CVS 1999 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1999 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

Capital Resources ~ Although there can be no assurance

and assuming market interest rates remain favorable, we

currently believe that we will continue to have access to

capital at attractive interest rates in 2000. We further

believe that our cash on hand and cash provided by

operations, together with our ability to obtain additional

short-term and long-term financing, will be sufficient to

cover our future working capital needs, capital expenditures

and debt service requirements for at least the next 12 months.

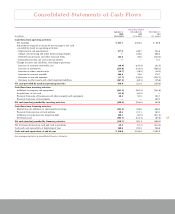

Net Cash Provided by Operations ~ Net cash provided by

operations was $658.8 million in 1999. This compares to

net cash provided by operations of $221.0 million in 1998

and net cash used in operations of $105.8 million in 1997.

The improvement in net cash provided by operations was

primarily the result of higher net earnings, improved working

capital management and a reduction in cash payments

associated with the Arbor and Revco mergers. You should

be aware that cash flow from operations will continue to

be negatively impacted by future payments associated with

the Arbor and Revco mergers and the Company’s strategic

restructuring program. As of January 1, 2000, the future

cash payments associated with these programs totaled

$123.0 million. These payments primarily include: (i)

$12.1 million for employee severance, which extends

through 2000, (ii) $9.0 million for retirement benefits and

related excess parachute payment excise taxes, which

extend for a number of years to coincide with the future

payment of retirement benefits, and (iii) $98.5 million for

continuing lease obligations, which extend through 2020.

Capital Expenditures ~ Our capital expenditures totaled

$493.5 million in 1999. This compared to $502.3 million

in 1998 and $341.6 million in 1997. During 1999, we

opened 146 new stores, relocated 299 existing stores and

closed 170 stores. During 2000, we currently expect to

open 425 stores, including 250 relocations. As of January

1, 2000, we operated 4,098 retail drugstores in 26 states

and the District of Columbia.

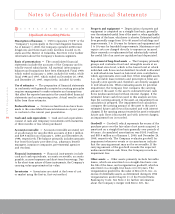

Recent Accounting Pronouncements

In June 1998, the Financial Accounting Standards Board

issued Statement of Financial Accounting Standards No.

133, “Accounting for Derivative Instruments and Hedging

Activities.” This statement, which establishes the accounting

and financial reporting requirements for derivative

instruments, requires companies to recognize derivatives

as either assets or liabilities on the balance sheet and

measure those instruments at fair value. In May 1999,

the Financial Accounting Standards Board delayed the

implementation date for this statement by one year. We

expect to adopt SFAS No. 133 in 2001. We currently are in

the process of determining what impact, if any, this

pronouncement will have on our consolidated financial

statements.

Cautionary Statement Concerning

Forward-Looking Statements

We have made forward-looking statements in this Annual

Report that are subject to risks and uncertainties that could

cause actual results to differ materially. For these statements,

we claim the protection of the safe harbor for forward-

looking statements contained in the Private Securities

Litigation Reform Act of 1995. We strongly recommend

that you become familiar with the specific risks and

uncertainties that we have outlined for you under the

caption “Cautionary Statement Concerning Forward-

Looking Statements” in our Annual Report on Form 10-K

for the fiscal year ended January 1, 2000.

Financial Condition and Results of Operations