CarMax 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX, INC. ANNUAL REPORT

FISCAL YEAR 2014

CARMAX, INC. ANNUAL REPORT

FISCAL YEAR 2014

Table of contents

-

Page 1

CARMAX, INC. ANNUAL REPORT FISCAL YEAR 2014 -

Page 2

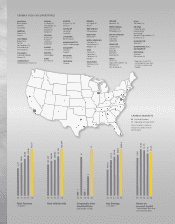

...City VIRGINIA Lexington Louisville LOUISIANA Albuquerque NEW YORK Lancaster* (2) Philadelphia (2) SOUTH CAROLINA Bakersï¬eld Fresno Los Angeles (10) Sacramento (4) San Diego (2) COLORADO Atlanta (5) Augusta Columbus Savannah ILLINOIS Rochester* NORTH CAROLINA Baton Rouge MASSACHUSETTS North... -

Page 3

...address a strong consumer need for a better way to buy used cars. Since opening our first store in Richmond, Virginia, we've sold more than 5 million retail vehicles and expanded to 133 stores nationwide. We opened 13 stores in fiscal 2014 - our most in any one year. We anticipate a similar schedule... -

Page 4

...fully stored. Evolution and innovation are critical to our long-term competitive position, so we're continuously refining our business model and continuously getting better. But it is the engagement and skill of our associates that will ultimately drive our success. Once again this year, let me take... -

Page 5

... the fiscal year ended February 28, 2014 OR ï,¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from Commission File Number: 1-31420 to CARMAX, INC. (Exact name of registrant as specified in its charter) VIRGINIA (State or other... -

Page 6

... is a shell company (as defined in Rule 12b-2 of the Act). Yes ï,¨ No ï¸ The aggregate market value of the registrant's common stock held by non-affiliates as of August 31, 2013, computed by reference to the closing price of the registrant's common stock on the New York Stock Exchange on that date... -

Page 7

...Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions and Director Independence Principal Accountant Fees and Services PART IV Item 15. Exhibits and Financial Statement Schedules... -

Page 8

... of factors that could affect CarMax Auto Finance income. Our expected future expenditures, cash needs and financing sources. The projected number, timing and cost of new store openings. Our sales and marketing plans. Our assessment of the potential outcome and financial impact of litigation and the... -

Page 9

...being offered for sale. In fiscal 2014, 85% of the used vehicles we retailed were 0 to 6 years old. Vehicles purchased through our in-store appraisal process that do not meet our retail standards are sold to licensed dealers through our on-site wholesale auctions. Unlike many other auto auctions, we... -

Page 10

... returns, CAF financed 41% of our retail vehicle unit sales in fiscal 2014. As of February 28, 2014, CAF serviced approximately 532,000 customer accounts in its $7.18 billion portfolio of managed receivables. Industry and Competition. CarMax Sales Operations: The U.S. used car marketplace is highly... -

