CVS 2001 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2001 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS Corporation

22

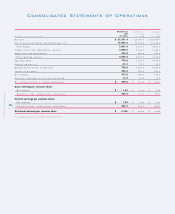

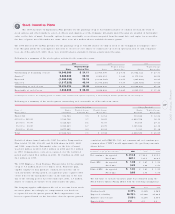

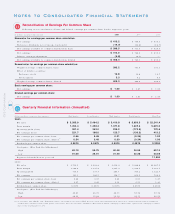

Diluted earnings per co mmo n share is co mputed by dividing: ( i)

net earnings, after acco unting fo r the difference between the

dividends o n the ESOP preferenc e sto ck and co mmo n stoc k and

after making adjustments fo r the incentive co mpensatio n plans by

( ii) Basic Shares plus the additio nal shares that wo uld be issued

assuming that all dilutive stoc k o ptio ns are exercised and the

ESOP preference sto ck is co nverted into c o mmo n stoc k.

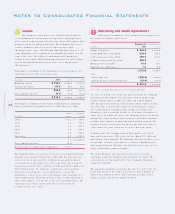

New Account ing Pronouncement s ~ In June 2001, SFAS No.

141, “Business Co mbinatio ns” was issued. SFAS No . 141, which is

effective for acquisitio ns initiated after June 30, 2001, pro hibits

the use o f the po o ling- o f-interests metho d o f acc o unting fo r

business co mbinatio ns and amends the acco unting and financial

repo rting requirements fo r business co mbinatio ns.

In June 2001, SFAS No . 142, “Go o dwill and Other Intangible

Assets” was issued. SFAS No. 142, addresses financ ial acco unting

and repo rting fo r acquired go o dwill and o ther intangible assets.

Amo ng o ther things, SFAS No . 142 requires that go o dwill no

lo nger be amo rtized, but rather tested annually for impairment.

This statement is effective fo r fiscal years beginning after

December 15, 2001. Acco rdingly, the Co mpany will ado pt SFAS

No . 142 effective fiscal 2002 and is evaluating the effec t such

ado ptio n may have o n its co nso lidated results o f o peratio ns and

financial po sitio n. Amo rtizatio n expense related to goo dwill was

$31.4 millio n in 2001 and $33.7 million in 2000.

Also in June 2001, SFAS No . 143, “Acc o unting fo r Asset

Retirement Obligatio ns” was issued. SFAS No. 143 applies to legal

o bligatio ns asso ciated with the retirement o f certain tang ible

lo ng- lived assets. This statement is effec tive fo r fiscal years

beginning after June 15, 2002. Acco rdingly, the Co mpany will

ado pt SFAS No . 143 effective fiscal 2003 and do es no t expect

that the ado ption will have a material impact o n its co nso lidated

results of operatio ns o r financial po sition.

In August 2001, SFAS No . 144, “Acco unting fo r the Impairment o r

Dispo sal of Lo ng-Lived Assets” was issued. This statement

addresses financial acco unting and repo rting fo r the impairment

o r dispo sal of lo ng- lived assets. SFAS No . 144 is effective fo r

fiscal years beginning after December 15, 2001. Acco rding ly, the

Co mpany will ado pt SFAS No . 144 effec tive fisc al 2002 and do es

not expect that the ado ptio n will have a material impact o n its

co nsolidated results of operatio ns o r financial po sitio n.

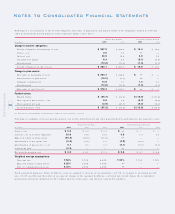

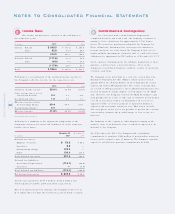

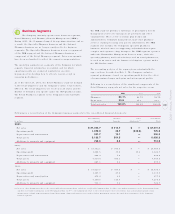

Restructuring & Asset I mpairment

Charge

During the fo urth quarter of 2001, management appro ved an

Actio n Plan, which resulted fro m a co mprehensive business review

designed to streamline o peratio ns and enhance operating

efficiencies.

Fo llo wing is a summary o f the spec ific initiatives co ntained in

the Actio n Plan:

1. 229 CVS/ pharmacy and CVS Pro Care sto re lo catio ns ( the

“Sto re s”) wo uld be c lo sed by no later than March 2002. Since

these lo catio ns were leased facilities, management planned to

either return the premises to the respective landlo rds at the

co nclusio n of the current lease term o r negotiate an early

termination of the co ntractual obligatio ns. As o f March 2002,

all of the Sto res had been closed.

2. The Henderso n, No rth Caro lina distributio n c enter ( the “D.C.”)

would be clo sed and its o peratio ns wo uld be transferred to the

Co mpany’s remaining distributio n centers by no later than May

2002. Since this loc atio n was o wned, management planned to

sell the property upo n clo sure. As o f March 2002, the D.C. is

in the final stages of being shutdown and will be co mpletely

clo sed in May 2002.

3. The Co lumbus, Ohio mail o rder facility ( the “Mail Facility”)

would be clo sed and its o peratio ns wo uld be transferred to the

Co mpany’s Pittsburgh, Pennsylvania mail order facility by no

later than April 2002. Since this lo catio n was a leased facility,

management planned to either return the premises to the

landlo rd at the co nclusion of the lease o r nego tiate an early

termination of the co ntractual obligatio n. The Mail Facility was

clo sed in March 2002.

4. Two satellite office facilities ( the “Satellite Facilities”) wo uld

be clo sed and their operatio ns wo uld be co nso lidated into the

Co mpany’s Wo o nso cket, Rho de Island c o rpo rate headquarters

by no later than December 2001. Since these lo catio ns were

leased facilities, management planned to either return the

premises to the landlo rds at the co nclusio n o f the leases o r

nego tiate an early terminatio n o f the c o ntractual obligatio ns.

The Satellite Facilities were clo sed in December 2001.

5. Staff reductio ns related to the abo ve clo sings and other

streamlining initiatives.

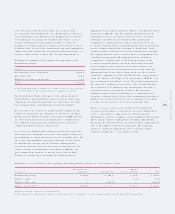

In acc o rdance with, Emerging Issues Task Fo rce ( “EITF”) Issue

94- 3, “Liability Reco g nitio n for Certain Emplo yee Terminatio n

Benefits and Other Co sts to Exit an Activity (Including Certain

Co sts Incurred in a Restructuring) ,” SFAS No . 121, and Staff

Acc o unting Bulletin No . 100, “Restructuring and Impairment

Charge s,” the Co mpany reco rded a $346.8 millio n pre-tax charge

( $226.9 millio n after-tax) to o perating expenses during the

fo urth quarter of 2001 fo r restructuring and asset impairment

Notes to Consolidated Financial Statements

2