CVS 1999 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 1999 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

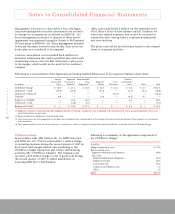

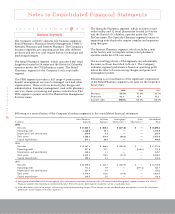

Merger transaction costs included $22.0 million for

estimated investment banker fees, $10.0 million for

estimated professional fees, and $3.0 million for estimated

filing fees, printing costs and other costs associated with

furnishing information to shareholders.

Employee severance and benefits included $17.0 million

for estimated excess parachute payment excise taxes and

related income tax gross-ups, $53.7 million for estimated

employee severance, $18.0 million for estimated incremental

retirement benefits and $1.1 million for estimated employee

outplacement costs. The excess parachute payment excise

taxes and related income tax gross-ups relate to employment

agreements that Revco had in place with 26 senior

executives. Employee severance and benefits and employee

outplacement costs relate to 1,195 employees who were

located in Revco’s Twinsburg, Ohio corporate headquarters,

including the 26 senior executives who were covered by

employment agreements. The incremental retirement

benefits (i.e., enhanced SERP benefits) also resulted from

the change in control.

Exit Costs ~ In conjunction with the merger transaction,

management made the decision to close Revco’s Twinsburg,

Ohio corporate headquarters and 223 Revco store locations.

As a result, the following exit plan was executed:

1. Revco’s Twinsburg, Ohio corporate headquarters would

be closed as soon as possible after the merger. Management

anticipated that this facility would be closed by no later

than December 31, 1997. The corporate headquarters

complex included both leased and owned facilities.

Management planned to return the leased facilities to

the respective landlords at the conclusion of the current

lease term and/or negotiate an early termination of the

contractual obligations. Management intended to sell the

owned facility. These facilities were closed in March 1998.

The related continuing lease obligations extend through

2007. The owned facility was sold on May 8, 1998.

2. Revco’s Twinsburg, Ohio corporate headquarters employees

would be terminated as soon as possible after the merger.

Management anticipated that these employees would be

terminated by no later than December 31, 1997. However,

significant headcount reductions at Revco were planned

and occurred throughout the transition period. As of

December 31, 1998, all of the above employees had been

terminated.

3. The 223 Revco store locations discussed above would be

closed as soon as practical after the merger. At the time

the exit plan was executed, management anticipated that

these stores would be closed by no later than December

31, 1998. Since these facilities were leased facilities,

management planned to either return the premises to

the respective landlords at the conclusion of the current

lease term and/or negotiate an early termination of the

contractual obligations. As of December 31, 1998, all of

these locations have been closed.

Noncancelable lease obligations included $67.0 million for

the estimated continuing lease obligations of the 223 Revco

store locations discussed above. As required by EITF 88-10,

the estimated continuing lease obligations were reduced by

estimated probable sublease rental income.

Duplicate facility included the estimated costs associated

with Revco’s Twinsburg, Ohio corporate headquarters during

the shutdown period. This facility was considered to be a

duplicate facility that was not required by the combined

company. Immediately after the merger transaction, the

Company assumed all decision-making responsibility for

Revco and Revco’s corporate employees. The combined

company did not retain these employees since they were

incremental to their CVS counterparts. During the shutdown

period, these employees primarily worked on shutdown

activities. The $50.2 million charge included $10.4 million

for the estimated cost of payroll and benefits that would be

incurred in connection with complying with the WARN

Act, $13.3 million for the estimated cost of payroll and

benefits that would be incurred in connection with shutdown

activities, $8.5 million for the estimated cost of temporary

labor that would be incurred in connection with shutdown

activities and $18.0 million for the estimated occupancy-

related costs that would be incurred in connection with

closing the duplicate corporate headquarters facility.

Asset write-offs included $40.3 million for estimated fixed

asset write-offs and $41.9 million for estimated intangible

asset write-offs. The Company allocates goodwill to

individual stores based on historical store contribution,

which approximates store cash flow. Other intangibles (i.e.,

favorable lease interests and prescription files) are typically

store specific and, therefore, are directly assigned to stores.

The asset write-offs relate to the 223 store locations

discussed above and the Twinsburg, Ohio corporate

headquarters. Management’s decision to close the store

locations was considered to be an event or change in

circumstances as defined in SFAS No. 121. Since management

intended to use these locations on a short-term basis