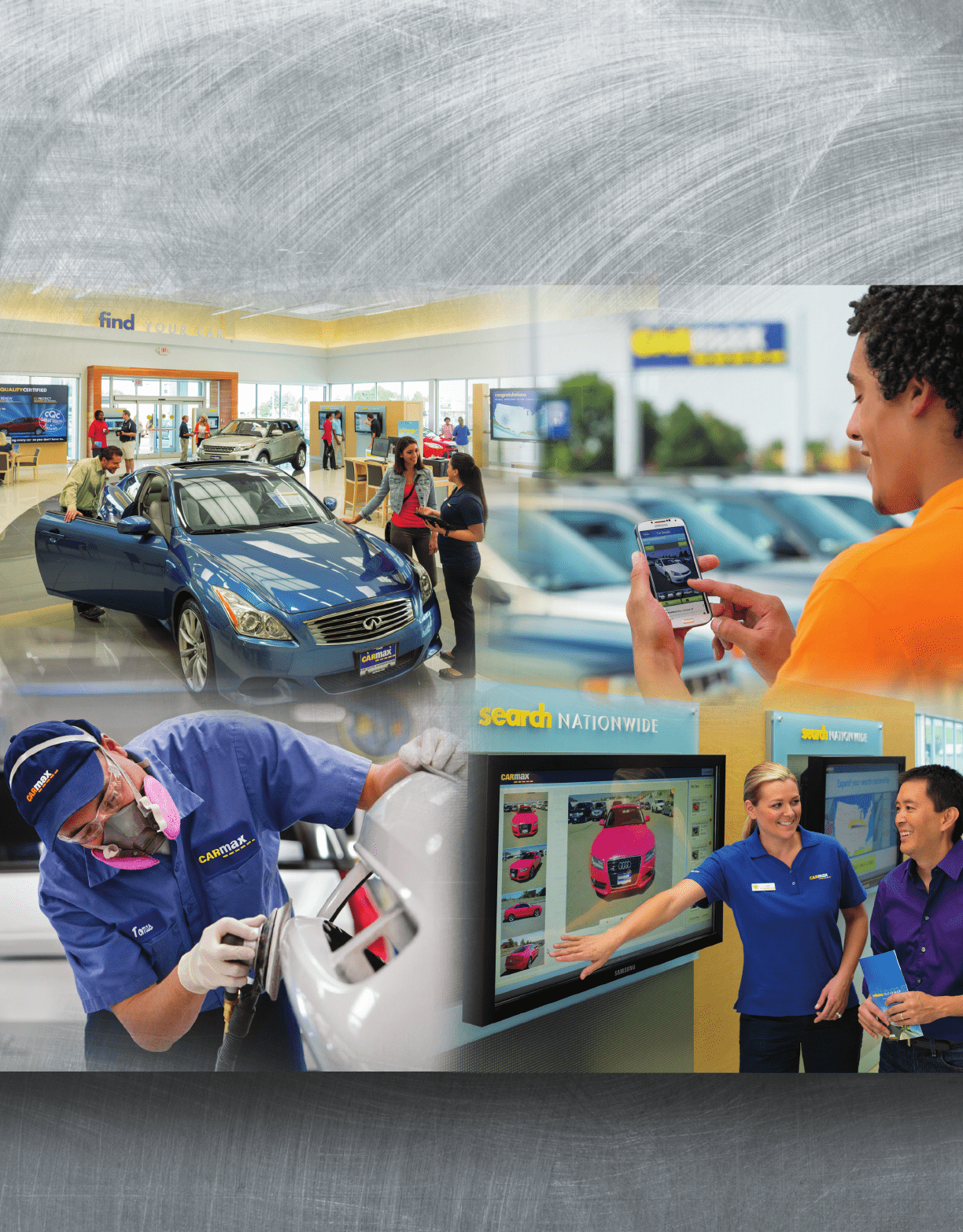

Page 11

... part of the shopping and sales process online. The website and mobile apps offer complete inventory and pricing search capabilities. Information on the thousands of cars available in our nationwide inventory is updated several times per day. Carmax.com includes detailed information, such as vehicle... -

Page 12

..., mileage or condition, fewer than half of the vehicles acquired through this in-store appraisal process meet our high-quality retail standards. Those vehicles that do not meet our retail standards are sold to licensed dealers through our on-site wholesale auctions. The inventory purchasing function... -

Page 13

... the time of sale. In fiscal 2014, more than 25% of customers who purchased a used vehicle also purchased GAP. Reconditioning and Service. An integral part of our used car consumer offer is the renewal process used to make sure every car meets our high standards before it can become a CarMax Quality... -

Page 14

... management with real-time information about many aspects of store operations, such as inventory management, pricing, vehicle transfers, wholesale auctions and sales consultant productivity. In addition, our store system provides a direct link to our proprietary credit processing information system... -

Page 15

... to new and used motor vehicle dealers. These laws also include federal and state wage-hour, anti-discrimination and other employment practices laws. Our financing activities with customers are subject to federal truth-in-lending, consumer leasing, equal credit opportunity and fair credit reporting... -

Page 16

... increasing use of the Internet to market, buy and sell used vehicles could adversely affect our business, sales and results of operations. Automotive retailing is a highly competitive and highly fragmented business. Our competition includes publicly and privately owned new and used car dealers, as... -

