CVS 1999 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 1999 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

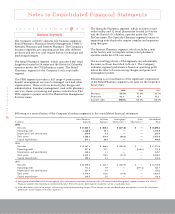

Stock Incentive Plans

As of January 1, 2000, the Company had the following stock

incentive plans, which include the pre-merger plans of

Arbor and Revco. Effective with the mergers, all outstanding

Arbor and Revco stock options were exchanged for options

to purchase CVS common stock.

1997 Incentive Compensation Plan

The 1997 Incentive Compensation Plan (the “1997 ICP”)

superceded the 1990 Omnibus Stock Incentive Plan, the

1987 Stock Option Plan and the 1973 Stock Option Plan

(collectively, the “Preexisting Plans”). Upon approval of the

1997 ICP, authority to make future grants under the

Preexisting Plans was terminated, although previously

granted awards remain outstanding in accordance with

their terms and the terms of the Preexisting Plans.

As of January 1, 2000, the 1997 ICP provided for the granting

of up to 23,382,245 shares of common stock in the form of

stock options, stock appreciation rights, restricted shares,

deferred shares and performance-based awards to selected

officers, employees and directors of the Company. All grants

under the 1997 ICP are awarded at fair market value on the

date of grant. The right to exercise or receive these awards

generally commences between one and five years from the

date of the grant and expires not more than ten years after

the date of the grant, provided that the holder continues to

be employed by the Company. As of January 1, 2000, there

were 17,915,519 shares available for future grants under

the 1997 ICP.

Restricted shares issued under the 1997 ICP may not exceed

3.6 million shares. In fiscal 1999, 1998 and 1997, 14,402,

155,400 and 44,610 shares of restricted stock were granted

at a weighted average grant date fair value of $50.88, $37.80

and $23.02, respectively. Participants are entitled to vote

and receive dividends on their restricted shares, although

they are subject to certain transfer restrictions. Compensation

costs, which are recognized over the restricted period,

totaled $2.3 million in 1999, $3.1 million in 1998 and

$3.5 million in 1997.

The 1996 Directors Stock Plan

The 1996 Directors Stock Plan (the “1996 DSP”) provides

for the granting of up to 346,460 shares of common stock

to the Company’s nonemployee directors (the “Eligible

Directors”). The 1996 DSP allows the Eligible Directors to

elect to receive shares of common stock in lieu of cash

compensation. Eligible Directors may also elect to defer

compensation payable in common stock until their service

as a director concludes. The 1996 DSP replaced the

Company’s 1989 Directors Stock Option Plan. As of

January 1, 2000, there were 247,071 shares available for

future grant under the 1996 DSP.

1 2 3 4 5 6 78 9 10 11 12 13 14 15

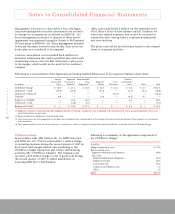

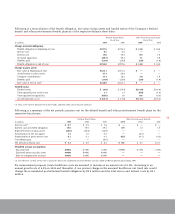

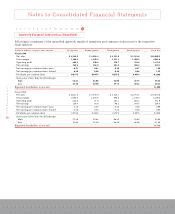

Following is a summary of the fixed stock option activity for the respective fiscal years:

1999 1998 1997

Weighted Average Weighted Average Weighted Average

Shares Exercise Price Shares Exercise Price Shares Exercise Price

Outstanding at beginning of year 11,982,122 $ 23.31 16,070,146 $ 16.95 23,569,930 $ 13.96

Granted 2,175,342 48.02 3,119,410 37.16 3,695,530 23.62

Exercised (927,080) 18.87 (7,137,027) 15.01 (10,756,726) 12.99

Canceled (265,784) 37.65 (70,407) 26.48 (438,588) 14.48

Outstanding at end of year 12,964,600 27.38 11,982,122 23.31 16,070,146 16.95

Exercisable at end of year 6,065,351 $ 17.92 6,127,402 $ 17.16 11,729,688 $ 16.11

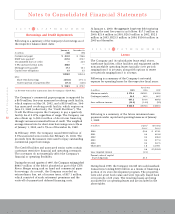

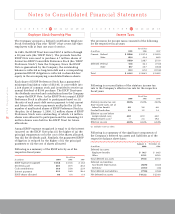

Following is a summary of the fixed stock options outstanding and exercisable as of January 1, 2000:

Options Outstanding Options Exercisable

Range of Number Weighted Average Weighted Average Number Weighted Average

Exercise Prices Outstanding Remaining Life Exercise Price Exercisable Exercise Price

Under $15 516,927 5.3 $ 11.43 496,038 $ 11.83

$15.01 to $20.00 4,934,909 4.9 16.72 4,607,689 16.72

20.01 to 25.00 2,357,420 6.4 22.81 652,241 22.27

25.01 to 40.00 3,110,464 8.0 36.71 297,019 36.24

40.01 to 51.38 2,044,880 9.3 48.19 12,364 42.65

Total 12,964,600 6.6 $ 27.38 6,065,351 $ 17.92