CVS 2001 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2001 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

When we relo cate a sto re from an inline sho pping

center to a freestanding co rner lo catio n, the new

sto re usually generates sig nificantly higher sales,

impro ved margins and a better return o n invested

capital than the sto re it replaces.

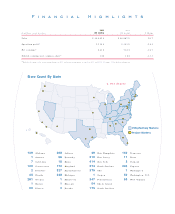

In 2001, we o pened 248 new and relo cated

sto res. Our net new sto re growth in 2001 to taled

58 sto res, fo r an increase in square fo o tage of

approximately 2% .

Fo r 2002, we plan to o pen 250-275 new o r

relo cated CVS/ pharmacies. At year-end 2001,

approximately 43% o f o ur stores were in freestanding

lo catio ns. Our lo ng-term go al remains to have 70-80%

of o ur stores in freestanding / co nvenient lo catio ns

with drive- thru pharmacies.

We also anno unced we will clo se 229 sto res in

early 2002 where we identified no relo catio n o ption

and limited lo ng- term growth po tential. Mo st of these

sto res became part o f CVS with the 1997 acquisitio n

of Revco . The clo sing o f these lo w-vo lume stores will

elevate the quality of o ur store base and sho uld help

to impro ve o ur same-sto re sales perfo rmance.

Location, Locat ion, Locat ion

The selec tio n of sto re lo catio ns is no simple

task. Our CVS Realty team uses a so phisticated

analytical pro cess that leverages extensive market

research and pro prietary CVS software systems to

identify the prime lo catio ns, right do wn to an

exact co rner o f a given intersectio n.

We use statistical and in-field research, as well

as spatial mo deling, to identify demo graphic and

o ther facto rs that drive custo mer traffic to o ur

sto res. Thus, when we o pen a new sto re o r enter a

new market, we do so with great co nfidence in the

po tential return o n invested capital o ver the

lo ng term.

Our real estate expansio n strateg y—entering new

markets, o pening new sto res in existing markets, and

relo cating sto res to mo re co nvenient lo catio ns—will

co ntinue to be an impo rtant part of o ur lo ng- term

gro wth plan.

Estate Expansion

2001 Annual Report

9

new markets, such as Flo rida, Chicago and Texas, are exceeding o ur expectatio ns.