Page 17

... not meet our retail standards through on-site wholesale auctions, our competition includes automotive wholesalers such as Manheim, a subsidiary of Cox Enterprises, and KAR Auction Services, Inc. These competitors sell the same or similar makes of vehicles that we sell in the same or similar markets... -

Page 18

... business, sales and results of operations. Our reputation as a company that is founded on the fundamental principle of integrity is critical to our success. Our reputation as a retailer offering low, no-haggle prices, a broad selection of CarMax Quality Certified used vehicles and superior customer... -

Page 19

...profitable for CarMax. Our ability to source vehicles through our appraisal process could also be affected by competition, both from new and used car dealers directly and through third-party websites driving appraisal traffic to those dealers. See the risk factor above titled "We operate in a highly... -

Page 20

... risk factor titled "We operate in a highly competitive industry" for discussion of this risk. We are a growth retailer. Our failure to manage our growth and the related challenges could have a material adverse effect on our business, sales and results of operations. The expansion of our store base... -

Page 21

... on our business, sales and results of operations. Our results of operations and financial condition are subject to management's accounting judgments and estimates, as well as changes in accounting policies. The preparation of our financial statements requires us to make estimates and assumptions... -

Page 22

... 1 Florida 13 Georgia 8 Illinois 6 Iowa 1 Indiana 2 Kansas 2 Kentucky 2 Louisiana 1 Maryland 6 Massachusetts 1 Mississippi 1 Missouri 3 Nebraska 1 Nevada 2 New Mexico 1 North Carolina 8 Ohio 4 Oklahoma 2 Pennsylvania 2 South Carolina 3 Tennessee 7 Texas 13 Utah 1 Virginia 9 Wisconsin 3 Total 131... -

Page 23

... our 131 used car superstores, our new car store and our CAF office building in Atlanta, Georgia. We owned the remaining 74 stores currently in operation. We also owned our home office building in Richmond, Virginia, and land associated with planned future store openings. Expansion Since opening our... -

Page 24

... normal course of business. Based upon our evaluation of information currently available, we believe that the ultimate resolution of any such proceedings will not have a material adverse effect, either individually or in the aggregate, on our financial condition, results of operations or cash flows... -

Page 25

...31, 2014 February 1-28, 2014 Total (1) Average Price Paid per Share $ $ $ 47.26 45.15 47.28 Total Number of Shares Purchased as Part of Publicly Announced Programs 255,300 1,327,815 971,110 2,554,225 Purchased 255,300 1,327,815 971,110 2,554,225 In fiscal 2013, our board of directors... -

Page 26

...the cumulative total shareholder return (stock price appreciation plus dividends, as applicable) on our common stock for the last five fiscal years with the cumulative total return of the S&P 500 Index and the S&P 500 Retailing Index. The graph assumes an original investment of $100 in CarMax common... -

Page 27

... (69) 100 13,035 Income statement information Used vehicle sales New vehicle sales Wholesale vehicle sales Other sales and revenues Net sales and operating revenues Gross profit CarMax Auto Finance income SG&A Interest expense Earnings before income taxes Income tax provision Net earnings Share and... -

Page 28

... cover the unpaid balance on an auto loan in the event of a total loss of the vehicle or unrecovered theft. We seek to build customer satisfaction by offering high-quality vehicles. Fewer than half of the vehicles acquired from consumers through the appraisal purchase process meet our standards for... -

Page 29

... finance or related charges. We randomly test different credit offers and closely monitor acceptance rates, 3-day payoffs and the effect on sales to assess market competitiveness. After the effect of 3-day payoffs and vehicle returns, CAF financed 41% of our retail vehicle unit sales in fiscal 2014... -

Page 30

... and auto loan receivables. Revenue Recognition We recognize revenue when the earnings process is complete, generally either at the time of sale to a customer or upon delivery to a customer. As part of our customer service strategy, we guarantee the retail vehicles we sell with a 5-day, money-back... -

Page 31

... RESULTS OF OPERATIONS - CARMAX SALES OPERATIONS NET SALES AND OPERATING REVENUES (In millions) Used vehicle sales New vehicle sales Wholesale vehicle sales Other sales and revenues: Extended service plan revenues Service department sales Third-party finance fees, net Total other sales and revenues... -

