CVS 1999 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 1999 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

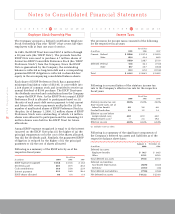

Notes to Consolidated Financial Statements

38

CVS Corporation

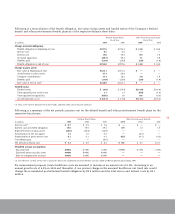

Business Segments

The Company currently operates four business segments:

Retail Pharmacy, Pharmacy Benefit Management (“PBM”),

Specialty Pharmacy and Internet Pharmacy. The Company’s

business segments are operating units that offer different

products and services, and require distinct technology and

marketing strategies.

The Retail Pharmacy segment, which includes 4,086 retail

drugstores located in 24 states and the District of Columbia,

operates under the CVS/pharmacy name. The Retail

Pharmacy segment is the Company’s only reportable

segment.

The PBM segment provides a full range of prescription

benefit management services to managed care and other

organizations. These services include plan design and

administration, formulary management, mail order pharmacy

services, claims processing and generic substitution. The

PBM segment operates under the PharmaCare Management

Services name.

The Specialty Pharmacy segment, which includes a mail

order facility and 12 retail pharmacies located in 9 states

and the District of Columbia, operates under the CVS

ProCare name. The Specialty Pharmacy segment focuses on

supporting individuals who require complex and expensive

drug therapies.

The Internet Pharmacy segment, which includes a mail

order facility and a complete online retail pharmacy,

operates under the CVS.com name.

The accounting policies of the segments are substantially

the same as those described in Note 1. The Company

evaluates segment performance based on operating profit

before the effect of nonrecurring charges and gains and

intersegment profits.

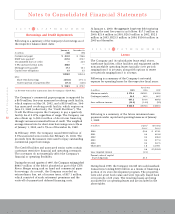

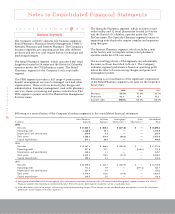

Following is a reconciliation of the significant components

of the Retail Pharmacy segment’s net sales for the respective

fiscal years:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 1 5

1999 1998 1997

Pharmacy 58.7% 57.6% 54.7%

Front store 41.3 42.4 45.3

Total net sales 100.0% 100.0% 100.0%

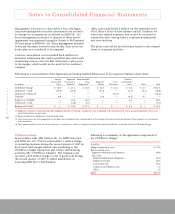

Following is a reconciliation of the Company’s business segments to the consolidated financial statements:

Retail Pharmacy All Other Intersegment Other Consolidated

In millions Segment Segments Eliminations(1) Adjustments(2) Totals

1999:

Net sales $ 17,625.7 $ 888.4 $ (415.8) $ — $ 18,098.3

Operating profit 1,120.4 15.1 — — 1,135.5

Depreciation and amortization 274.6 3.3 — — 277.9

Total assets 7,146.1 173.4 (44.1) — 7,275.4

Capital expenditures 477.1 16.4 — — 493.5

1998:

Net sales $ 15,081.1 $ 488.4 $ (295.9) $ — $ 15,273.6

Operating profit 927.8 12.7 — (188.6) 751.9

Depreciation and amortization 248.6 1.1 — — 249.7

Total assets 6,602.1 119.6 (35.5) — 6,686.2

Capital expenditures 498.0 4.3 — — 502.3

1997:

Net sales $ 13,649.4 $ 320.7 $ (220.5) $ — $ 13,749.6

Operating profit 771.2 7.9 — (497.4) 281.7

Depreciation and amortization 237.8 0.4 — — 238.2

Total assets 5,878.9 60.6 (19.0) — 5,920.5

Capital expenditures 339.6 2.0 — — 341.6

(1) Intersegment eliminations relate to intersegment sales and accounts receivables that occur when a Pharmacy Benefit Management segment customer uses a Retail

Pharmacy segment store to purchase covered merchandise. When this occurs, both segments record the sale on a stand-alone basis.

(2) Other adjustments relate to the merger, restructuring and other nonrecurring charges. These charges are not considered when management assesses the stand-alone

performance of the Company’s business segments.