Blackberry 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

to enhance the online experience for mobile, dial and

broadband subscribers, while significantly reducing bandwidth

requirements.

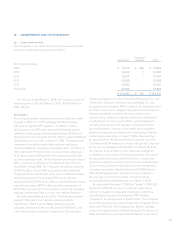

During the first quarter of fiscal 2007, the Company

purchased 100% of the common shares of Ascendent Systems

Inc. (“Ascendent”). The transaction closed on March 9, 2006.

Ascendent specializes in enterprise solutions to simplify voice

mobility implementations and allows the Company to further

extend and enhance the use of wireless communications by

offering a voice mobility solution that helps customers align

their mobile voice and data strategies.

During the first quarter of fiscal 2006, the Company

purchased 100% of the common shares of a company whose

proprietary software was incorporated into the Company’s

software. The transaction closed on March 24, 2005.

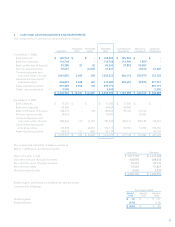

The following table summarizes the estimated fair value

of the assets acquired and liabilities assumed at the date of

acquisition along with prior year’s acquisition allocations:

During the second quarter of fiscal 2008, the Company

purchased 100% of the common shares of a company

whose proprietary software will be incorporated into the

Company’s software. The transaction closed on August

22, 2007. The operating results were not material to the

Company’s consolidated operating results in fiscal 2008.

In the acquisitions noted above, the consideration paid

by the Company was cash and the results of the acquirees’

operations have been included in the consolidated financial

statements commencing from each respective closing date to

March 1, 2008.

During the third quarter of fiscal 2007, the Company

purchased 100% of the common shares of a company whose

proprietary software will be incorporated into the Company’s

software. The transaction closed on September 22, 2006.

During the second quarter of fiscal 2007, the Company

purchased 100% of the common shares of Slipstream Data Inc.

(“Slipstream”). The transaction closed on July 7, 2006. Slipstream

provides acceleration, compression and network optimization

For the year ended

March 1,

2008 March 3,

2007 March 4,

2006

Assets purchased

Current assets $ 23 $ 3,707 $ 158

Capital assets -802 -

Deferred income tax asset -10,440 259

Acquired technology 1,035 40,266 6,223

Intangible assets 960 - -

Goodwill 4,523 80,906 -

6,541 136,121 6,640

Liabilities assumed -8,597 645

Deferred income tax liability 341 11,334 2,200

341 19,931 2,845

Net non-cash assets acquired 6,200 116,190 3,795

Cash acquired 13,649 3

Net assets acquired $ 6,201 $ 119,839 $ 3,798

Consideration

Cash $ 6,201 $ 119,839 $ 3,798

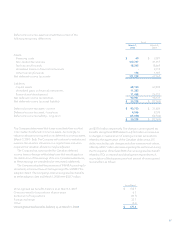

The acquisitions were accounted for using the purchase

method whereby identifiable assets acquired and liabilities

assumed were recorded at their estimated fair value as of

the date of acquisition. The excess of the purchase price

over such fair value was recorded as goodwill. Acquired

technology includes current and core technology, and is

amortized over periods ranging from two to five years.