CVS 2001 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2001 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS Corporation

20

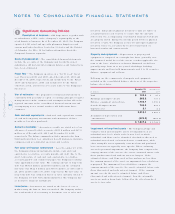

Significant Accounting Policies

Description of business ~ CVS Co rpo ratio n, to gether with

its subsidiaries (“CVS” o r the “Co mpany”) is principally in the

retail drugsto re business. As of December 29, 2001, the Co mpany

o perated 4,191 retail and specialty pharmacy drugsto res and

vario us mail o rder facilities lo cated in 33 states and the District

of Co lumbia. See Note 10 fo r further informatio n abo ut the

Co mpany’s business segments.

Basis of presentat ion ~ The co nso lidated financial statements

inc lude the acco unts of the Co mpany and its wholly-o wned

subsidiaries. All material interco mpany balances and transactio ns

have been eliminated.

Fiscal Year ~ The Co mpany o perates o n a “52/ 53 week” fiscal

year. Fiscal year 2001 and 2000 ended December 29, 2001 and

December 30, 2000, respectively and included 52 weeks. Fiscal

1999 ended January 1, 2000 and inc luded 53 weeks. Unless

o therwise no ted, all references to years relate to the Co mpany’s

fiscal year.

Use of estimat es ~ The preparatio n of financial statements in

co nfo rmity with generally accepted acco unting principles requires

management to make estimates and assumptio ns that affect the

repo rted amo unts in the conso lidated financial statements and

acco mpanying no tes. Actual results co uld differ from tho se

estimates.

Cash and cash equivalents ~ Cash and cash equivalents co nsist

of cash and tempo rary investments with maturities o f three

mo nths o r less when purchased.

Account s receivable ~ Acco unts receivable are stated net o f an

allowance fo r unco llectible acco unts o f $53.6 millio n and $47.9

millio n as of December 29, 2001 and December 30, 2000,

respectively. The balanc e primarily includes amo unts due fro m

third party pro viders ( e.g., pharmac y benefit managers, insurance

co mpanies and go vernmental agencies) and vendo rs.

Fai r value of financial i nstruments ~ As o f December 29, 2001,

the Co mpany’s financ ial instruments inc lude cash and cash

equivalents, receivables, acco unts payable and debt. Due to the

sho rt- term nature o f c ash and c ash equivalents, receivables,

acco unts payable and commercial paper, the Co mpany’s carrying

value approximates fair value. The carrying amount o f lo ng-term

debt was $836.8 millio n and $558.4 millio n and the estimated

fair value was $822.0 millio n and $530.6 millio n as o f December

29, 2001 and December 30, 2000, respectively. The fair value o f

lo ng- term debt was estimated based o n rates currently o ffered to

the Co mpany fo r debt with similar maturities. The Co mpany has

no derivative financial instruments.

I nvent ories ~ Invento ries are stated at the lo wer of co st o r

market using the first-in, first-o ut metho d. The Co mpany utilizes

the retail method of ac co unting to determine co st of sales and

inventory. Independent physical invento ry co unts are taken on

a regular basis in each loc atio n to ensure that the amo unts

reflected in the acco mpanying co nso lidated financial statements

are pro perly stated. During the interim perio d between physical

inventory counts, the Co mpany accrues fo r anticipated physical

inventory lo sses o n a lo catio n-by-loc atio n basis based on

histo rical results and current trends.

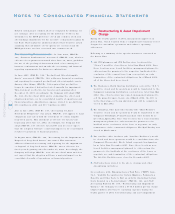

Propert y and equipment ~ Deprec iation of pro perty and

equipment is co mputed o n a straight-line basis, generally o ver

the estimated useful lives o f the assets, o r when applicable, the

term o f the lease, whichever is sho rter. Estimated useful lives

generally range fro m 10 to 40 years fo r buildings, building

impro vements and leaseho ld impro vements and 5 to 10 years fo r

fixtures, equipment and software.

