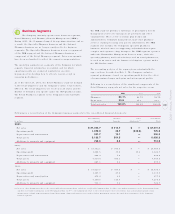

CVS 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

2001 Annual Report

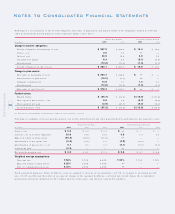

Employee St ock Ownership Plan

The Co mpany spo nso rs a defined co ntributio n Emplo yee

Stoc k Ownership Plan ( the “ESOP”) that covers full- time

employees with at least o ne year of service.

In 1989, the ESOP Trust issued and so ld $357.5 millio n o f

20- year, 8.52% no tes due December 31, 2008 ( the “ESOP No tes”) .

The pro ceeds fro m the ESOP No tes were used to purchase 6.7

millio n shares of Series One ESOP Co nvertible Preference Sto ck

( the “ESOP Preference Sto ck”) from the Co mpany. Since the ESOP

No tes are guaranteed by the Co mpany, the o utstanding balance

is reflected as lo ng-term debt and a c o rrespo nding guaranteed

ESOP o bligatio n is reflected in shareho lders’ equity in the

acco mpanying c o nso lidated balance sheets.

Each share of ESOP Preference Sto ck has a g uaranteed minimum

liquidatio n value o f $53.45, is co nvertible into 2.314 shares o f

co mmo n sto ck and is entitled to receive an annual dividend of

$3.90 per share. The ESOP Trust uses the dividends received and

co ntributio ns fro m the Co mpany to repay the ESOP No tes. As the

ESOP No tes are repaid, ESOP Preference Sto ck is allo cated to

participants based o n: ( i) the ratio of each year’s debt service

payment to to tal c urrent and future debt service payments

multiplied by ( ii) the number of unallo cated shares of ESOP

Preference Sto ck in the plan. As of Dec ember 29, 2001, 4.9

millio n shares of ESOP Preference Sto c k were o utstanding, of

which 2.3 millio n shares were allo cated to participants and the

remaining 2.6 millio n shares were held in the ESOP Trust fo r

future allocatio ns.

Annual ESOP expense reco gnized is equal to ( i) the interest

inc urred o n the ESOP No tes plus ( ii) the higher of ( a) the

principal repayments o r ( b) the co st of the shares allo cated, less

( iii) the dividends paid. Similarly, the g uaranteed ESOP o bligatio n

is reduced by the higher o f ( i) the principal payments o r ( ii) the

co st o f shares allo c ated.

Fo llo wing is a summary o f the ESOP activity fo r the

respective years:

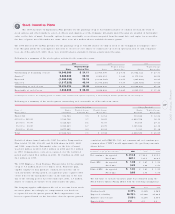

Pension Plans and Other

Postret irement Benef its

The Co mpany spo nso rs a nonco ntributo ry defined benefit pension

plan that c o vers certain full- time emplo yees o f Revco , D.S., Inc

who were no t co vered by co llective barg aining agreements. On

September 20, 1997, the Co mpany suspended future benefit

accruals under this plan. Benefits paid to retirees are based upo n

age at retirement, years o f credited servic e and average

co mpensatio n during the five year perio d ending September 20,

1997. The plan is funded based o n actuarial c alculatio ns and

applicable federal regulatio ns.

Pursuant to vario us labo r agreements, the Co mpany is also

required to make contributio ns to certain unio n- administered

pensio n and health and welfare plans that to taled $11.1 millio n,

$9.3 millio n and $8.4 millio n in 2001, 2000 and 1999,

respectively. The Co mpany also has no nqualified supplemental

executive retirement plans in place fo r certain key emplo yees fo r

who m it has purchased co st reco very variable life insurance.

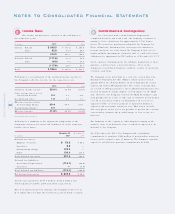

Def ined Contribution Plans

The Co mpany spo nso rs a voluntary 401( k) Savings Plan that

co vers substantially all emplo yees who meet plan eligibility

requirements. The Co mpany makes matching co ntributions

co nsistent with the pro visio ns of the plan. At the partic ipant’s

o ptio n, acco unt balances, including the Co mpany’s matc hing

co ntributio n, can be mo ved witho ut restrictio n among various

investment o ptio ns, including the Co mpany’s c o mmo n stoc k. The

Co mpany also maintains a no nqualified, unfunded Deferred

Co mpensatio n Plan fo r certain key emplo yees. This plan pro vides

participants the o ppo rtunity to defer po rtio ns of their

co mpensatio n and receive matching co ntributio ns that they

would have o therwise received under the 401( k) Savings Plan if

not fo r certain restrictio ns and limitatio ns under the Internal

Revenue Co de. The Co mpany’s co ntributio ns under the abo ve

defined co ntributio n plans to taled $26.7 millio n, $23.0 millio n

and $17.0 millio n in 2001, 2000 and 1999, respectively. The

Co mpany also spo nso rs an Emplo yee Sto ck Ownership Plan. See

No te 5 fo r further info rmatio n abo ut this plan.

Ot her Postretirement Benefit s

The Co mpany pro vides postretirement healthcare and life

insuranc e benefits to certain retirees who meet eligibility

requirements. The Co mpany’s funding po licy is generally to pay

co vered expenses as they are incurred.

5

6

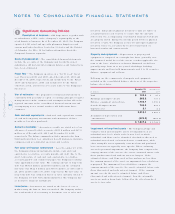

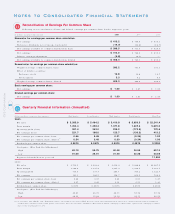

In millions 200 1 2000 1999

ESOP expense reco gnized $ 22.1 $ 18.8 $ 16.6

Dividends paid 19.1 19.5 20.1

Cash co ntributio ns 22.1 18.8 16.6

Interest payments 20.5 21.9 23.1

ESOP shares allo cated 0 .4 0.3 0.3