CVS 1999 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 1999 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

37

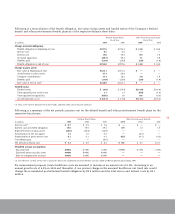

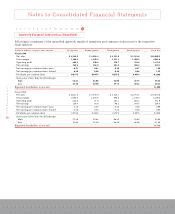

Income taxes paid were $354.5 million, $102.6 million and

$258.9 million for fiscal 1999, 1998 and 1997, respectively.

Based on historical pre-tax earnings, the Company believes

it is more likely than not that the deferred tax assets will

be realized.

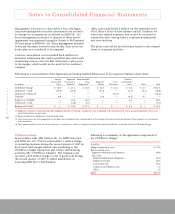

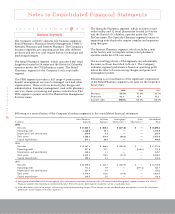

Supplemental Information

Following are the components of property and equipment

included in the consolidated balance sheets as of the

respective balance sheet dates:

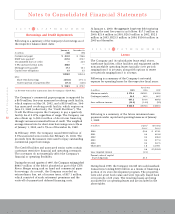

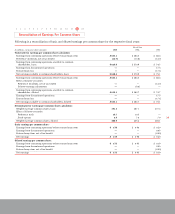

Following is a summary of the Company’s noncash

financing activities for the respective fiscal years:

Interest expense was $66.1 million, $69.7 million and

$59.1 million and interest income was $7.0 million, $8.8

million and $15.0 million in fiscal 1999, 1998 and 1997,

respectively. Interest paid totaled $69.0 million, $70.7

million and $58.4 million in fiscal 1999, 1998 and 1997,

respectively.

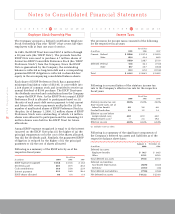

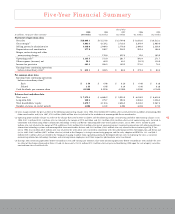

Commitments & Contingencies

In connection with certain business dispositions completed

between 1991 and 1997, the Company continues to guarantee

lease obligations for approximately 1,400 former stores.

The Company is indemnified for these obligations by the

respective purchasers. Assuming that each respective

purchaser became insolvent, an event which the Company

believes to be highly unlikely, management estimates that

it could settle these obligations for approximately $1.0

billion as of January 1, 2000.

In the opinion of management, the ultimate disposition of

these guarantees will not have a material adverse effect on

the Company’s consolidated financial condition, results of

operations or future cash flows.

As of January 1, 2000, the Company had outstanding

commitments to purchase $283.8 million of merchandise

inventory for use in the normal course of business. The

Company currently expects to satisfy these purchase

commitments by 2002.

The Company is also a defendant in various lawsuits

arising in the ordinary course of business. In the opinion

of management and the Company’s outside counsel, the

ultimate disposition of these lawsuits, exclusive of

potential insurance recoveries, will not have a material

adverse effect on the Company’s consolidated financial

condition, results of operations or future cash flows.

January 1, December 26,

In millions 2000 1998

Land $ 89.6 $ 91.0

Buildings and improvements 467.8 296.8

Fixtures and equipment 1,326.5 1,171.8

Leasehold improvements 518.5 477.4

Capital leases 2.2 2.8

2,404.6 2,039.8

Accumulated depreciation and

amortization (803.6) (688.6)

$ 1,601.0 $ 1,351.2

In millions 1999 1998 1997

Fair value of assets acquired $ —$ 62.2 $ —

Cash paid —62.2 —

Liabilities assumed $ —$— $—

Equity securities or notes

received from sale

of business $ —$ — $ 52.0

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15