CVS 2001 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2001 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS Corporation

24

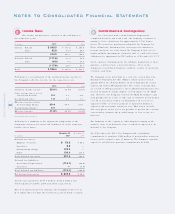

Leases

The Co mpany leases mo st o f its retail lo c atio ns and five

of its distribution centers under no ncancelable o perating leases,

who se initial terms are typically 22 years, alo ng with o ptio ns that

permit renewals fo r additio nal perio ds. The Co mpany also leases

certain equipment and o ther assets under noncancelable

o perating leases, who se initial terms typic ally range from 3 to 10

years. Minimum rent is expensed o n a straight-line basis o ver the

term o f the lease. In additio n to minimum rental payments,

certain leases require additio nal payments based o n sales vo lume,

as well as reimbursements fo r real estate taxes, maintenance

and insurance.

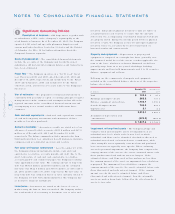

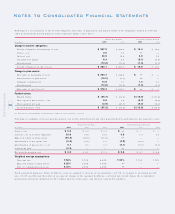

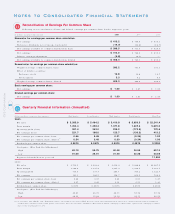

Fo llo wing is a summary o f the Co mpany’s net rental expense fo r

o perating leases fo r the respective years:

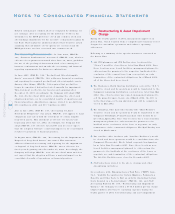

Fo llo wing is a summary o f the future minimum lease payments

under capital and o perating leases as o f December 29, 2001:

The Co mpany finances a po rtion of its store develo pment program

through sale- leaseback transactio ns. Typically, the pro perties are

so ld at net bo o k value and the resulting leases qualify and are

acco unted fo r as o perating leases. Pro ceeds fro m sale-leaseback

transactio ns to taled $323.3 millio n in 2001 and $299.3 millio n in

2000. During 2001, the Co mpany co mpleted a sale- leasebac k

transactio n invo lving five o f o ur distributio n centers. The

distributio n centers were so ld at fair market value resulting in a

$35.5 millio n gain, which was deferred and is being amo rtized to

offset rent expense o ver the life of the new o perating leases. The

o perating leases that resulted fro m these transactio ns are

inc luded in the above table.

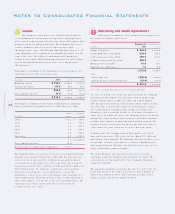

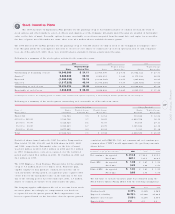

Borrowing and Credit Agreement s

Fo llo wing is a summary o f the Co mpany’s bo rrowings as o f

the respective balance sheet dates:

In c o nnection with o ur co mmercial paper pro gram the Co mpany

maintains a $650 millio n, five-year unsecured back-up credit

facility, which expires o n May 30, 2006 and a $650 million,

364- day unsecured back-up credit facility, whic h expires o n May

30, 2002. The credit facilities allo w fo r bo rro wings at vario us

rates depending o n o ur public debt ratings and require the

Co mpany to pay a quarterly fac ility fee o f 0.08% , regardless o f

usage. As o f December 29, 2001, the Co mpany had no t bo rrowed

against the c redit facilities. Interest paid to taled $75.2 millio n

in 2001, $98.3 millio n in 2000 and $69.0 millio n in 1999. The

weighed average interest rate for sho rt-term debt was 2.1% as

of Dec ember 29, 2001 and 6.9% as of December 30, 2000.

In March 2001, the Co mpany issued $300 million of 5.625%

unsecured senio r notes. The notes are due March 15, 2006 and

pay interest semi- annually. The Co mpany may redeem these no tes

at any time, in who le o r in part, at a defined redemptio n price

plus accrued interest. Net pro ceeds from the no tes were used to

repay o utstanding co mmercial paper.

The Credit Facilities and unsecured senio r no tes c o ntain

custo mary restrictive financ ial and operating c o venants. The

co venants do no t materially affect the Co mpany’s financial o r

o perating flexibility.

The aggregate maturities of lo ng-term debt fo r each o f the five

years subsequent to December 29, 2001 are $26.4 millio n in

2002, $32.2 millio n in 2003, $323.4 millio n in 2004, $28.1

millio n in 2005 and $334.5 millio n in 2006.

Notes to Consolidated Financial Statements

4

3

Capital Operating

In millions Le ases Leases

2002 $ 0.2 $ 756.4

2003 0.2 712.5

2004 0.2 671.9

2005 0.2 623.2

2006 0.2 559.4

Thereafter 0.7 5,507.5

1.7 $ 8,830.9

Less: imputed interest ( 0.7)

Present value of capital lease o bligatio ns $ 1. 0

In millions 200 1 2000 1999

Minimum rentals $ 758 .2 $ 684.9 $ 572.4

Co ntingent rentals 67.6 66.3 64.8

825 .8 751.2 637.2

Less: sublease inco me ( 9.1) ( 9.2) ( 1 3. 2)

$ 816 .7 $ 742.0 $ 624.0

December 2 9 , Dec embe r 30,

In millions 200 1 2000

Co mmercial paper $ 235 .8 $ 589.6

8.52% ESOP notes due 2008 ( 1 ) 219.9 240.6

5.5% senio r no tes due 2004 300.0 300.0

5.625% senio r no tes due 2006 300.0 —

Mo rtg age no tes payable 15.9 16.6

Capital lease o blig atio ns 1.0 1.2

1,072.6 1,148.0

Less:

Sho rt-term debt (235.8) ( 589. 6)

Current po rtion of lo ng-term debt ( 26.4) ( 2 1. 6)

$ 810 .4 $ 536.8

( 1) See No te 5 fo r further info rmatio n about the Co mpany’s ESOP Plan.