CVS 1999 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1999 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

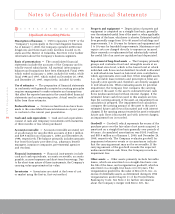

Notes to Consolidated Financial Statements

26

CVS Corporation

Business Combinations

CVS/Arbor Merger

On March 31, 1998, CVS completed a merger with Arbor

Drugs, Inc. (“Arbor”), pursuant to which 37.8 million

shares of CVS common stock were exchanged for all the

outstanding common stock of Arbor (the “CVS/Arbor

Merger”). Each outstanding share of Arbor common stock

was exchanged for 0.6364 shares of CVS common stock.

In addition, outstanding Arbor stock options were converted

at the same exchange ratio into options to purchase 5.3

million shares of CVS common stock.

CVS/Revco Merger

On May 29, 1997, CVS completed a merger with Revco D.S.,

Inc. (“Revco”), pursuant to which 120.6 million shares of

CVS common stock were exchanged for all the outstanding

common stock of Revco (the “CVS/Revco Merger”). Each

outstanding share of Revco common stock was exchanged

for 1.7684 shares of CVS common stock. In addition,

outstanding Revco stock options were converted at the

same exchange ratio into options to purchase 6.6 million

shares of CVS common stock.

The CVS/Arbor Merger and CVS/Revco Merger constituted

tax-free reorganizations and have been accounted for as

pooling of interests under APB Opinion No. 16, “Business

Combinations.” Accordingly, all prior period financial

statements were restated to include the combined results

of operations, financial position and cash flows of Arbor

and Revco as if they had always been owned by CVS.

The Company also acquired other businesses that were

accounted for as purchase business combinations and

immaterial pooling of interests. These acquisitions did

not have a material effect on the Company’s consolidated

financial statements either individually or in the aggregate.

The results of operations of these businesses have been

included in the consolidated financial statements since

their respective dates of acquisition.

Merger, Restructuring & Asset Impairment Charges

CVS/Arbor Charge

In accordance with APB Opinion No. 16, Emerging Issues

Task Force (“EITF”) Issue 94-3, “Liability Recognition for

Certain Employee Termination Benefits and Other Costs

to Exit an Activity (Including Certain Costs Incurred in a

Restructuring)” and SFAS No. 121, “Accounting for the

Impairment of Long-Lived Assets and for Long-Lived Assets

to Be Disposed Of,” CVS recorded a $147.3 million charge

to operating expenses during the second quarter of 1998

for direct and other merger-related costs pertaining to the

CVS/Arbor merger transaction and certain restructuring

activities (the “CVS/Arbor Charge”). The Company also

recorded a $10.0 million charge to cost of goods sold during

the second quarter of 1998 to reflect markdowns on

noncompatible Arbor merchandise.

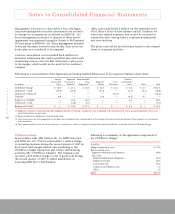

Following is a summary of the significant components of

the CVS/Arbor Charge:

Merger transaction costs included $12.0 million for estimated

investment banker fees, $2.5 million for estimated professional

fees, and $0.5 million for estimated filing fees, printing costs

and other costs associated with furnishing information to

shareholders.

Employee severance and benefits included $15.0 million for

estimated excess parachute payment excise taxes and related

income tax gross-ups, $11.0 million for estimated employee

severance and $1.1 million for estimated employee

outplacement costs. The excess parachute payment excise

taxes and related income tax gross-ups relate to employment

agreements that Arbor had in place with 22 senior executives.

Employee severance and benefits and employee outplacement

costs relate to 236 employees who were located in Arbor’s

Troy, Michigan corporate headquarters, including the 22

senior executives who were covered by employment

agreements.

1 23 4 5 6 7 8 9 10 11 12 13 14 15 1 2 34 5 6 7 8 9 10 11 12 13 14 15

In millions

Merger transaction costs $ 15.0

Restructuring costs:

Employee severance and benefits 27.1

Exit costs:

Noncancelable lease obligations 40.0

Duplicate facility 16.5

Asset write-offs 41.2

Contract cancellation costs 4.8

Other 2.7

Total $147.3