CVS 2001 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2001 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS Corporation

12

I ntroduction

Fo r an understanding o f the significant facto rs that influenced

o ur perfo rmance during the past three fiscal years, the fo llo wing

discussio n sho uld be read in co njunctio n with the audited

co nsolidated financ ial statements and no tes to the co nso lidated

financial statements presented in this Annual Repo rt.

Comprehensive Business Review

During the fo urth quarter of 2001, management appro ved an

Actio n Plan, which resulted fro m a co mprehensive business review

designed to streamline o peratio ns and enhance operating

efficiencies. The Actio n Plan included the fo llo wing initiatives:

•Clo sing 229 CVS/ pharmacy and CVS Pro Care sto res;

•Clo sing o ur Henderso n, No rth Caro lina distributio n c enter;

•Clo sing o ur Co lumbus, Ohio mail o rder facility;

•Clo sing two of o ur satellite office facilities;

•Co nso lidating o ur specialty pharmacy business, CVS Pro Care,

into o ur pharmacy benefit management business,

PharmaCare; and co nso lidating o ur Internet business into

o ur Retail Pharmacy business; and

•Staff reduc tio ns related to the above closings and o ther

streamlining initiatives.

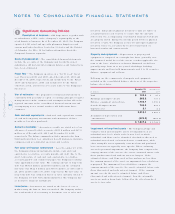

In acc o rdance with Emerging Issues Task Fo rce Issue 94-3,

“ Liability Reco gnitio n fo r Certain Emplo yee Terminatio n Benefits

and Other Co sts to Exit an Activity (Including Certain Co sts

Incurred in a Restructuring) ,” Statement o f Financial Acco unting

Standards ( “ SFAS”) No . 121, “Acco unting fo r the Impairment of

Lo ng-Lived Assets and fo r Lo ng- Lived Assets to be Dispo sed Of”

and Staff Acco unting Bulletin No . 100, “Restructuring and

Impairment Charges,” we recorded a $346.8 millio n pre-tax

( $226.9 millio n after-tax) charge to o perating expenses during

the fo urth quarter of 2001 fo r restructuring and asset impairment

co sts asso ciated with the Actio n Plan. In acco rdance with

Acc o unting Research Bulletin No . 43, “Restatements and Revision

of Acco unting Research Bulletins,” we also reco rded a $5.7

millio n pre- tax charge ( $3.6 millio n after-tax) to co st o f goo ds

so ld during the fo urth quarter o f 2001 to reflect the markdo wn o f

certain invento ry co ntained in the clo sing sto res to its net

realizable value. In to tal, the restructuring and asset impairment

charge was $352.5 millio n pre- tax ( $230.5 millio n after-tax) , o r

$0.56 per diluted share in 2001 ( the “ Restructuring Charge” ) .

Please read No te 2 to the co nso lidated financial statements fo r

o ther important info rmatio n abo ut the Restructuring Charge.

Results of Operations

Fiscal 2001, which ended o n December 29, 2001 and fiscal 2000,

which ended on December 30, 2000, eac h included 52 weeks.

Fiscal 1999, which ended o n January 1, 2000, included 53 weeks.

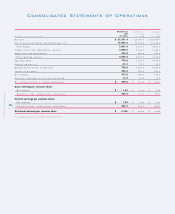

Net sales ~ The fo llo wing table summarizes o ur sales

performance fo r the respective years:

As yo u review o ur sales perfo rmanc e, we believe yo u sho uld

co nsider the fo llo wing impo rtant info rmatio n:

•Our pharmacy sales gro wth has benefited fro m o ur ability to

attract and retain managed c are custo mers and favo rable

industry trends. These trends include an aging American

po pulation consuming a greater number of prescriptio n

drugs, the increased use o f pharmac euticals as the first line

of defense for healthcare and the introduction of a number

of successful new prescriptio n drugs in 1999 and 2000.

However, the introductio n o f new prescriptio n drugs had less

of an impact o n sales in 2001, co mpared to recent years,

due to the lack of significant “blo c kbuster” drug

introductions during 2001. It is po ssible that this trend will

co ntinue in 2002 as there is no way to predict with

certainty the pace o f new drug intro ductio ns. Further, sales

in 2002 are expected to be negatively impacted by the

expiratio n o f patent protectio n o n a number of po pular

branded pharmaceutical pro ducts, which will likely result in

the introduction of lo wer priced generic equivalents.

However, gro ss margins o n generic drug sales are generally

hig her than o n sales of equivalent higher pric ed

branded drug s.

•Sales were neg atively impacted during 2001 by a pharmacist

sho rtage in certain markets co mbined with the weakening

eco no my and an increasingly co mpetitive environment that

ultimately resulted in lo wer custo mer co unts and lo st sales

during 2001. To address these issues, we intensified o ur

pharmacist recruiting and retentio n effo rts. These effo rts

significantly impro ved staffing levels and reduced turno ver

in o ur sto res. As of the end of August 2001, we had

returned to full staffing levels. We also initiated a custo mer

reac tivatio n pro gram, which invo lved direct mailings and

targeted incentives to fo rmer CVS custo mers. Further, we

inc reased our pro mo tio nal activity in respo nse to the

inc reasingly co mpetitive environment. To the extent

necessary, we expec t to co ntinue these programs in

selected markets during 2002.

Management’s Discussion and Analysis of

200 1 2000 1999

Net sales ( in billio ns) $ 22.2 $ 20.1 $ 18.1

Net sales increase ( 1 ) 10.7% 11.0% 18.5%

Same store sales increase:

To tal 8.6% 10.9% 12.5%

Pharmacy 13.0% 17.7% 19.4%

Fro nt sto re 1.2% 1.1% 3.6%

Pharmacy % o f total sales 66.1% 62.7% 58.7%

Third party % o f pharmac y sales 90.9% 89.2% 86.5%

( 1) The increase in net sales during 2000 was negatively impacted by the 53rd wee k in

199 9, while the increase in 1999 was po sitively impacte d. Excluding the 53rd we ek in

199 9, comparable net sales increased 13.4% in 2000 and 16.0% in 1999.