CVS 2001 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2001 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

2001 Annual Report

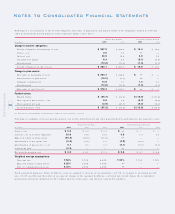

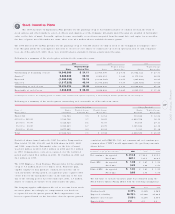

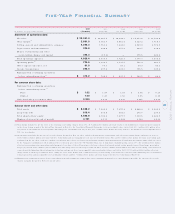

Five-Year Financial Summary

200 1 2000 1999 1998 1997

In millions, e xce pt pe r share amounts ( 5 2 weeks) ( 52 weeks) ( 53 weeks) ( 5 2 weeks) (52 wee ks)

St at ement of operations data:

Net sales $ 22,241.4 $ 20,087.5 $ 18,098.3 $ 15,273.6 $ 13,749.6

Gro ss margin( 1 ) 5,691.0 5,361.7 4,861.4 4,129.2 3,718.3

Selling, general and administrative expenses 4,256.3 3,761.6 3,448.0 2,949.0 2,776.0

Depreciatio n and amo rtizatio n 320 .8 296.6 277.9 249.7 238.2

Merger, restruc turing and o ther

nonrecurring c harges and ( gains) 343 .3 ( 1 9. 2) —178.6 422.4

To tal o perating expenses 4,920.4 4,039.0 3,725.9 3,377.3 3,436.6

Operating pro fit ( 2 ) 770 .6 1,322.7 1,135. 5 751.9 281.7

Other expense ( inco me) , net 61.0 79.3 59.1 60.9 44. 1

Inco me tax pro visio n 296 .4 497.4 441.3 306.5 149.2

Earnings fro m co ntinuing o perations

before extrao rdinary item ( 3 ) $ 41 3.2 $ 746.0 $ 635.1 $ 384.5 $ 88.4

Per common share dat a:

Earnings fro m co ntinuing o perations

before extrao rdinary item: ( 3 )

Basic $ 1.02 $ 1.87 $ 1.59 $ 0.96 $ 0.20

Diluted 1.00 1.83 1.55 0.95 0.19

Cash dividends per co mmon share 0.230 0.230 0.230 0.225 0. 220

Balance sheet and ot her data:

To tal assets $ 8,628 .2 $ 7,949.5 $ 7,275.4 $ 6,686.2 $ 5,920.5

Lo ng-term debt 810 .4 536.8 558.5 275.7 290.4

To tal shareho lders’ equity 4,566.9 4,304.6 3,679.7 3,110.6 2,626.5

Number of stores ( at end o f period) 4,191 4,133 4,098 4,122 4,094

( 1) Gross margin inc ludes the pre-tax effect o f the follo wing no nrec urring charges: ( i) in 2001, $5. 7 millio n ( $3.6 million after-tax) related to the markdo wn o f certain invento ry c o ntaine d

in the sto res clo sing as part of the Actio n Plan, disc ussed in No te 2 to the Co nso lidate d Financial Stateme nts, to its ne t realizable value, ( ii) in 1998, $10.0 millio n ( $5.9 millio n after-

tax) related to the markdown of no nc o mpatible Arbo r Drugs, Inc. merchandise and ( iii) in 1997, $75.0 millio n ($49.9 millio n after-tax) related to the markdo wn of nonc o mpatible Revco

D.S., Inc. merchandise.

( 2) Operating profit includes the pre- tax effect of the c harges discussed in No te (1) above and the fo llowing merger, restructuring, and o ther no nrec urring charges and g ains: ( i) in 2001,

$34 6.8 million ( $226. 9 millio n after- tax) related to restruc turing and asset impairment co sts associated with the Action Plan and $3.5 millio n ($2.1 millio n after-tax) no nrec urring gain

resulting from the net effect of the $50.3 millio n o f settlement proc ee ds received fro m vario us lawsuits against c ertain manufacturers o f brand name presc riptio n drugs which was o ffset

by the Co mpany’s co ntributio n of $46.8 millio n of these settlement proc ee ds to the CVS Charitable Trust, Inc. to fund future c haritable giving, ( ii) in 2000, $19.2 millio n ($11.5 millio n

afte r-tax) no nrecurring g ain representing partial payment o f o ur share of the settleme nt pro ceeds fro m a c lass actio n lawsuit against c ertain manufacturers o f brand name presc riptio n

drugs, ( iii) in 1998, $147.3 millio n ( $101.3 millio n after-tax) c harge related to the me rger of CVS and Arbo r and $31.3 millio n ($18.4 millio n after-tax) of nonrecurring c o sts incurred in

co nnec tio n with eliminating Arbo r’s info rmatio n te chno lo g y systems and Revco ’s no nc o mpatible sto re merchandise fixtures and ( iv) in 1997, $337.1 millio n ( $229.8 millio n after-tax)

charge related to the merger o f CVS and Revco o n May 29, 1997, $54.3 millio n ( $32.0 millio n afte r-tax) of no nrec urring co sts incurred in co nnectio n with eliminating Revco ’s informatio n

tec hno logy systems and no nco mpatible sto re merchandise fixtures and $31.0 millio n ( $19.1 millio n afte r-tax) charge related to the restructuring o f Big B, Inc.

( 3) Earnings from co ntinuing o perations befo re extrao rdinary item and e arnings per co mmo n share fro m co ntinuing o peratio ns befo re extrao rdinary item include the after-tax effect o f the

charges and gains disc ussed in No tes ( 1) and ( 2) above.