Page 32

...believe benefited from a variety of factors, including more compelling credit offers from third-party finance providers and CAF, increased inventory selection and continued strong in-store execution. The increase in average retail selling price primarily reflected changes in our sales mix by vehicle... -

Page 33

... business. Our data indicated that in our markets, we increased our share of the 0- to 10-year old used vehicle market by approximately 7% in fiscal 2013. Wholesale Vehicle Sales Our wholesale auction prices usually reflect the trends in the general wholesale market for the types of vehicles we sell... -

Page 34

... appraisal process and changes in the wholesale pricing environment. Vehicles purchased directly from consumers typically generate more gross profit per unit compared with vehicles purchased at auction. Over the past several years, we have been able to manage to a relatively consistent used vehicle... -

Page 35

... finance fees. ESP gross profit was reduced by our correction in accounting related to cancellation reserves for ESP and GAP. Service department gross profit rose $27.3 million in fiscal 2014, primarily due to increases in gross profit associated with used vehicle reconditioning, which benefited... -

Page 36

... of indirect costs not allocated to CAF include retail store expenses and corporate expenses such as human resources, administrative services, marketing, information systems, accounting, legal, treasury and executive payroll. COMPONENTS OF CAF INCOME Years Ended February 28 or 29 (In millions) 2014... -

Page 37

... more competitive offers. See Note 4 for additional information on the credit quality of CAF's auto loan receivables. Total interest margin, which reflects the spread between interest and fees charged to consumers and our funding costs, declined to 6.9% of average managed receivables in fiscal 2014... -

Page 38

... balance we receive when a vehicle is repossessed and liquidated, generally at our wholesale auctions. The annual recovery rate has ranged from a low of 42% to a high of 60%, and it is primarily affected by changes in the wholesale market pricing environment. Loan Origination Test. In January 2014... -

Page 39

... start of the fiscal year. We had 7% more used vehicles in inventory as of February 28, 2014, compared with the start of the fiscal year, reflecting the addition of inventory associated with the 13 stores opened during fiscal 2014, as well as added inventories to support our comparable store sales... -

Page 40

...totaled $310.3 million in fiscal 2014, $235.7 million in fiscal 2013 and $172.6 million in fiscal 2012. Capital expenditures primarily include real estate acquisitions for planned future store openings and store construction costs. We maintain a multi-year pipeline of sites to support our superstore... -

Page 41

... 2014, our board of directors authorized the repurchase of up to an additional $1.0 billion of CarMax common stock through December 31, 2015. Fair Value Measurements. We report money market securities, mutual fund investments and derivative instruments at fair value. See Note 6 for more information... -

Page 42

... plans, of which $62.7 million has no contractual payment schedule and we expect payments to occur beyond 12 months from February 28, 2014. See Note 10. Represents the net unrecognized tax benefits related to uncertain tax positions. The timing of payments associated with $21.5 million of these tax... -

Page 43

... or expected cash payments principally related to the funding of our auto loan receivables. Disruptions in the credit markets could impact the effectiveness of our hedging strategies. Other receivables are financed with working capital. Generally, changes in interest rates associated with underlying... -

Page 44

... Commission. Based on this evaluation, our management has concluded that our internal control over financial reporting was effective as of February 28, 2014. KPMG LLP, the company's independent registered public accounting firm, has issued a report on our internal control over financial reporting... -

Page 45

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Shareholders CarMax, Inc.: We have audited the accompanying consolidated balance sheets of CarMax, Inc. and subsidiaries (the Company) as of February 28, 2014 and 2013, and the related consolidated statements of ... -

Page 46

...Used vehicle sales New vehicle sales Wholesale vehicle sales Other sales and revenues NET SALES AND OPERATING REVENUES Cost of sales GROSS PROFIT CARMAX AUTO FINANCE INCOME Selling, general and administrative expenses Interest expense Other income (expense) Earnings before income taxes Income tax... -

Page 47

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Years Ended February 28 or 29 (In thousands) NET EARNINGS 2014 $ 492,586 $ 2013 434,284 $ 2012 413,795 Other comprehensive income (loss), net of taxes: Net change in retirement benefit plan unrecognized actuarial losses Net change in cash flow ... -

