CVS 1999 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1999 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

CVS Corporation

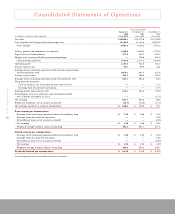

The decrease in interest expense in 1999 was primarily

due to the fact that we replaced $300 million of our

commercial paper borrowings with unsecured senior notes

that bear a lower interest rate than our commercial paper.

The increase in interest expense in 1998 was primarily

due to higher average borrowing levels when compared

to 1997. The decrease in interest income in 1998 was

primarily due to interest income recognized during 1997

on a note receivable that we received when we sold Kay-

Bee Toys in 1996. This note was sold in 1997.

Income tax provision ~ Our effective income tax rate was

41.0% in 1999 compared to 44.4% in 1998 and 62.8% in

1997. Our effective income tax rates were higher in 1998

and 1997 because certain components of the nonrecurring

charges we recorded in conjunction with the CVS/Arbor

and CVS/Revco merger transactions were not deductible for

income tax purposes.

Earnings from continuing operations before extraordinary

item increased $250.6 million to $635.1 million (or $1.55

per diluted share) in 1999. This compares to $384.5 million

(or $0.95 per diluted share) in 1998 and $88.4 million (or

$0.19 per diluted share) in 1997. If you exclude the effect of

the nonrecurring charges we recorded in cost of goods sold

and in total operating expenses, our comparable earnings from

continuing operations before extraordinary item increased

24.5% to $635.1 million (or $1.55 per diluted share) in 1999.

This compares to $510.1 million (or $1.26 per diluted

share) in 1998 and $419.2 million (or $1.05 per diluted

share) in 1997.

Discontinued Operations ~ In November 1997, we

completed the final phase of a comprehensive strategic

restructuring program, under which we sold Marshalls,

Kay-Bee Toys, Wilsons, This End Up and Bob’s Stores. As

part of this program, we also completed the spin-off of

Footstar, Inc., which included Meldisco, Footaction and

Thom McAn, completed the initial and secondary public

offerings of Linens ‘n Things and eliminated certain

corporate overhead costs. During 1997, we sold our

remaining investment in Linens ‘n Things and recorded,

as a component of discontinued operations, an after-tax

gain of $38.2 million. In connection with recording this

gain, we also recorded, as a component of discontinued

operations, an after-tax charge of $20.7 million during 1997

to finalize our original liability estimates. Please read Note 4

to the consolidated financial statements for other important

information about this program.

Extraordinary item ~ During 1997, we retired $865.7 million

of the debt we absorbed when we acquired Revco. As a

result, we recorded a charge for an extraordinary item, net

of income taxes, of $17.1 million. The extraordinary item

included the early retirement premiums we paid and the

balance of our deferred financing costs.

Net earnings were $635.1 million (or $1.55 per diluted share)

in 1999. This compares to $384.5 million (or $0.95 per

diluted share) in 1998 and $88.8 million (or $0.19 per

diluted share) in 1997.

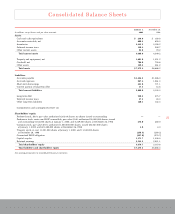

Liquidity & Capital Resources

Liquidity ~ The Company has three primary sources of

liquidity: cash provided by operations, commercial paper

and uncommitted lines of credit. We generally finance

our inventory and capital expenditure requirements with

internally generated funds and commercial paper. We

currently expect to continue to utilize our commercial

paper program to support our working capital needs. In

addition, we may elect to use long-term borrowings in

the future to support our continued growth.

Our commercial paper program is supported by a $670

million, five-year unsecured revolving credit facility that

expires on May 30, 2002, and a $530 million, 364-day

unsecured revolving credit facility that expires on June 21,

2000. We can also obtain up to $35.0 million of short-term

financing through various uncommitted lines of credit. As

of January 1, 2000, we had $451.0 million of commercial

paper outstanding at a weighted average interest rate of

6.2%. There were no borrowings outstanding under the

uncommitted lines of credit as of January 1, 2000.

On February 11, 1999, we issued $300 million of 5.5%

unsecured senior notes due February 15, 2004. The proceeds

from the issuance were used to repay outstanding commercial

paper borrowings.

Our credit facilities and unsecured senior notes contain

customary restrictive financial and operating covenants.

We do not believe that the restrictions contained in these

covenants materially affect our financial or operating

flexibility.

Management’s Discussion and Analysis of