014 2013

N

et actuarial (gain) loss $ (16,268) $ 17,182 $ 803 $ (488) $ (15,465) $ 16,694

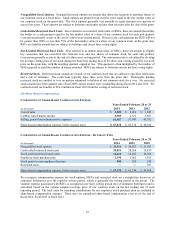

In fiscal 2015, we anticipate that $1.4 million in estimated actuarial losses of the pension plan will be amortized

from accumulated other comprehensive loss. We do not anticipate that any appreciable estimated actuarial losses

will be amortized from accumulated other comprehensive loss for the restoration plan.