CarMax 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

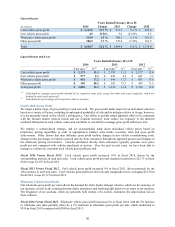

Fiscal 2013 Versus Fiscal 2012. Wholesale vehicle gross profit increased 2% in fiscal 2013, driven by the 3%

increase in wholesale unit sales. Wholesale gross profit per unit was relatively stable, declining only $4 per unit.

Other Gross Profit

Other gross profit includes profits related to ESP and GAP revenues, net third-party finance fees and service

department operations, including used vehicle reconditioning. We have no cost of sales related to ESP and GAP

revenues or net third-party finance fees, as these represent commissions paid to us by certain third-party providers.

Third-party finance fees are reported net of the fees we pay to third-party subprime finance providers. Accordingly,

changes in the relative mix of the other gross profit components can affect the composition and amount of other

gross profit.

Fiscal 2014 Versus Fiscal 2013. Other gross profit increased 4% in fiscal 2014, as higher service department gross

profits and a modest increase in ESP gross profit, was largely offset by the reduction in net third-party finance fees.

ESP gross profit was reduced by our correction in accounting related to cancellation reserves for ESP and GAP.

Service department gross profit rose $27.3 million in fiscal 2014, primarily due to increases in gross profit

associated with used vehicle reconditioning, which benefited from strong used unit sales growth and the resulting

leverage of service overhead costs.

Fiscal 2013 Versus Fiscal 2012. Other gross profit declined 1% in fiscal 2013, as improved service department and

ESP profits were more than offset by the lower net third-party finance fees.

Impact of Inflation

Historically, inflation has not had a significant impact on results. Profitability is primarily affected by our ability to

achieve targeted unit sales and gross profit dollars per vehicle rather than by changes in average retail prices.

However, increases in average vehicle selling prices benefit CAF income, to the extent the average amount financed

also increases.

In the years following the recession, we experienced a period of appreciation in used vehicle wholesale pricing. We

believe the appreciation resulted, in part, from a reduced supply of late-model used vehicles in the market. This

reduced supply was caused by the dramatic decline in new car industry sales and the associated slow down in used

vehicle trade-in activity, compared with pre-recession periods. The higher wholesale values increased both our

vehicle acquisition costs and our used vehicle average selling prices, which climbed from $16,291 in fiscal 2009 to

$19,408 in fiscal 2014. In fiscal 2013 and fiscal 2012, we also experienced inflationary increases in key

reconditioning costs.

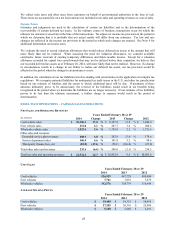

Selling, General and Administrative Expenses

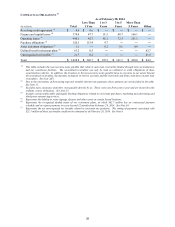

COMPONENTS OF SG&A EXPENSE

Years Ended February 28 or 29

(In millions except per unit data) 2014 Change 2013 Change 2012

Compensation and benefits (1) $656.7 12.9 %$581.9 11.7 % $521.0

Store occupancy costs 216.8 8.5 % 199.9 6.5 % 187.6

Advertising expense 112.2 5.6 %106.3 7.2 % 99.1

Other overhead costs (2)

169.5 18.6 % 142.9 7.5 % 133.1

Total SG&A expenses $1,155.2 12.0 %$1,031.0 9.6 % $940.8

SG&A per retail unit $ 2,161 $ (102) $ 2,263 $ ― $ 2,263

(1) Excludes compensation and benefits related to reconditioning and vehicle repair service, which is included in cost of sales.

(2) Includes IT expenses, insurance, bad debt, travel, preopening and relocation costs, charitable contributions and other

administrative expenses.

Fiscal 2014 Versus Fiscal 2013. SG&A expenses increased 12% in fiscal 2014. The increase reflected the 11%

increase in our store base during fiscal 2014 (representing the addition of 13 stores) and higher variable selling costs

resulting from the 12% increase in comparable store used unit sales. SG&A per retail unit declined $102 to $2,161

versus $2,263 in fiscal 2013, as our comparable store used unit sales growth generated overhead leverage.