CVS 1999 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 1999 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

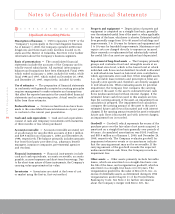

Revenue recognition ~ The Company recognizes revenue

from the sale of merchandise at the time the merchandise

is sold. Service revenues from the Company’s pharmacy

benefit management segment are recognized at the time the

service is provided.

Vendor allowances ~ The total value of any up-front or

other periodic payments received from vendors that are

linked to purchase commitments is initially deferred. The

deferred amounts are then amortized to reduce cost of

goods sold over the life of the contract based upon periodic

purchase volume. The total value of any up-front or other

periodic payments received from vendors that are not linked

to purchase commitments is also initially deferred. The

deferred amounts are then amortized to reduce cost of goods

sold on a straight-line basis over the life of the related

contract. Funds that are directly linked to advertising

commitments are recognized as a reduction of advertising

expense when the related advertising commitment is satisfied.

Store opening and closing costs ~ New store opening

costs are charged directly to expense when incurred. When

the Company closes a store, the estimated unrecoverable

costs, including the remaining lease obligation, are charged

to expense.

Stock-based compensation ~ The Company has adopted

Statement of Financial Accounting Standards (“SFAS”) No.

123, “Accounting for Stock-Based Compensation.” Under SFAS

No. 123, companies can elect to account for stock-based

compensation using a fair value based method or continue

to measure compensation expense using the intrinsic value

method prescribed in Accounting Principles Board (“APB”)

Opinion No. 25, “Accounting for Stock Issued to Employees.”

The Company has elected to continue to account for its

stock-based compensation plans under APB Opinion No.

25. See Note 7 for further information about the Company’s

stock incentive plans.

Advertising costs ~ External costs incurred to produce media

advertising are charged to expense when the advertising

takes place.

Insurance ~ The Company is self-insured for general

liability, workers’ compensation and automobile liability

claims up to $500,000. Third party insurance coverage

is maintained for claims that exceed this amount. The

Company’s self-insurance accruals are calculated using

standard insurance industry actuarial assumptions and

the Company’s historical claims experience.

Income taxes ~ Deferred tax assets and liabilities are

recognized for the future tax consequences attributable to

differences between the carrying amount of assets and

liabilities for financial reporting purposes and the amounts

used for income tax purposes as well as for the deferred tax

effects of tax credit carryforwards. Deferred tax assets and

liabilities are measured using the enacted tax rates expected

to apply to taxable income in the years in which those

temporary differences are expected to be recovered or

settled.

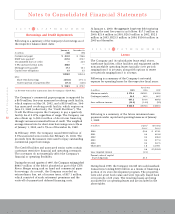

Earnings per common share ~ Basic earnings per common

share is computed by dividing: (i) net earnings, after

deducting the after-tax dividends on the ESOP preference

stock, by (ii) the weighted average number of common

shares outstanding during the year (the “Basic Shares”).

When computing diluted earnings per common share, the

Company normally assumes that the ESOP preference

stock is converted into common stock and all dilutive stock

options are exercised. After the assumed ESOP preference

stock conversion, the ESOP trust would hold common

stock rather than ESOP preference stock and would receive

common stock dividends (currently $0.23 per share) rather

than ESOP preference stock dividends (currently $3.90 per

share). Since the ESOP Trust uses the dividends it receives

to service its debt, the Company would have to increase its

contribution to the ESOP trust to compensate it for the

lower dividends. This additional contribution would reduce

the Company’s net earnings, which in turn, would reduce

the amounts that would be accrued under the Company’s

incentive compensation plans.

Diluted earnings per common share is computed by dividing:

(i) net earnings, after accounting for the difference between

the dividends on the ESOP preference stock and common

stock and after making adjustments for the incentive

compensation plans by (ii) Basic Shares plus the additional

shares that would be issued assuming that all dilutive stock

options are exercised and the ESOP preference stock is

converted into common stock. In 1997, the assumed

conversion of the ESOP preference stock would have

increased diluted earnings per common share and,

therefore, was not considered.

New Accounting Pronouncements ~ During fiscal 1999,

the Company adopted American Institute of Certified Public

Accountants Statement of Position 98-1, “Accounting for

the Costs of Computer Software Developed or Obtained for

Internal Use.” This statement defines which costs incurred

to develop or purchase internal-use software should be

capitalized and which costs should be expensed. The

adoption of this statement did not have a material effect

on the Company’s consolidated financial statements.