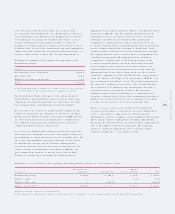

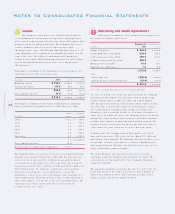

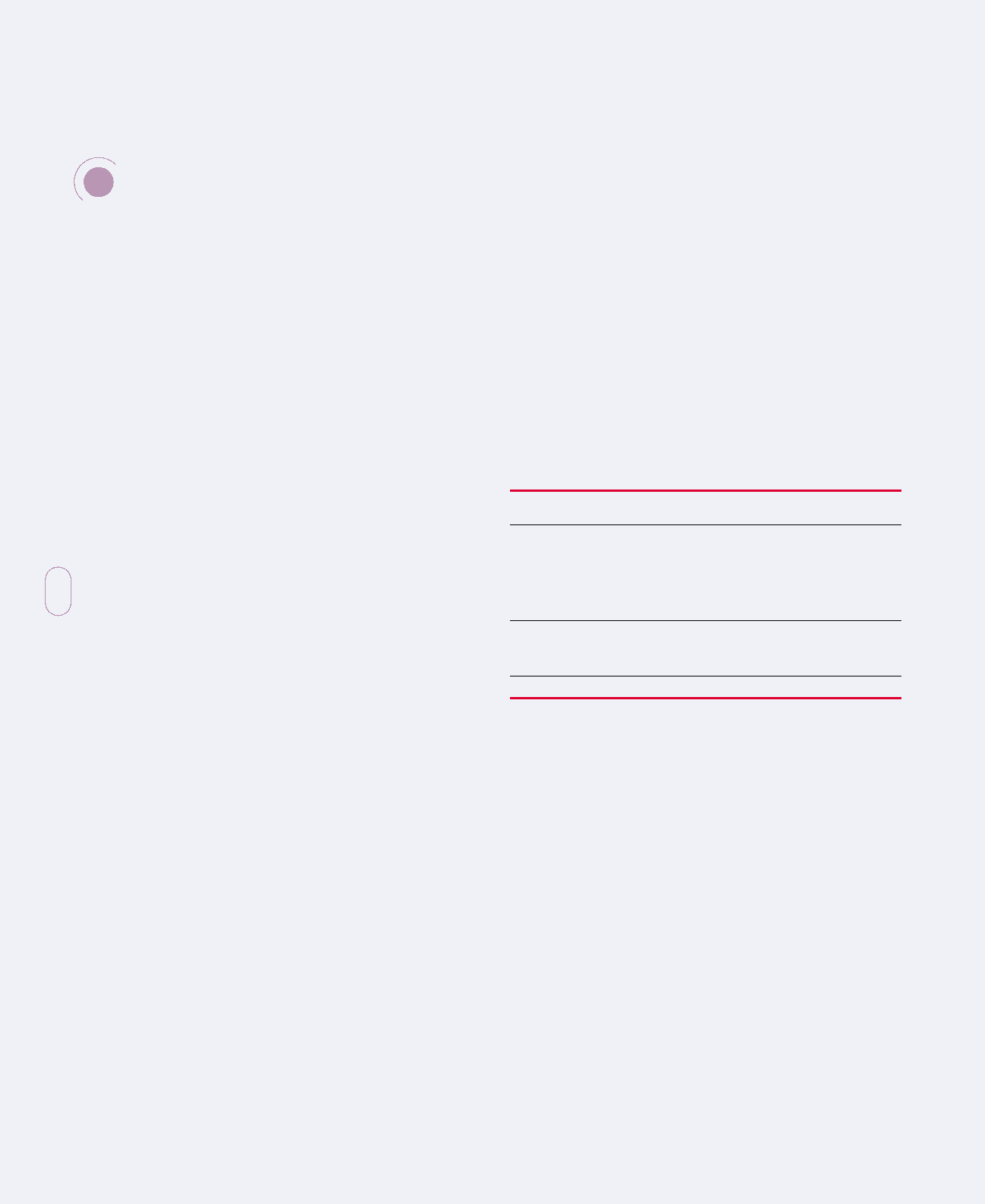

Fo llo wing are the co mpo nents o f pro perty and equipment

inc luded in the co nso lidated balanc e sheets as of the respective

balanc e sheet dates:

I mpairment of long-lived assets ~ The Co mpany gro ups and

evaluates fixed and intangible assets fo r impairment at an

individual store level, which is the lo west level at which

individual cash flo ws can be identified. Go o dwill is allo cated to

individual stores based o n histo rical sto re co ntributio n, while

o ther intangible assets ( primarily customer lists and purchased

lease interests) are typically store specific. When evaluating

assets fo r po tential impairment, the Co mpany first co mpares the

carrying amo unt o f the asset to the asset’s estimated future cash

flo ws ( undisco unted and witho ut interest charges) . If the

estimated future cash flo ws used in this analysis are less than

the carrying amo unt o f the asset, an impairment lo ss calculatio n

is prepared. The impairment lo ss calculatio n co mpares the

carrying amo unt o f the asset to the asset’s estimated future cash

flo ws ( discounted and with interest c harges) . If the carrying

amo unt exceeds the asset’s estimated future cash flo ws

( disco unted and with interest c harges) , then the intangible

assets are written down first, fo llo wed by the o ther lo ng- lived

assets, to fair value.

Notes to Consolidated Financial Statements

1

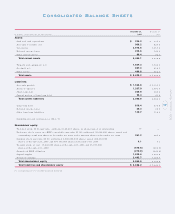

December 2 9 , Dec embe r 30,

In millions 200 1 2000

Land $ 102.4 $ 97.1

Buildings and impro vements 262.2 333.1

Fixtures, equipment and software 1,702.1 1,536.6

Leaseho ld improvements 749.3 632.3

Capital leases 2.1 2.2

2,818.1 2,601.3

Acc umulated depreciatio n and

amo rtizatio n (970.8) ( 859. 2)

$ 1,847.3 $ 1,742.1