CVS 1999 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 1999 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

CVS Corporation

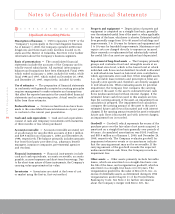

We strongly recommend that you read our accompanying

audited consolidated financial statements and footnotes

along with this important discussion and analysis.

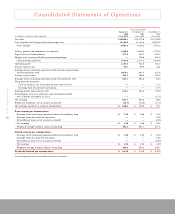

Results of Operations

Fiscal 1999, which ended on January 1, 2000, included

53 weeks, while fiscal 1998 and 1997, which ended on

December 26, 1998 and December 27, 1997, respectively,

included 52 weeks.

Net sales increased 18.5% in 1999 to $18.1 billion. This

compares to increases of 11.1% in 1998 and 16.2% in 1997.

Same-store sales, consisting of sales from stores that have

been open for more than one year, rose 12.5% in 1999,

10.8% in 1998 and 9.7% in 1997. Pharmacy same-store

sales increased 19.4% in 1999 and 16.5% in 1998 and

1997. Our pharmacy sales as a percentage of total net sales

were 59% in 1999, 58% in 1998 and 55% in 1997. Our

third party prescription sales as a percentage of total

pharmacy sales were 87% in 1999, 84% in 1998 and 81%

in 1997.

As you review our sales performance, we believe you

should consider the following important information:

•Our pharmacy sales growth continued to benefit

from our ability to attract and retain managed care

customers, our ongoing program of purchasing

prescription files from independent pharmacies and

favorable industry trends. These trends include an

aging American population; many “baby boomers”

are now in their fifties and are consuming a greater

number of prescription drugs. The increased use of

pharmaceuticals as the first line of defense for

healthcare and the introduction of a number of

successful new prescription drugs also contributed

to the growing demand for pharmacy services.

•Our front store sales growth was driven by strong

performance in the health and beauty, photo,

seasonal, and general merchandise categories.

•The increase in net sales in 1999 was positively

affected by the 53rd week. Excluding the positive

impact of the 53rd week, net sales increased 16.0%

in 1999 when compared to 1998.

•The increase in net sales in 1998 was positively

affected by our efforts to improve the performance

of the Revco stores. To do this, we converted the

retained Revco stores to the CVS store format and

relocated certain stores. Our performance during the

conversion period was positively affected by

temporary promotional events.

•The increase in net sales in 1997 was positively

affected by our acquisition of Big B, Inc., effective

November 16, 1996. Excluding the positive impact

of the Big B acquisition, net sales increased 11.3%

in 1997 when compared to 1996. Please read Note 3

to the consolidated financial statements for other

important information about the Big B acquisition.

•We continued to relocate our existing shopping

center stores to larger, more convenient, freestanding

locations. Historically, we have achieved significant

improvements in customer count and net sales when

we do this. The resulting increase in net sales has

typically been driven by an increase in front store

sales, which normally have a higher gross margin.

We believe that our relocation program offers a

significant opportunity for future growth, as only

33% of our existing stores are freestanding. We

currently expect to have approximately 40% of our

stores in freestanding locations by the end of 2000.

Our long-term goal is to have 80% of our stores

located in freestanding sites. We cannot, however,

guarantee that future store relocations will deliver

the same results as those historically achieved.

Please read the “Cautionary Statement Concerning

Forward-Looking Statements” section below.

Gross margin as a percentage of net sales was 26.9% in

1999. This compares to 27.0% in 1998 and 1997. Inventory

shrinkage was 0.9% of net sales in 1999, compared to 0.8%

of net sales in 1998 and 1997. As you review our gross

margin performance, please remember to consider the

impact of the following nonrecurring charges:

•During 1998, we recorded a $10.0 million charge to cost

of goods sold to reflect markdowns on noncompatible

Arbor merchandise, which resulted from the CVS/

Arbor merger transaction. Please read Notes 2 and 3

to the consolidated financial statements for other

important information about the CVS/Arbor merger.

•During 1997, we recorded a $75.0 million charge to cost

of goods sold to reflect markdowns on noncompatible

Revco merchandise, which resulted from the CVS/

Revco merger transaction. Please read Notes 2 and 3

to the consolidated financial statements for other

important information about the CVS/Revco merger.

If you exclude the effect of these nonrecurring charges, our

comparable gross margin as a percentage of net sales was

26.9% in 1999, 27.1% in 1998 and 27.6% in 1997.

Management’s Discussion and Analysis of