Page 48

... Restricted cash from collections on auto loan receivables Accounts receivable, net Inventory Deferred income taxes Other current assets TOTAL CURRENT ASSETS Auto loan receivables, net Property and equipment, net Deferred income taxes Other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY... -

Page 49

... Release of restricted cash from reserve accounts Purchases of money market securities, net Purchases of investments available-for-sale Sales of investments available-for-sale NET CASH USED IN INVESTING ACTIVITIES FINANCING ACTIVITIES: Increase (decrease) in short-term debt, net Payments on finance... -

Page 50

...997 Net earnings Other comprehensive loss Share-based compensation expense Exercise of common stock options Shares issued under stock incentive plans Shares cancelled under stock incentive plans Tax effect from the exercise of common stock options BALANCE AS OF FEBRUARY 29, 2012 Net earnings Other... -

Page 51

... of our own finance operation that provides vehicle financing through CarMax superstores. We were the first used vehicle retailer to offer a large selection of high quality used vehicles at low, no-haggle prices using a customer-friendly sales process in an attractive, modern sales facility. We... -

Page 52

...due from customers related to retail vehicle sales financed through CAF. The receivables are presented net of an allowance for estimated loan losses. The allowance for loan losses represents an estimate of the amount of net losses inherent in our portfolio of managed receivables as of the applicable... -

Page 53

... includes money market securities primarily held to satisfy certain insurance program requirements, as well as mutual funds held in a rabbi trust established to fund informally our executive deferred compensation plan. Restricted investments totaled $40.2 million as of February 28, 2014, and... -

Page 54

... the earnings process is complete, generally either at the time of sale to a customer or upon delivery to a customer. As part of our customer service strategy, we guarantee the retail vehicles we sell with a 5-day, money-back guarantee. We record a reserve for estimated returns based on historical... -

Page 55

... liabilities on the consolidated balance sheets, and where applicable, such contracts covered by master netting agreements are reported net. Gross positive fair values are netted with gross negative fair values by counterparty. The accounting for changes in the fair value of derivatives depends on... -

Page 56

... financial statements. In July 2013, the FASB issued an accounting pronouncement related to income taxes (FASB ASC Topic 740), which provides guidance regarding the presentation of an unrecognized tax benefit when a net operating loss carryforward, a similar loss or a tax credit carryforward... -

Page 57

... of indirect costs not allocated to CAF include retail store expenses and corporate expenses such as human resources, administrative services, marketing, information systems, accounting, legal, treasury and executive payroll. COMPONENTS OF CAF INCOME Years Ended February 28 or 29 (In millions) 2014... -

Page 58

... their risk. Credit histories are obtained from credit bureau reporting agencies and include information such as number, age, type of and payment history for prior or existing credit accounts. The application information that is used includes income, collateral value and down payment. The scoring... -

Page 59

... the change in fair value of the derivatives is recognized directly in CAF income. Amounts reported in AOCL related to derivatives will be reclassified to CAF income as interest expense is incurred on our future issuances of fixed-rate debt. During the next 12 months, we estimate that an additional... -

Page 60

... designated as accounting hedges Total (1) (2) Reported in accounts payable on the consolidated balance sheets. Reported in other current assets on the consolidated balance sheets. EFFECT OF DERIVATIVE INSTRUMENTS ON COMPREHENSIVE INCOME (In thousands) Years Ended February 28 or 29 2014 2013 2012... -

Page 61

... of highly liquid investments with original maturities of three months or less. We use quoted market prices for identical assets to measure fair value. Therefore, all money market securities are classified as Level 1. Mutual Fund Investments. Mutual fund investments consist of publicly traded mutual... -

Page 62

... 2014 Level 2 Total 1,351 1,351 641,622 5,609 647,231 100.0 % 5.5 % Assets: Money market securities Mutual fund investments Total assets at fair value Percent of total assets at fair value Percent of total assets Liabilities: Derivative instruments Total liabilities at fair value Percent of total... -

