CVS 1999 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 1999 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

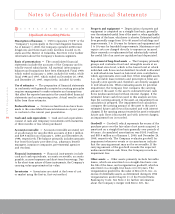

Notes to Consolidated Financial Statements

28

CVS Corporation

Management’s decision to close Arbor’s Troy, Michigan

corporate headquarters was also considered to be an event

or change in circumstances as defined in SFAS No. 121.

Since management intended to dispose of these assets,

impairment was measured using the “Assets to Be Disposed

Of” provisions of SFAS No. 121. Since management intended

to discard the assets located in this facility, their entire net

book value was considered to be impaired.

Contract cancellation costs included $4.8 million for

estimated termination fees and/or penalties associated with

terminating various contracts that Arbor had in place prior

to the merger, which would not be used by the combined

company.

Other costs included $1.3 million for the estimated write-

off of Arbor’s Point-of-Sale software and $1.4 million for

travel and related expenses that would be incurred in

connection with closing Arbor’s corporate headquarters

and store facilities.

The above costs did not provide future benefit to the retained

stores or corporate facilities.

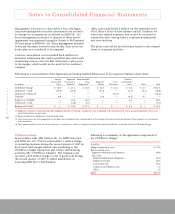

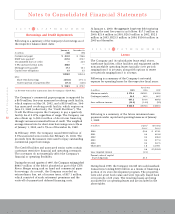

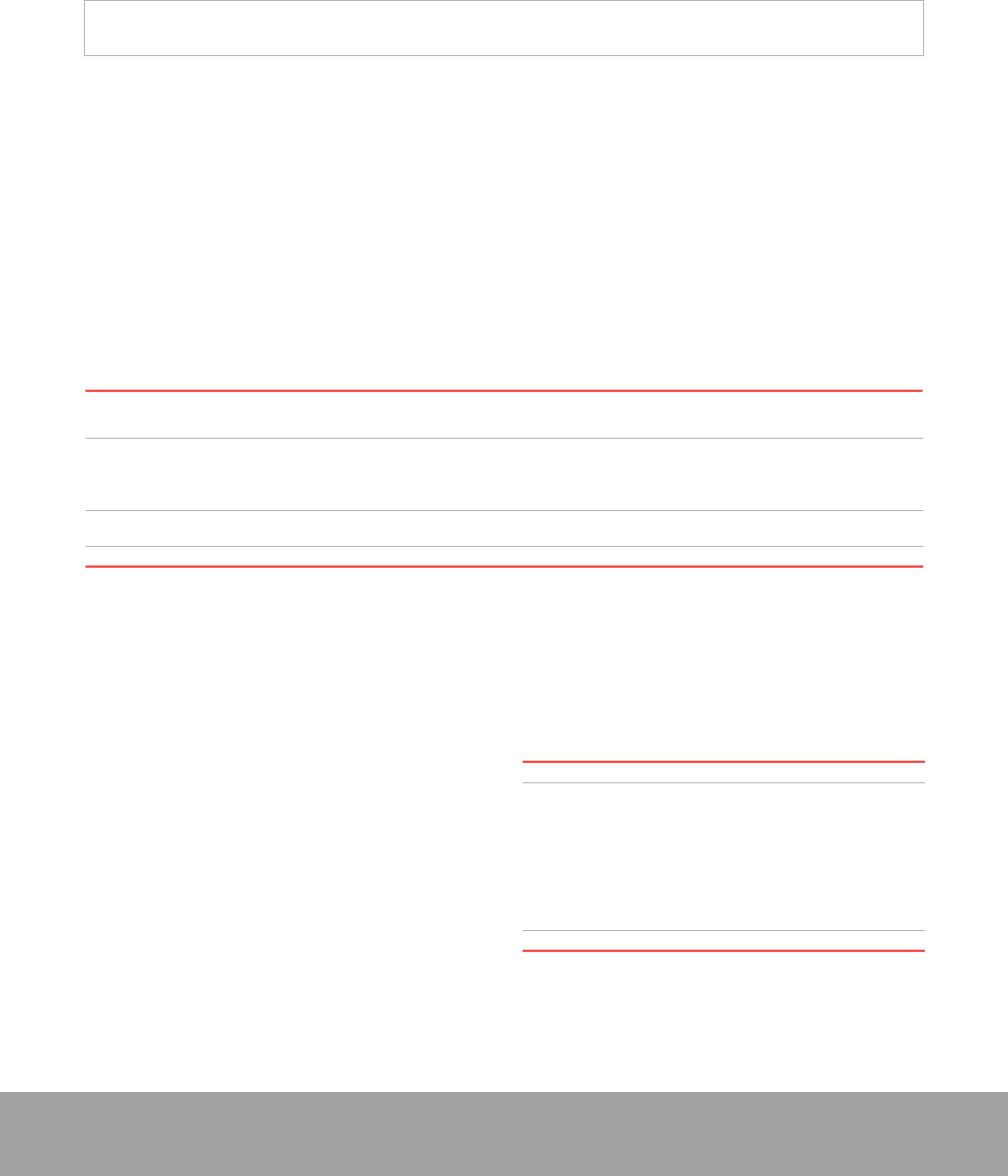

Following is a reconciliation of the beginning and ending liability balances as of the respective balance sheet dates:

Merger Employee Noncancelable Contract

Transaction Severance & Lease Duplicate Asset Cancellation

In millions Costs Benefits(1) Obligations(2) Facility Write-offs Costs Other Total

CVS/Arbor Charge $ 15.0 $ 27.1 $ 40.0 $ 16.5 $ 41.2 $ 4.8 $ 2.7 $147.3

Utilization -- Cash (15.9) (13.8) — (15.1) — (1.2) (3.4) (49.4)

Utilization -- Noncash — — — — (41.2) — — (41.2)

Transfer(3) 0.9 — — (1.4) — (0.2) 0.7 —

Balance at 12/26/98 — 13.3 40.0 — — 3.4 — 56.7

Utilization -- Cash — (3.0) (2.7) — — — — (5.7)

Balance at 01/1/00(4) $ — $ 10.3 $ 37.3 $ — $ — $ 3.4 $ — $ 51.0

(1) Employee severance extends through 2000. Employee benefits extend for a number of years to coincide with the payment of excess parachute payment excise taxes

and related income tax gross-ups.

(2) Noncancelable lease obligations extend through 2020.

(3) The transfers between the components of the plan were recorded in the same period that the changes in estimates were determined. These amounts are considered

to be immaterial.

(4) The Company believes that the reserve balances as of January 1, 2000, are adequate to cover the remaining liabilities associated with the CVS/Arbor Charge.

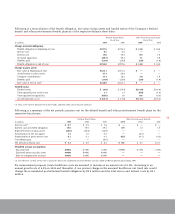

CVS/Revco Charge

In accordance with APB Opinion No. 16, EITF Issue 94-3

and SFAS No. 121, CVS recorded a $337.1 million charge

to operating expenses during the second quarter of 1997 for

direct and other merger-related costs pertaining to the

CVS/Revco merger transaction and certain restructuring

activities (the “CVS/Revco Charge”). The Company also

recorded a $75 million charge to cost of goods sold during

the second quarter of 1997 to reflect markdowns on

noncompatible Revco merchandise.

In millions

Merger transaction costs $ 35.0

Restructuring costs:

Employee severance and benefits 89.8

Exit costs:

Noncancelable lease obligations 67.0

Duplicate facility 50.2

Asset write-offs 82.2

Contract cancellation costs 7.4

Other 5.5

Total $337.1

Following is a summary of the significant components of

the CVS/Revco Charge: