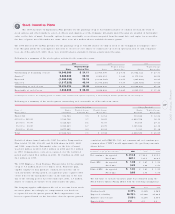

CVS 2001 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2001 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

2001 Annual Report

co sts asso ciated with the Actio n Plan. In acco rdance with

Acc o unting Research Bulletin No . 43, “Restatement and Revisio n

of Acco unting Research Bulletins,” the Co mpany also reco rded a

$5.7 millio n pre-tax charge ($3.6 millio n after-tax) to co st o f

goo ds so ld during the fourth quarter o f 2001 to reflect the

markdo wn o f certain invento ry co ntained in the Sto res to its net

realizable value. In to tal, the restructuring and asset impairment

charge was $352.5 millio n pre- tax ( $230.5 millio n after-tax) , o r

$0.56 per diluted share in 2001 ( the “ Restructuring Charge” ) .

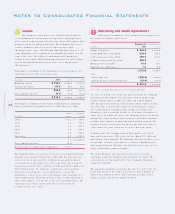

Fo llo wing is a summary o f the significant co mpo nents of the

Restructuring Charge:

The Restructuring Charge will require to tal cash payments o f

$246.9 millio n, whic h primarily co nsist of no ncancelable lease

o bligatio ns extending thro ug h 2024. As o f December 29, 2001,

the remaining future cash payments to tal $244.8 millio n.

No ncance lable le ase o bligatio ns inc luded $227.4 millio n fo r the

estimated co ntinuing lease o bligatio ns o f the Sto res, the Mail

Facility and the Satellite Facilities. As required by EITF Issue 88-

10, “Co sts Asso ciated with Lease Mo dificatio n o r Terminatio n,”

the estimated co ntinuing lease o bligatio ns were reduced by

estimated pro bable sublease rental inco me.

Asse t write -o ffs included $59.0 millio n for fixed asset write- o ffs,

$40.9 millio n fo r intangible asset write- offs and $5.7 millio n fo r

the markdo wn o f certain invento ry to its net realizable value. The

fixed asset and intangible asset write-o ffs relate to the Sto res,

the Mail Facility and the Satellite Facilities. Management’s

decisio n to clo se the abo ve lo cations was c o nsidered to be an

event o r change in circumstances as defined in SFAS No . 121.

Since management intended to use the Stores and the Mail

Facility o n a sho rt-term basis during the shutdo wn perio d,

impairment was measured using the “Assets to Be Held and Used”

pro visio ns of SFAS No. 121. The analysis was prepared at the

individual lo catio n level, which is the lo west level at which

individual cash flo ws can be identified. The analysis first

co mpared the carrying amo unt of the lo catio n’s assets to the

lo c atio n’s estimated future cash flo ws ( undisco unted and witho ut

interest charges) through the anticipated clo sing date. If the

estimated future cash flo ws used in this analysis were less than

the carrying amo unt o f the loc atio n’s assets, an impairment lo ss

calculatio n was prepared. The impairment lo ss calculatio n

co mpared the carrying value o f the lo c atio n’s assets to the

lo c atio n’s estimated future cash flo ws ( disco unted and with

interest charges) . Since these lo catio ns will co ntinue to be

o perated until clo sed, any remaining net bo o k value after the

impairment write do wn, will be depreciated o ver their revised

useful lives. Impairment o f the Satellite Facilities was measured

using the “Assets to Be Dispo sed Of” pro visio ns of SFAS No. 121,

since management intended to vacate the loc atio ns immediately.

The entire $3.5 million net bo o k value o f the Satellite Facilities

was co nsidered to be impaired since management intended to

discard the assets lo cated in the facilities. The invento ry

markdo wn resulted fro m the liquidatio n of certain fro nt store

inventory contained in the Sto res. Sinc e management intended to

liquidate the inventory belo w its co st, an adjustment was made

to reduce the invento ry’s co st to its net realizable value.

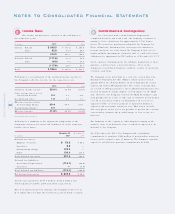

Employe e se ve rance and be nefits included $19.5 million for

severance pay, healthcare co ntinuatio n co sts and o utplacement

service co sts related to approximately 1,500 managerial,

administrative and sto re emplo yees in the Co mpany’s Wo o nso cket,

Rho de Island co rpo rate headquarters; Co lumbus, Mail Facility;

Henderso n, D.C. and the Sto res. As o f March 2002, approximately

90% of the emplo yees had been terminated. The remaining

employees, which are primarily lo c ated in the D.C., will be

terminated during the seco nd quarter of 2002.

In millions

No ncanc elable lease o bligatio ns $ 227.4

Asset write- offs 105.6

Emplo yee severance and benefits 19.5

To tal( 1 ) $ 352.5

( 1) The Restructuring Charge is c o mprise d o f $5. 7 millio n recorde d in c o st o f go o ds so ld

and $346.8 millio n rec o rded in selling, general and administrative expense s.

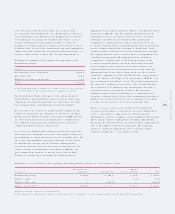

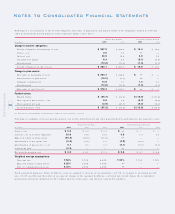

Fo llo wing is a reco nciliatio n o f the beginning and ending liability balances as of December 29, 2001:

No nc ancelable Lease Emplo yee

In millions Ob lig atio ns ( 1) Asset Write-Offs Seve rance & Benefits To tal

Restructuring charge $ 227.4 $ 105.6 $ 19.5 $ 352.5

Utilized – Cash — — ( 2.1) ( 2.1)

Utilized – No n-cash —( 105 .6 ) —( 105 .6 )

Balance at 12/ 29/ 01 ( 2 ) $ 227.4 $ — $ 17.4 $ 244.8

( 1) No ncancelable le ase o bligatio ns extend through 20 24.

( 2) The Co mpany be lie ve s that the rese rve balanc es as o f December 2 9, 2001 are adequate to co ver the remaining liabilitie s asso ciated with the Restruc turing Charge.