CVS 1999 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 1999 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

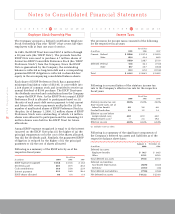

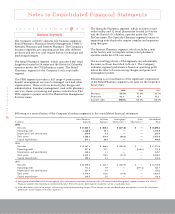

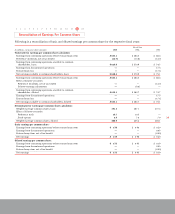

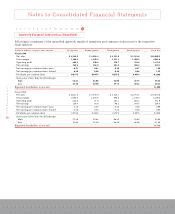

Notes to Consolidated Financial Statements

32

CVS Corporation

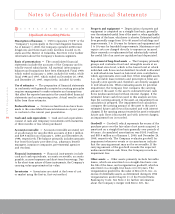

Borrowings and Credit Agreements

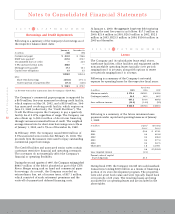

Following is a summary of the Company’s borrowings as of

the respective balance sheet dates:

The Company’s commercial paper program is supported by

a $670 million, five-year unsecured revolving credit facility,

which expires on May 30, 2002, and a $530 million, 364-

day unsecured revolving credit facility, which expires on

June 21, 2000 (collectively, the “Credit Facilities”). The

Credit Facilities require the Company to pay a quarterly

facility fee of 0.07%, regardless of usage. The Company can

also obtain up to $35.0 million of short-term financing

through various uncommitted lines of credit. The weighted

average interest rate for short-term borrowings was 6.2% as

of January 1, 2000, and 5.7% as of December 26, 1998.

In February 1999, the Company issued $300 million of

5.5% unsecured senior notes due February 15, 2004. The

proceeds from the issuance were used to repay outstanding

commercial paper borrowings.

The Credit Facilities and unsecured senior notes contain

customary restrictive financial and operating covenants.

The covenants do not materially affect the Company’s

financial or operating flexibility.

During the second quarter of 1997, the Company extinguished

$865.7 million of the debt it absorbed as part of the CVS/

Revco Merger using cash on hand and commercial paper

borrowings. As a result, the Company recorded an

extraordinary loss, net of income taxes, of $17.1 million,

which consisted of early retirement premiums and the

write-off of unamortized deferred financing costs.

At January 1, 2000, the aggregate long-term debt maturing

during the next five years is as follows: $17.3 million in

2000, $21.6 million in 2001, $26.5 million in 2002, $32.3

million in 2003, $323.5 million in 2004, $154.6 million in

2005 and thereafter.

Leases

The Company and its subsidiaries lease retail stores,

warehouse facilities, office facilities and equipment under

noncancelable operating leases typically over periods

ranging from 5 to 20 years, along with options to renew

over periods ranging from 5 to 15 years.

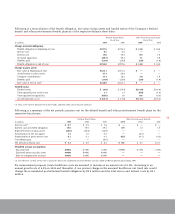

Following is a summary of the Company’s net rental

expense for operating leases for the respective fiscal years:

Following is a summary of the future minimum lease

payments under capital and operating leases as of January

1, 2000:

During fiscal 1999, the Company entered into sale-leaseback

transactions totaling $229 million as a means of financing a

portion of its store development program. The properties

were sold at net book value and were typically leased back

over periods of 20 years. The resulting leases are being

accounted for as operating leases and are included in the

above tables.

1 2 3 4 56 7 8 9 10 11 12 13 14 15

1 2 3 4 5 67 8 9 10 11 12 13 14 15

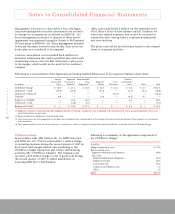

January 1, December 26,

In millions 2000 1998

Commercial paper $ 451.0 $ 736.6

ESOP note payable(1) 257.0 270.7

Uncommitted lines of credit —34.5

5.5% unsecured senior notes 300.0 —

Mortgage notes payable 17.3 16.1

Capital lease obligations 1.5 3.5

1,026.8 1,061.4

Less:

Short-term borrowings (451.0) (771.1)

Current portion of long-term debt (17.3) (14.6)

$ 558.5 $ 275.7

(1) See Note 9 for further information about the Company’s ESOP Plan.

Fiscal Year

In millions 1999 1998 1997

Minimum rentals $ 572.4 $ 459.1 $ 409.6

Contingent rentals 64.8 60.3 60.2

637.2 519.4 469.8

Less: sublease income (13.2) (14.0) (9.5)

$ 624.0 $ 505.4 $ 460.3

In millions Capital Operating

Leases Leases

2000 $ 0.4 $ 474.1

2001 0.4 441.8

2002 0.4 406.0

2003 0.4 377.4

2004 0.4 347.5

Thereafter 1.6 3,159.1

3.6 $ 5,205.9

Less: imputed interest (2.1)

Present value of capital

lease obligations $ 1.5