Blackberry 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

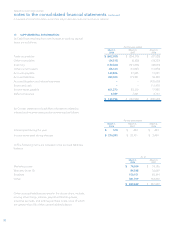

17. SUPPLEMENTAL INFORMATION

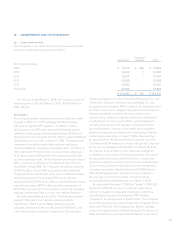

(a) Cash flows resulting from net changes in working capital

items are as follows:

For the year ended

March 1,

2008 March 3,

2007 March 4,

2006

Trade receivables $ (602,055)$ (254,370) $ (87,528)

Other receivables (34,515)(8,300) (18,727)

Inventory (140,360)(121,238) (42,034)

Other current assets (26,161)(16,827) (11,876)

Accounts payable 140,806 47,625 11,031

Accrued liabilities 383,020 119,997 59,398

Accrued litigation and related expenses –– (435,610)

Restricted cash –– 111,978

Income taxes payable 401,270 83,310 17,985

Deferred revenue 8,789 7,221 4,733

$ 130,794 $ (142,582) $ (390,650)

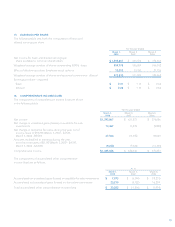

(b) Certain statement of cash flow information related to

interest and income taxes paid is summarized as follows:

For the year ended

March 1,

2008 March 3,

2007 March 4,

2006

Interest paid during the year $ 518 $ 494 $ 483

Income taxes paid during the year $ 216,095 $ 32,101 $ 2,449

(c) The following items are included in the accrued liabilities

balance:

As at

March 1,

2008 March 3,

2007

Marketing costs $ 74,034 $ 39,186

Warranty (note 13) 84,548 36,669

Royalties 150,151 48,344

Other 381,709 163,430

$ 690,442 $ 287,629

Other accrued liabilities as noted in the above chart, include,

among other things, salaries, payroll withholding taxes,

incentive accruals, and airtime purchase costs, none of which

are greater than 5% of the current liability balance.