CVS 1999 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 1999 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

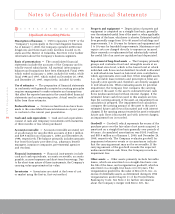

Strategic Restructuring Program

& Discontinued Operations

In November 1997, the Company completed the final phase

of its comprehensive strategic restructuring program, first

announced in October 1995 and subsequently refined in

May 1996 and June 1997. The strategic restructuring program

included: (i) the sale of Marshalls, Kay-Bee Toys, Wilsons,

This End Up and Bob’s Stores, (ii) the spin-off of Footstar,

Inc., which included Meldisco, Footaction and Thom McAn,

(iii) the initial and secondary public offerings of Linens ‘n

Things and (iv) the closing of the Company’s administrative

office facility located in Rye, New York.

The strategic restructuring program was completed without

significant changes to the Board approved plan.

During the second quarter of 1997, the Company sold its

remaining investment in Linens ‘n Things and recorded, as

a component of discontinued operations, a pre-tax gain of

$65.0 million ($38.2 million after-tax). In connection with

recording this gain, the Company also recorded, as a

component of discontinued operations, a pre-tax charge of

$35.0 million ($20.7 million after-tax) during the second

quarter of 1997 (the “1997 Charge”). The charge resulted

from the Company’s decision to retain and close seven

Bob’s Stores, which were affecting the overall marketability

of the Bob’s Stores business and the anticipated timing of

the sale. As a result of this decision, the Company recorded

a liability for the continuing lease obligations associated

with these locations. At the time of adopting the plan of

disposal, the Company expected to sell the entire Bob’s

Stores business and believed it was likely that the sale

could be consummated within 12 months.

1 2 3 45 6 7 8 9 10 11 12 13 14 15

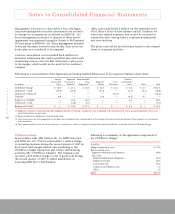

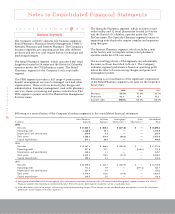

Following is a summary of the beginning and ending liability balances as of the respective balance sheet dates:

Noncancelable Employee

In millions Loss on Disposal Lease Obligations(1) Severance(2) Other Total(3)

Balance at 12/28/96 $ 162.5 $ 55.5 $ 35.1 $ 4.8 $257.9

1997 Charge — 35.0 — — 35.0

Utilization (192.9) (20.4) (22.0) (4.8) (240.1)

Transfers(4) 38.8 (32.8) (6.0) — —

Balance at 12/27/97 8.4 37.3 7.1 — 52.8

Utilization (8.4) (7.3) (2.4) — (18.1)

Balance at 12/26/98 — 30.0 4.7 — 34.7

Utilization — (8.0) (2.9) — (10.9)

Balance at 01/1/00(5) $ — $ 22.0 $ 1.8 $ — $ 23.8

(1) Noncancelable lease obligations extend through 2016.

(2) Employee severance extends through 2000.

(3) As of January 1, 2000, and December 26, 1998, there were no assets and $23.8 million and $34.7 million of liabilities, respectively, of the discontinued operations

reflected in the accompanying consolidated balance sheets.

(4) At the time the decision was made to separate Bob’s Stores from CVS, an estimated loss on disposal was recorded in the consolidated statements of operations within

discontinued operations. That loss included certain estimates. At the time of the sale, the total loss on disposal remained unchanged. However, the components of the

loss differed. The transfers between the components of the plan were made to reflect the nature of the remaining reserve. In conjunction with the sale, the buyer

assumed primary responsibility for the continuing lease obligations and retained certain employees that could have otherwise been terminated.

(5) The Company believes that the reserve balances as of January 1, 2000, are adequate to cover the remaining liabilities associated with this program.