CarMax 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 50

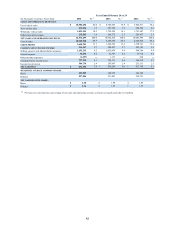

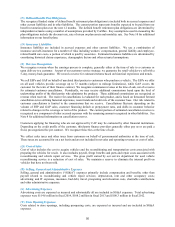

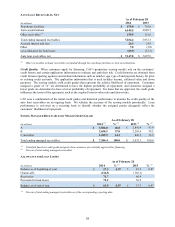

(N) Defined Benefit Plan Obligations

The recognized funded status of defined benefit retirement plan obligations is included both in accrued expenses and

other current liabilities and in other liabilities. The current portion represents benefits expected to be paid from our

benefit restoration plan over the next 12 months. The defined benefit retirement plan obligations are determined by

independent actuaries using a number of assumptions provided by CarMax. Key assumptions used in measuring the

plan obligations include the discount rate, rate of return on plan assets and mortality rate. See Note 10 for additional

information on our benefit plans.

(O) Insurance Liabilities

Insurance liabilities are included in accrued expenses and other current liabilities. We use a combination of

insurance and self-insurance for a number of risks including workers’ compensation, general liability and employee-

related health care costs, a portion of which is paid by associates. Estimated insurance liabilities are determined by

considering historical claims experience, demographic factors and other actuarial assumptions.

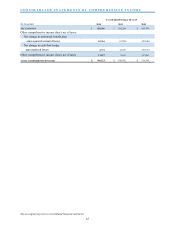

(P) Revenue Recognition

We recognize revenue when the earnings process is complete, generally either at the time of sale to a customer or

upon delivery to a customer. As part of our customer service strategy, we guarantee the retail vehicles we sell with a

5-day, money-back guarantee. We record a reserve for estimated returns based on historical experience and trends.

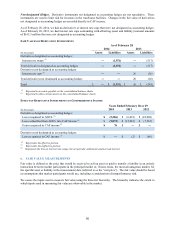

We sell ESPs and GAP on behalf of unrelated third parties to customers who purchase a vehicle. The ESPs we offer

on all used vehicles provide coverage up to 72 months (subject to mileage limitations), while GAP covers the

customer for the term of their finance contract. We recognize commission revenue at the time of sale, net of a reserve

for estimated customer cancellations. Periodically, we may receive additional commissions based upon the level of

underwriting profits of the third parties who administer the products. These additional commissions are recognized as

revenue when received. The reserve for cancellations is evaluated for each product, and is based on forecasted forward

cancellation curves utilizing historical experience, recent trends and credit mix of the customer base. Our risk related to

customer cancellations is limited to the commissions that we receive. Cancellations fluctuate depending on the

volume of ESP and GAP sales, customer financing default or prepayment rates, and shifts in customer behavior

related to changes in the coverage or term of the product. The current portion of estimated cancellation reserves is

recognized as a component of other accrued expenses with the remaining amount recognized in other liabilities. See

Note 8 for additional information on cancellation reserves.

Customers applying for financing who are not approved by CAF may be evaluated by other financial institutions.

Depending on the credit profile of the customer, third-party finance providers generally either pay us or are paid a

fixed, pre-negotiated fee per contract. We recognize these fees at the time of sale.

We collect sales taxes and other taxes from customers on behalf of governmental authorities at the time of sale.

These taxes are accounted for on a net basis and are not included in net sales and operating revenues or cost of sales.

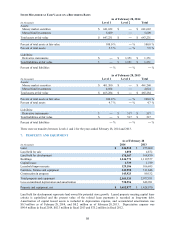

(Q) Cost of Sales

Cost of sales includes the cost to acquire vehicles and the reconditioning and transportation costs associated with

preparing the vehicles for resale. It also includes payroll, fringe benefits and parts and repair costs associated with

reconditioning and vehicle repair services. The gross profit earned by our service department for used vehicle

reconditioning service is a reduction of cost of sales. We maintain a reserve to eliminate the internal profit on

vehicles that have not been sold.

(R) Selling, General and Administrative Expenses

Selling, general and administrative (“SG&A”) expenses primarily include compensation and benefits, other than

payroll related to reconditioning and vehicle repair services; depreciation, rent and other occupancy costs;

advertising; and IT expenses, insurance, bad debt, travel, preopening and relocation costs, charitable contributions

and other administrative expenses.

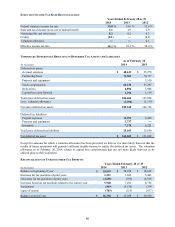

(S) Advertising Expenses

Advertising costs are expensed as incurred and substantially all are included in SG&A expenses. Total advertising

expenses were $114.6 million in fiscal 2014, $108.2 million in fiscal 2013 and $100.3 million in fiscal 2012.

(T) Store Opening Expenses

Costs related to store openings, including preopening costs, are expensed as incurred and are included in SG&A

expenses.