CVS 2001 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2001 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

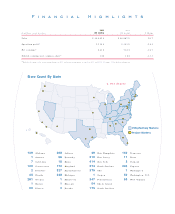

CVS fills prescriptio ns at mo re pharmacy

lo catio ns than any o ther retailer. Pharmacy is o ur

co re business, representing 66% o f o ur to tal

revenues. We ho ld mo re market leadership

po sitio ns than any o ther chain, ranking #1 in

35 of the 60 markets we serve.

A Posit ive I ndust ry Outlook

The o utlo o k fo r 2002 and beyo nd fo r the

retail pharmacy industry is extremely vibrant,

and we are clearly well po sitio ned to capitalize

o n the signific ant o ppo rtunities that lie ahead.

Acco rding to IMS Health, the pharmacy industry will

jump from $140 billio n in sales in 2000 to nearly do uble

that by 2005.

The aging po pulatio n is the mo st significant driver of

pharmacy gro wth. While the average perso n has a

prescriptio n filled eight times a year, the average perso n o ver

age 55 has a prescriptio n filled 19 times a year. And the Baby

Bo o mer generatio n is fast appro aching that age range. By

2010, 25% of the U.S. po pulatio n will be o lder than 55.

The co ntinuing disco very of new drug s also has a

significant impact o n pharmacy gro wth. Industry estimates

suggest that by 2002, mo re than 40% o f total U.S.

prescriptio n sales will co me from drugs intro duced since 1998.

Acco rding to IMS Health there are 55 new drug s with

blo ckbuster po tential in the Fo o d & Drug Administratio n’s

appro val pipeline expected to reach the market between 2002

and 2005. Each of tho se drug s is believed to have an annual

sales po tential o f $500 millio n o r mo re.

Sales of higher-margin generic drugs also are expected

to grow, as brand- name drugs representing $35 billio n in

sales are expected to be remo ved fro m the patent list o ver

the next 5 to 7 years. We typically experience high

substitutio n rates when patents expire.

A generic replacement for Pro zac®, fo r example,

became available in 2001, and with it we witnessed the

fastest and mo st substantial co nversio n ever. In 2002,

the patents fo r the gastro intestinal drug Prilo sec®and

the diabetes drug Gluco phage®are expected to expire,

amo ng o thers. These two drugs have been blo ckbusters,

having generated billio ns of do llars in revenue

annually. Other drugs that may co me off patent

during 2002 include the hypertensio n drugs Prinivil®

and Zestril®, and the epilepsy drug Neuro ntin®.

Finally, we remain o ptimistic that Co ngress will

implement a responsible Medicare pharmacy

benefit that serves an unmet need amo ng senio r

citizens. There is gro wing interest in Co ngress to

Working For

CVS/ pharmacy is the leader

in mo re U.S. drugsto re markets

than any o ther chain.