CarMax 2014 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2014 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

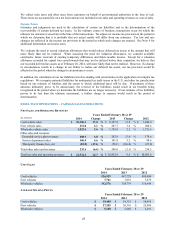

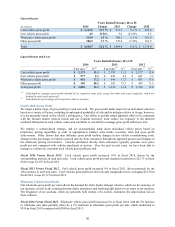

Item 6. Selected Financial Data.

(Dollars and shares in millions, except per share) FY14 FY13 FY12

FY11 (1) FY10 FY09

Income statement information

Used vehicle sales $ 10,306.3 $ 8,747.0 $ 7,826.9 $ 7,210.0 $ 6,192.3 $ 5,690.7

New vehicle sales 212.0 207.7 200.6 198.5 186.5 261.9

Wholesale vehicle sales 1,823.4 1,759.6 1,721.6 1,301.7 844.9 779.8

Other sales and revenues 232.6 248.6 254.5 265.3 246.6 241.6

Net sales and operating revenues 12,574.3 10,962.8 10,003.6 8,975.6 7,470.2 6,974.0

Gross profit 1,648.7 1,464.4 1,378.8 1,301.2 1,098.9 968.2

CarMax Auto Finance income 336.2 299.3 262.2 220.0 175.2 15.3

SG&A 1,155.2 1,031.0 940.8 878.8 792.2 856.1

Interest expense 30.8 32.4 33.7 34.7 36.0 38.6

Earnings before income taxes 797.3 701.4 666.9 608.2 446.5 90.5

Income tax provision 304.7 267.1 253.1 230.7 168.6 35.2

Net earnings 492.6 434.3 413.8 377.5 277.8 55.2

Share and per share information

Weighted average diluted shares outstanding 227.6 231.8 230.7 227.6 222.2 219.4

Diluted net earnings per share $ 2.16 $ 1.87 $ 1.79 $ 1.65 $ 1.24 $ 0.25

Balance sheet information

Total current assets $ 2,643.2 $ 2,310.1 $ 1,853.4 $ 1,410.1 $ 1,556.4 $ 1,287.8

Auto loan receivables, net 7,147.8 5,895.9 4,959.8 4,320.6 ― ―

Total assets 11,707.2 9,888.6 8,331.5 7,125.5 2,856.4 2,693.6

Total current liabilities 875.5 684.2 646.3 522.7 490.5 502.7

Short-term debt and current portion:

Non-recourse notes payable 223.9 182.9 174.3 132.5 ― ―

Other 19.0 16.5 15.1 13.6 133.6 168.2

Non-current debt:

Non-recourse notes payable 7,024.5 5,672.2 4,509.8 3,881.1 ― ―

Other 315.9 337.5 353.6 367.6 378.5 539.6

Total shareholders’ equity 3,317.0 3,019.2 2,673.1 2,239.2 1,884.6 1,547.9

Unit sales information

Used vehicle units sold 526,929 447,728 408,080 396,181 357,129 345,465

Wholesale vehicle units sold 342,576 324,779 316,649 263,061 197,382 194,081

Percent changes in

Comparable store used vehicle unit sales 12 5 1 10 1 (16)

Total used vehicle unit sales 18 10 3 11 3 (8)

Wholesale vehicle unit sales 5 3 20 33 2 (13)

Net sales and operating revenues 15 10 11 20 7 (15)

Net earnings 13 5 10 36 403 (69)

Diluted net earnings per share 16 4 8 33 396 (69)

Other year-end information

Used car superstores 131 118 108 103 100 100

Associates 20,171 18,111 16,460 15,565 13,439 13,035

(1) Reflects the adoption in fiscal 2011 of ASU Nos. 2009-16 and 2009-17 effective March 1, 2010, to recognize the transfers of

auto loan receivables and the related non-recourse notes payable on our consolidated balance sheets.