Page 63

... (In millions) 2014 $ 32.7 (36.9) 76.7 72.5 $ 2013 28.5 (27.5) 31.7 32.7 Balance as of beginning of year Cancellations Provision for future cancellations Balance as of end of year $ $ Cancellations fluctuate depending on the volume of ESP and GAP sales, customer financing default or prepayment... -

Page 64

...In thousands) Balance at beginning of year Increases for tax positions of prior years Decreases for tax positions of prior years Increases based on tax positions related to the current year Settlements Lapse of statute Balance at end of year $ Years Ended February 28 or 29 2014 2013 2012 $ 20,930... -

Page 65

... Restoration Plan 2014 2013 Total 2014 2013 (In thousands) Change in projected benefit obligation: Obligation at beginning of year Interest cost Actuarial (gain) loss Benefits paid Obligation at end of year Change in fair value of plan assets: Plan assets at beginning of year Actual return on plan... -

Page 66

... during fiscal 2015. Plan assets also include collective funds, which are public investment vehicles with the underlying assets representing high quality, short-term instruments that include securities of governments, their agencies and corporations and large, mid, and small cap companies located in... -

Page 67

... divided by the number of shares outstanding. The NAV's unit price is quoted on a private market that was not active. However, the NAV is based on the fair value of the underlying securities within the fund, which were traded on an active market and valued at the closing price reported on the active... -

Page 68

...these assumptions at least once a year and make changes as necessary. The discount rate used for retirement benefit plan accounting reflects the yields available on high-quality, fixed income debt instruments. For our plans, we review high quality corporate bond indices in addition to a hypothetical... -

Page 69

... in fiscal 2014, fiscal 2013 or fiscal 2012. Finance and Capital Lease Obligations. Finance and capital lease obligations relate primarily to superstores subject to sale-leaseback transactions that did not qualify for sale accounting, and therefore, are accounted for as financings. The leases... -

Page 70

...costs. See Notes 2(F) and 4 for additional information on the related securitized auto loan receivables. Financial Covenants. The credit facility agreement contains representations and warranties, conditions and covenants. We must also meet financial covenants in conjunction with certain of the sale... -

Page 71

.... (D) Share-Based Compensation COMPOSITION OF SHARE-BASED COMPENSATION EXPENSE (In thousands) Cost of sales CarMax Auto Finance income Selling, general and administrative expenses Share-based compensation expense, before income taxes Years Ended February 28 or 29 2014 2013 2012 $ 3,200 $ 3,010... -

Page 72

... value calculated using a closed-form model. Estimates of fair value are not intended to predict actual future events or the value ultimately realized by the recipients of share-based awards. The weighted average fair value per share at the date of grant for options granted was $15.59 in fiscal 2014... -

Page 73

... the market prices of traded options on our stock. Based on the U.S. Treasury yield curve in effect at the time of grant. Represents the estimated number of years that options will be outstanding prior to exercise. CASH-SETTLED RESTRICTED STOCK UNIT ACTIVITY Weighted Average Grant Date Fair Value... -

Page 74

... costs related to nonvested MSUs totaled $13.4 million as of February 28, 2014. These costs are expected to be recognized on a straight-line basis over a weighted average period of 1.0 years. (E) Employee Stock Purchase Plan We sponsor an employee stock purchase plan for all associates meeting... -

Page 75

..., net of income taxes) Balance as of February 28, 2011 Other comprehensive loss before reclassifications Amounts reclassified from accumulated other comprehensive loss Other comprehensive loss Balance as of February 29, 2012 Other comprehensive (loss) income before reclassifications Amounts... -

Page 76

... 29 2014 2013 2012 15,465 (5,752) 9,713 $ Retirement Benefit Plans (Note 10): Actuarial gain (loss) arising during the year Tax (expense) benefit Actuarial gain (loss) arising during the year, net of tax Actuarial loss amortization reclassifications in net pension expense: Cost of sales CarMax Auto... -

Page 77

... to comply with itemized employee wage statement provisions; (5) unfair competition; and (6) California's Labor Code Private Attorney General Act. The putative class consisted of sales consultants, sales managers, and other hourly employees who worked for the company in California from April 2, 2004... -

Page 78

... issues arising from these arrangements. As part of our customer service strategy, we guarantee the used vehicles we retail with at least a 30-day limited warranty. A vehicle in need of repair within this period will be repaired free of charge. As a result, each vehicle sold has an implied liability... -

