CVS 2001 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2001 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

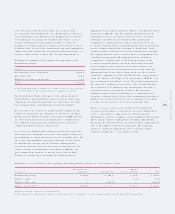

17

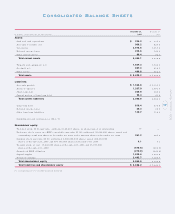

Consolidated Balance Sheets

2001 Annual Report

December 2 9 , Dec embe r 30,

In millions, e xce pt shares and pe r share amo unts 200 1 2000

Assets:

Cash and cash equivalents $ 236 .3 $ 337.3

Acc o unts receivable, net 966.2 824.5

Inve nto ries 3,918.6 3,557.6

Deferred inco me taxes 242.6 124.9

Other current assets 90.4 92.3

Tot al current assets 5,454.1 4,936.6

Pro perty and equipment, net 1,847.3 1,742.1

Go o dwill, net 827.0 818.5

Other assets 499.8 452.3

Tot al assets $ 8,628.2 $ 7,949.5

Liabilit i es:

Acc o unts payable $ 1,535.8 $ 1,351.5

Acc rued expenses 1,267.9 1,001.4

Sho rt-term debt 235.8 589.6

Current po rtion of lo ng-term debt 26.4 21.6

Tot al current liabilities 3,065.9 2,964.1

Lo ng-term debt 810.4 536.8

Deferred inco me taxes 35.3 28.0

Other lo ng- term liabilities 149.7 116.0

Co mmitments and contingenc ies ( Note 9)

Shareholders’ equity:

Preferred sto ck, $0.01 par value: autho rized 120,619 shares; no shares issued or o utstanding ——

Preference sto ck, series o ne ESOP co nvertible, par value $1.00: autho rized 50,000,000 shares; issued and

o utstanding 4,887,000 shares at December 29, 2001 and 5,006, 000 shares at December 30, 2000 261.2 267.5

Co mmon sto c k, par value $0.01: autho rized 1,000,000,000 shares; issued 408,532,000

shares at December 29, 2001 and 407,395,000 shares at December 30, 2000 4.1 4.1

Treasury sto ck, at co st: 17,645,000 shares at December 29, 2001 and 15,073,000

shares at December 30, 2000 (510.8) ( 404.9)

Guaranteed ESOP o bligatio n (219.9) ( 240. 6)

Capital surplus 1,539.6 1,493.8

Retained earnings 3,492.7 3,184.7

Tot al shareholders’ equity 4,566.9 4,304.6

Tot al liabilit i es and shareholders’ equity $ 8,628.2 $ 7,949.5

See ac co mpanying no tes to conso lidated financ ial statements.