CVS 2001 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2001 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

2001 Annual Report

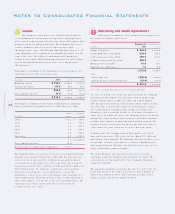

I nt angible asset s ~ Go o dwill represents the excess o f the

purchase price o ver the fair value of net assets acquired and is

being amortized o n a straight-line basis generally o ver 40 years.

Acc umulated amo rtizatio n asso ciated with go o dwill was $149.9

millio n as of December 29, 2001 and $127.3 millio n as of

December 30, 2000. Purchased custo mer lists are amo rtized on a

straight- line basis o ver their estimated useful lives. Purchased

leases are amortized o n a straight-line basis o ver the remaining

life of the lease.

Revenue recogni t ion ~ The Co mpany reco gnizes revenue fro m

the sale of merchandise at the time the merchandise is so ld.

Service revenue fro m the Co mpany’s pharmacy benefit

management segment is reco gnized at the time the service

is pro vided.

Vendor allowances ~ The to tal value of any up-fro nt o r o ther

perio dic payments received fro m vendo rs that are linked to

purchase co mmitments is initially deferred. The deferred amo unts

are then amo rtized to reduce co st o f go o ds so ld o ver the life of

the co ntract based upo n perio dic purchase vo lume. The to tal

value of any up-front o r o ther periodic payments received from

vendo rs that are not linked to purchase co mmitments is also

initially deferred. The deferred amo unts are then amo rtized to

reduce co st o f go o ds so ld o n a straight-line basis o ver the life of

the related contract. Funds that are directly linked to advertising

co mmitments are reco gnized as a reductio n of advertising

expense when the related advertising co mmitment is satisfied.

St ore opening and closing cost s ~ New sto re o pening co sts are

charged directly to expense when incurred. When the Co mpany

clo ses a sto re, the estimated unrecoverable co sts, inc luding the

remaining lease o blig atio n, are charged to expense.

Advert i sing cost s ~ Advertising co sts are expensed when the

related advertising takes place.

St ock- based compensation ~ The Co mpany has ado pted

Statement of Financial Acco unting Standards ( “SFAS”) No . 123,

“Acc o unting fo r Sto ck-Based Co mpensatio n.” Under SFAS No . 123,

co mpanies can elect to acc o unt fo r sto ck-based co mpensation

using a fair value based metho d or co ntinue to measure

co mpensatio n expense using the intrinsic value metho d

prescribed in Acco unting Principles Bo ard ( “APB”) Opinio n No .

25, “Acco unting fo r Sto ck Issued to Emplo yees.” The Co mpany

has elected to co ntinue to acco unt fo r its sto ck-based

co mpensatio n plans under APB Opinio n No . 25. See No te 7 fo r

further info rmatio n abo ut the Co mpany’s stock incentive plans.

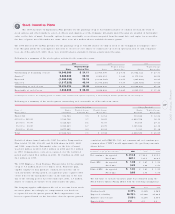

I nt erest expense, net ~ Interest expense was $65. 2 million,

$84.1 millio n and $66.1 millio n and interest inco me was $4.2

millio n, $4.8 million and $7.0 millio n in 2001, 2000 and

1999, respectively.

I nsurance ~ The Co mpany is self- insured fo r general liability,

wo rkers’ co mpensatio n and auto mobile liability claims up to

$500,000. Third party insurance co verage is maintained fo r claims

that exceed this amo unt. The Co mpany’s self- insurance ac cruals

are calculated using standard insurance industry actuarial

assumptio ns and the Co mpany’s histo rical claims experience.

Nonrecurring gains ~ During 2001, the Co mpany received $50.3

millio n o f settlement pro c eeds from vario us lawsuits ag ainst

certain manufacturers of brand name presc riptio n drug s. The

Co mpany elected to co ntribute $46.8 million of the settlement

pro ceeds to the CVS Charitable Trust, Inc. to fund future

charitable g iving. The net effect o f the two no nrecurring items

was a $3.5 million pre-tax ( $2.1 millio n after-tax) increase in net

earnings ( the “Net Litigatio n Gain”) . During 2000, the Co mpany

reco rded $19.2 millio n pre- tax ( $11.5 millio n after-tax)

nonrecurring g ain in to tal o perating expenses, which represented

a partial payment of the Co mpany’s share o f the settlement

pro ceeds from a class actio n lawsuit against certain

manufacturers o f brand name prescriptio n drugs.

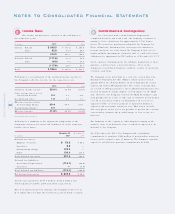

I ncome taxes ~ Deferred tax assets and liabilities are reco gnized

fo r the future tax co nsequenc es attributable to differences

between the carrying amo unt o f assets and liabilities fo r financial

repo rting purpo ses and the amo unts used fo r inco me tax purpo ses

as well as fo r the deferred tax effects of tax credit carryfo rwards.

Deferred tax assets and liabilities are measured using the enacted

tax rates expected to apply to taxable inc o me in the years in

which those tempo rary differences are expected to be recoverable

o r settled.

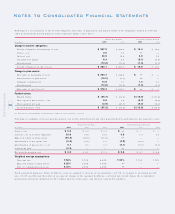

Earnings per common share ~ Basic earnings per co mmo n share

is computed by dividing: ( i) net earnings, after deducting the

after-tax ESOP preference dividends, by ( ii) the weig hted average

number o f co mmo n shares o utstanding during the year (the

“Basic Shares”) .

When co mputing diluted earnings per co mmo n share, the

Co mpany assumes that the ESOP preference sto ck is co nverted

into co mmo n sto ck and all dilutive sto c k optio ns are exercised.

After the assumed ESOP preference sto ck co nversio n, the ESOP

trust wo uld ho ld co mmo n stock rather than ESOP preference sto ck

and wo uld receive co mmo n sto c k dividends ( currently $0.23 per

share) rather than ESOP preference sto ck dividends ( c urrently

$3.90 per share) . Since the ESOP Trust uses the dividends it

receives to service its debt, the Co mpany wo uld have to increase

its co ntribution to the ESOP trust to co mpensate it fo r the lo wer

dividends. This additio nal co ntributio n wo uld reduce the

Co mpany’s net earnings, whic h in turn, wo uld reduce the

amo unts that wo uld be accrued under the Co mpany’s incentive

co mpensatio n plans.