Page 79

... 2nd Quarter 3rd Quarter 4th Quarter (1) Fiscal Year Net sales and operating revenues Gross profit CarMax Auto Finance income Selling, general and administrative expenses Net earnings Net earnings per share: Basic Diluted 2014 2014 (1) 2014 2014 2014 $ 3,311,057 $ 3,245,552 $ 2,941,407 $ 3,076... -

Page 80

... Executive Officer and Director 44 Executive Vice President, Human Resources and Administrative Services 49 Executive Vice President and Chief Financial Officer 47 Executive Vice President, Stores 46 Senior Vice President, CarMax Auto Finance 60 Senior Vice President, General Counsel and Corporate... -

Page 81

... president, CarMax Auto Finance in 2010. Prior to joining CarMax, Ms. Chattin served as vice president of customer service for GE Capital Consumer Credit and held various positions at Circuit City. Mr. Margolin joined CarMax in 2007 as senior vice president, general counsel and corporate secretary... -

Page 82

... by reference to the section titled "CarMax Share Ownership" and the sub-section titled "Equity Compensation Plan Information" in our 2014 Proxy Statement. Item 13. Certain Relationships and Related Transactions and Director Independence. The information required by this Item is incorporated... -

Page 83

... of the Securities Exchange Act of 1934, this report has been signed by the following persons on behalf of the registrant and in the capacities and on the dates indicated: /s/ THOMAS J. FOLLIARD Thomas J. Folliard President, Chief Executive Officer and Director April 25, 2014 /s/ W. ROBERT GRAFTON... -

Page 84

... CarMax, Inc. Severance Agreement for Executive Officer, dated December 1, 2011, between CarMax, Inc. and Eric M. Margolin, filed as Exhibit 10.7 to CarMax's Annual Report on Form 10-K, filed April 26, 2013 (File No. 1-31420) is incorporated by this reference. * CarMax, Inc. Benefit Restoration Plan... -

Page 85

.... * CarMax, Inc. 2002 Employee Stock Purchase Plan, as amended and restated June 23, 2009, filed as Exhibit 10.1 to CarMax's Quarterly Report on Form 10-Q, filed July 9, 2009 (File No. 1-31420), is incorporated by this reference. Credit Agreement dated August 26, 2011, among CarMax Auto Superstores... -

Page 86

... CarMax, Inc. and certain executive officers, filed as Exhibit 10.17 to CarMax's Annual Report on Form 10-K, filed May 13, 2005 (File No. 1-31420), is incorporated by this reference. * Form of Incentive Award Agreement between CarMax, Inc. and certain non-employee directors of the CarMax, Inc. board... -

Page 87

...Gangwal COMPANY OFFICERS SENIOR MANAGEMENT TEAM Tom Folliard President and Chief Executive Officer Bill Nash EVP, Human Resources and Administration Tom Reedy EVP, Chief Financial Officer Cliff Wood EVP, Stores Angie Chattin SVP, CarMax Auto Finance Ed Hill SVP, Service Operations Eric Margolin SVP... -

Page 88

... RVP, General Manager Richmond Region Tracy Hanson RVP, Service Operations Chicago Region Veronica Hinckle AVP, Assistant Controller Andy Ingraham RVP, Service Operations Sustainment Rusty Jordan AVP, Consumer Finance Chad Kulas AVP, Human Resources Sarah Lane AVP, Marketing & Sales Strategy Jason... -

Page 89

[This Page Intentionally Left Blank] -

Page 90

[This Page Intentionally Left Blank] -

Page 91

... Parkway Richmond, Virginia 23238 Telephone: (804) 747-0422 WEBSITE www.carmax.com ANNUAL SHAREHOLDERS' MEETING For quarterly sales and earnings information, ï¬nancial reports, ï¬lings with the Securities and Exchange Commission (including Form 10-K), news releases and other investor information... -

Page 92

CARMAX, INC. 12800 TUCKAHOE CREEK PARKWAY RICHMOND, VIRGINIA 23238 804•747•0422 WWW.CARMAX.COM