CVS 2001 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2001 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS Corporation

28

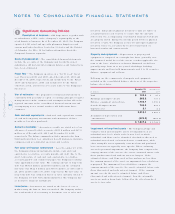

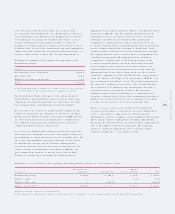

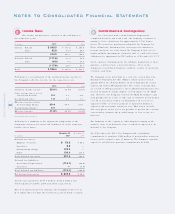

I ncome Taxes

The inco me tax pro visio n c o nsisted of the fo llo wing fo r

the respective years:

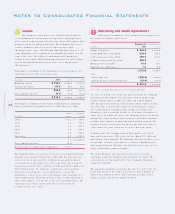

Fo llo wing is a reco nciliatio n o f the statutory inco me tax rate to

the Co mpany’s effective tax rate fo r the respective years:

Fo llo wing is a summary o f the significant co mpo nents of the

Co mpany’s deferred tax assets and liabilities as o f the respective

balanc e sheet dates:

Inco me taxes paid were $397.0 millio n, $342.5 millio n and

$354.5 millio n fo r 2001, 2000 and 1999, respectively.

Based o n histo rical pre-tax earnings, the Co mpany believes it is

mo re likely than no t that the deferred tax assets will be realized.

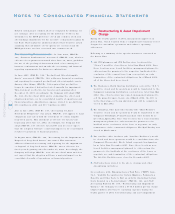

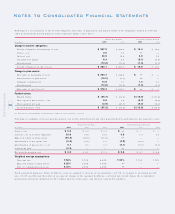

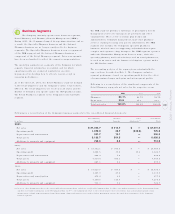

Commitment s & Contingencies

In c o nnection with certain business dispo sitio ns

co mpleted between 1991 and 1997, the Co mpany co ntinues to

guarantee lease obligatio ns fo r approximately 1,100 fo rmer

sto res. The respective purchasers indemnify the Co mpany fo r

these obligatio ns. Assuming that each respective purchaser

became inso lvent, an event which the Co mpany believes to be

hig hly unlikely, management estimates that it co uld settle these

o bligatio ns fo r approximately $760 millio n as of December 29, 2001.

In the o pinio n o f management, the ultimate dispositio n o f these

guarantees will no t have a material adverse effect on the

Co mpany’s co nso lidated financial co nditio n, results of o perations

o r future cash flo ws.

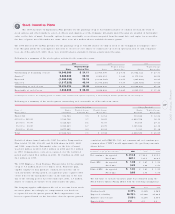

The Co mpany is the defendant in a c o llective actio n under the

Fair Labo r Standards Act ( the " FLSA") , whic h has been filed

against CVS in the Federal District Co urt o f Alabama by c ertain

current and fo rmer CVS pharmacists. The actio n co ntends that,

as a result o f CVS' pay practices, these pharmacists sho uld no t be

treated as salaried exempt emplo yees fo r purpo ses of the FLSA

and, therefo re, the Co mpany vio lated the FLSA by failing to pay

such pharmacists at a rate o f time and o ne-half fo r ho urs wo rked

o ver 40 in any given work week. Plaintiffs seek reco very o f

unpaid o vertime as well as payment of liquidated damages,

expenses and reaso nable atto rneys' fees. This actio n is in the

disco very phase and it is no t yet po ssible to predict the o utco me

o r reaso nably estimate the po ssible range of lo ss, if any, fo r

this case.

The Co mpany is also a party to o ther litigation arising in the

normal c o urse of its business, none o f which is expected to be

material to the Co mpany.

As o f December 29, 2001, the Co mpany had o utstanding

co mmitments to purchase $269 millio n of merchandise invento ry

fo r use in the no rmal course o f business. The Co mpany currently

expec ts to satisfy these purchase co mmitments by 2008.

Notes to Consolidated Financial Statements

8

In millions 200 1 2000 1999

Current: Federal $ 360.3 $ 397.2 $ 289.6

State 53.9 73.9 68.4

414 .2 471.1 358.0

Deferred: Federal ( 111.8) 21.9 72.6

State ( 6.0) 4.4 10.7

( 117 .8 ) 26.3 83.3

To tal $ 296 .4 $ 497.4 $ 441.3

200 1 2000 1999

Statuto ry inc o me tax rate 3 5.0% 35.0% 35.0%

State inco me taxes, net of

federal tax benefit 3.4 4.1 4.8

Go o dwill and o ther 1.0 0.9 1.2

Effective tax rate befo re

Restructuring Charge 3 9.4 40.0 41.0

Restructuring Charge ( 1 ) 2.4 — —

Effective tax rate 41 .8% 40.0% 41.0%

( 1) Inc ludes state tax effec t.

December 2 9 , Dec embe r 30,

In millions 200 1 2000

Deferred tax assets:

Emplo yee benefits $ 53.2 $ 65.1

Inve nto ry 9.8 —

Restructuring Charge 122.0 —

Other 136.4 137.4

To tal deferred tax assets 3 21.4 202.5

Deferred tax liabilities:

Acc elerated depreciation (114.1) ( 98.6)

Inve nto ry —( 7.0)

To tal deferred tax liabilities (114.1) ( 10 5. 6)

Net deferred tax assets $ 2 07.3 $ 96. 9

9