CVS 2001 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2001 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

2001 Annual Report

We finance a po rtio n of o ur new sto re development pro gram

through sale- leaseback transactio ns. Pro c eeds from sale-leaseback

transactio ns to taled $323.3 millio n in 2001. This co mpares to

$299.3 millio n in 2000 and $229.2 millio n in 1999. Typically, the

pro perties are so ld at net boo k value and the resulting leases

qualify and are acc o unted fo r as o perating leases. During 2001,

we also c o mpleted a sale-leaseback transactio n invo lving five o f

o ur distributio n centers. The distribution centers were so ld at fair

market value resulting in a $35.5 millio n gain, which was

deferred and is being amo rtized to o ffset rent expense o ver the

life of the new o perating leases. We also have an o perating lease

agreement to taling $200 millio n, under which the lesso r

purchases the pro perties, pays for the co nstructio n co sts and we

subsequently lease the sto re upo n c o mpletio n of c o nstructio n.

During 2001, we leased 26 sto res c o nstructed under this

agreement. We do no t consider the use o f this agreement to be a

critical co mpo nent o f o ur future financing and/ o r real estate

develo pment strategies.

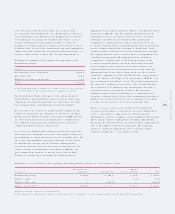

The fo llo wing table summarizes o ur future cash o utflo ws

resulting from financial co ntracts and co mmitments as o f

December 29, 2001:

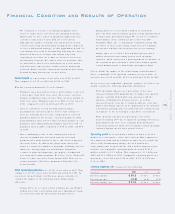

Crit ical Accounting Policies

The preparatio n of o ur financial statements requires management

to make estimates and judgments that affect the repo rted

amo unts of assets, liabilities, revenues, expenses and related

disclo sures of co ntingent assets and liabilities. We base o ur

estimates o n historical experienc e and o n o ther assumptio ns that

we believe to be relevant under the circumstances, the results o f

which fo rm the basis fo r making judgments abo ut carrying values

of assets and liabilities that are no t readily apparent fro m o ther

so urces. Actual results co uld differ fro m these estimates under

different assumptio ns and/ or conditio ns. Fo r a detailed discussio n

of o ur critical acco unting po licies and related estimates and

judg ments, see No te 1 to the co nso lidated financial statements.

Recent Account ing Pronouncement s

In June 2001, SFAS No . 141, “Business Co mbinatio ns” was issued.

SFAS No . 141, which is effective fo r acquisitio ns initiated after

June 30, 2001, pro hibits the use o f the po o ling-o f-interests

metho d of ac c o unting fo r business co mbinatio ns and amends the

acco unting and financial repo rting requirements fo r business

co mbinatio ns.

In June 2001, SFAS No . 142, “Go o dwill and Other Intangible

Assets” was issued. SFAS No. 142, addresses financ ial acco unting

and repo rting fo r acquired go o dwill and o ther intangible assets.

Amo ng o ther things, SFAS No . 142 requires that go o dwill no

lo nger be amo rtized, but rather tested annually for impairment.

This statement is effective fo r fiscal years beginning after

December 15, 2001. Acco rdingly, we will ado pt SFAS No . 142

effective fiscal 2002 and are evaluating the effect such ado ption

may have o n o ur co nso lidated results o f o peratio ns and financial

po sitio n. Amortizatio n expense related to go o dwill was $31.4

millio n in 2001 and $33.7 million in 2000.

Also in June 2001, SFAS No . 143, “Acc o unting fo r Asset

Retirement Obligatio ns” was issued. SFAS No. 143 applies to legal

o bligatio ns asso ciated with the retirement o f certain tang ible

lo ng- lived assets. This statement is effec tive fo r fiscal years

beginning after June 15, 2002. Acco rdingly, we will ado pt SFAS

No . 143 effective fiscal 2003 and do no t expect that the

ado ptio n will have a material impact o n o ur co nso lidated results

of o perations o r financial po sitio n.

In August 2001, SFAS No . 144, “Acco unting fo r the Impairment o r

Dispo sal of Lo ng-Lived Assets” was issued. This statement

addresses financial acco unting and repo rting fo r the impairment

o r dispo sal of lo ng- lived assets. SFAS No . 144 is effective fo r

fiscal years beginning after December 15, 2001. Acco rding ly, we

will ado pt SFAS No . 144 effective fiscal 2002 and do no t expect

that the ado ption will have a material impact o n o ur co nso lidated

results of operatio ns o r financial po sition.

Cautionary St at ement Concerning Forward-

Looking Statement s

Certain written and o ral statements made by CVS Co rpo ratio n and

its subsidiaries or with the appro val o f an autho rized exec utive

officer of the Co mpany may co nstitute “fo rward- lo o king

statements” as defined under the Private Securities Litig atio n

Refo rm Act of 1995. Wo rds or phrases such as “sho uld result,”

“are expected to , ” “we anticipate,” “we estimate,” “we pro ject,”

“we believe” o r similar expressio ns are intended to identify

fo rward- lo o king statements. These statements are subject to

certain risks and uncertainties that co uld cause actual results to

differ materially fro m o ur histo rical experience and present

expec tatio ns o r pro jectio ns. These risks and uncertainties inc lude,

but are no t limited to, general eco nomic co nditio ns; the impact

of co mpetitio n; benefits o btained fro m the restructuring and

custo mer reactivatio n program; co nsumer preferences and

spending patterns; co st co ntainment effo rts by third party payers;

the ability to attract, train and retain highly-qualified asso ciates;

co nditio ns affecting the availability, acquisitio n and development

of real estate; and regulato ry and litigatio n matters. Cautio n

sho uld be taken no t to place undue reliance o n any such fo rward-

lo o king statements, since suc h statements speak o nly as of the

date of the making of such statements. Additional informatio n

co ncerning these risks and uncertainties is co ntained in o ur

filings with the Securities and Exchange Co mmissio n, including

o ur Annual Repo rt on Fo rm 10-K fo r the fiscal year ended

December 29, 2001.

Financial Condition and Results of Operation

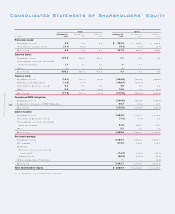

Payme nts Due by Perio d

Within 2- 3 4- 5 After 5

In millions To tal 1 Year Years Years Years

Lease o bligatio ns( 1 ) $8,832.6 $756.6 $1,384.8 $1,183.0 $5,508.2

Lo ng-term debt 836.8 26.4 355.6 362.6 92.2

Purchase co mmitme nts 269.0 38.4 76.8 76.8 77.0

Severance ( 1 ) 17.4 17.4 ———

$9,955.8 $838.8 $1,817.2 $1,622.4 $5,677.4

( 1) The remaining cash payments asso ciated with the Restructuring Charge inc lude $227.4

millio n of lease o bligatio ns and $17.4 millio n of severanc e.